Business Equity Agreement Format In Minnesota

Description

Form popularity

FAQ

How to Add a Member to an LLC Step 1: Revisit your operating agreement. Step 2: Get approval from the other members. Step 3: Update your operating agreement to finalize the deal. Step 4: File an amendment to your Articles of Organization. Step 5: File tax documents.

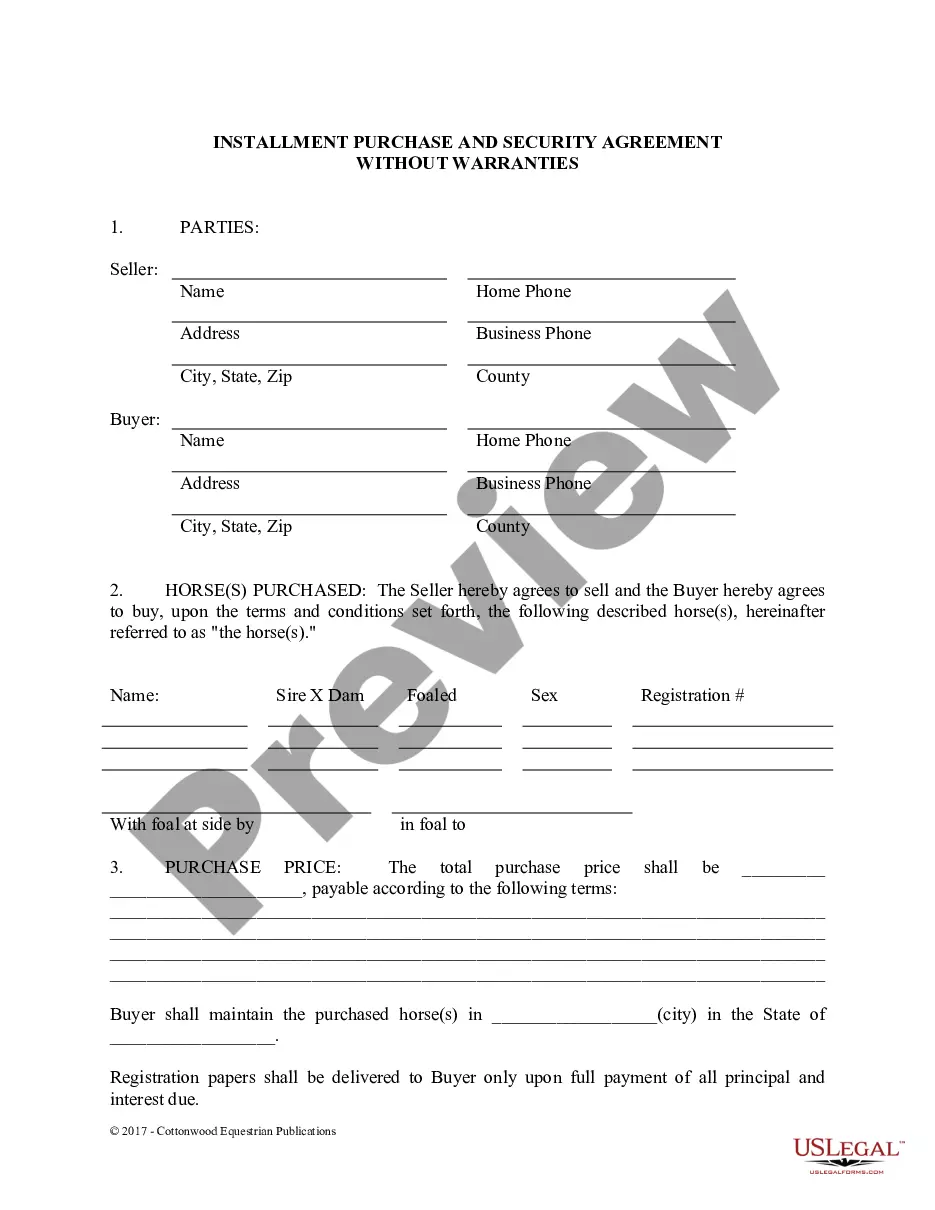

A Minnesota LLC isn't legally obligated to have an operating agreement. Minnesota Statute § 322C. 0110 outlines what an operating agreement may cover but doesn't state that LLCs must have one.

While not always legally required, operating agreements play a critical role in the smooth operation, legal protection, and financial clarity of LLCs. Their absence can lead to governance by default state laws, management, and financial disorganization, and increased legal vulnerabilities.

Yes, Minnesota requires all business entities to list a Registered Agent on their LLC formation paperwork. And they must keep a Registered Agent on file with the state for the life of the LLC. Technically, Minnesota only requires a Registered Office. Meaning, just an address to receive Service of Process.

A Minnesota LLC isn't legally obligated to have an operating agreement. Minnesota Statute § 322C. 0110 outlines what an operating agreement may cover but doesn't state that LLCs must have one.

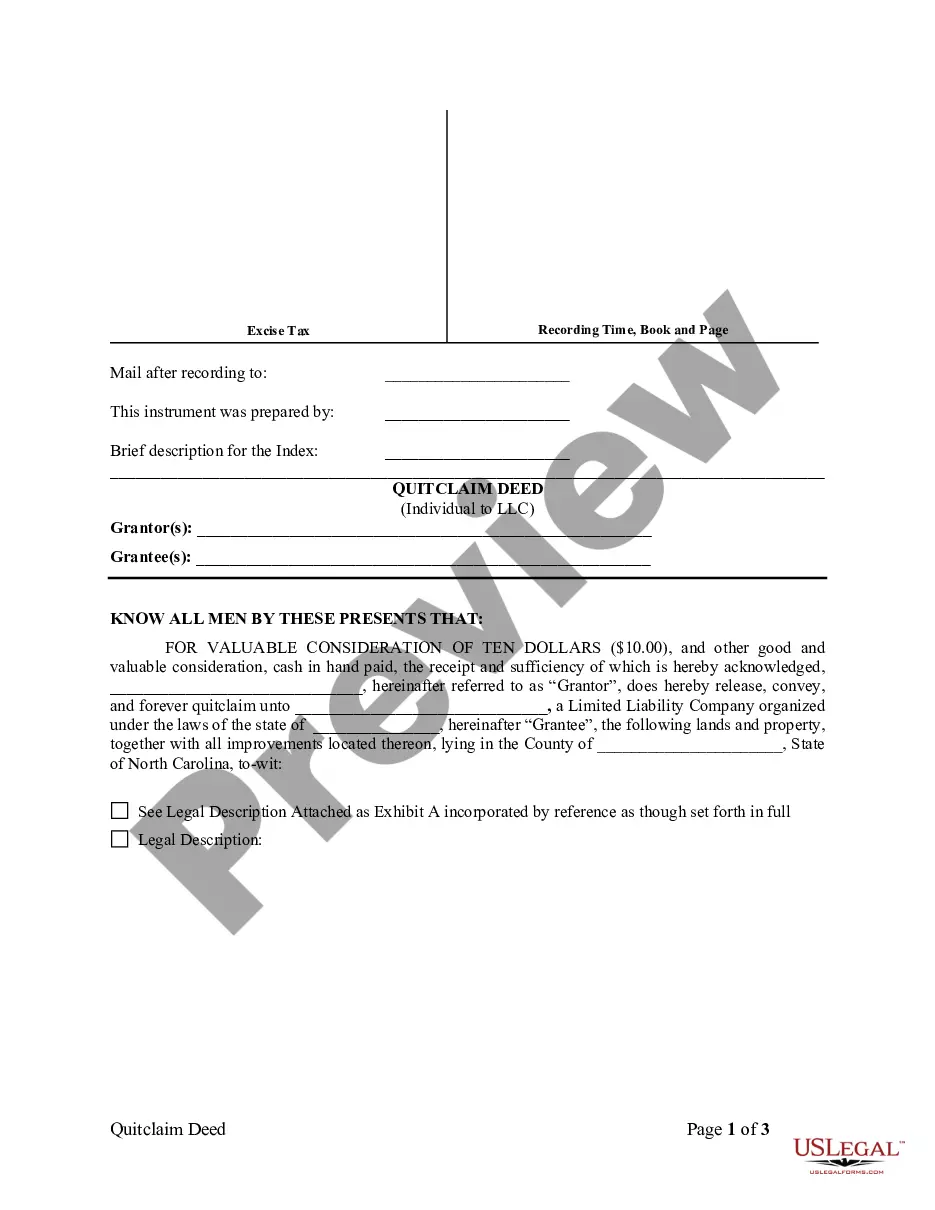

How to Form an S Corp in Minnesota Name your Minnesota LLC. Appoint a registered agent in Minnesota. File Minnesota Articles of Organization. Create an operating agreement. Apply for an EIN. Apply for S Corp status with IRS Form 2553.

LLC members may prepare and sign their own operating agreement. There is no obligation to use one prepared by a lawyer or an online filing service (though a lawyer-prepared agreement is most likely to be written correctly).

Although writing an operating agreement is not a mandatory requirement for most states, it is nonetheless considered a crucial document that should be included when setting up a limited liability company. The document, once signed by each member (owner), acts as a binding set of rules for them to adhere to.