Equity Agreement Template With Collateral In Michigan

Description

Form popularity

FAQ

Equity agreements commonly contain the following components: Equity program. This section outlines the details of the investment plan, including its purpose, conditions, and objectives. It also serves as a statement of intention to create a legal relationship between both parties.

Let's say your home has an appraised value of $250,000, and you enter into a contract with one of the home equity agreement companies on the market. They agree to provide a lump sum of $25,000 in exchange for 10% of your home's appreciation. If you sell the house for $250,000, the HEA company is entitled to $25,000.

Lenders will often let you tap into your home equity to use as collateral for new loans. This is a very common strategy for property investors. Done right, it can yield great results – as long as you're aware of the risks.

SAFE Example The SAFE investor would receive 6,250 shares under the 20% discount rate term in their agreement, or 15,000 shares if they had a valuation cap of $4 million. If an Investor had both features included in their SAFE agreement, the investor would likely choose the valuation cap and receive 15,000 shares.

Examples of collateral documents are a security agreement, guarantee and collateral agreement, pledge agreement, deposit account control agreement, securities account control agreement, mortgage, and UCC-1s.

Non-Transferable Assets: Assets that are legally restricted from being transferred, such as government benefits, social security payments, or certain insurance policies, cannot be used as collateral since they cannot be seized or sold.

With either, the amount you can borrow will depend on the value of your home and the amount of equity you have available. And with both, it's important to remember that you're using your home as collateral—and it could be at risk if its value drops or there's an interruption in your income.

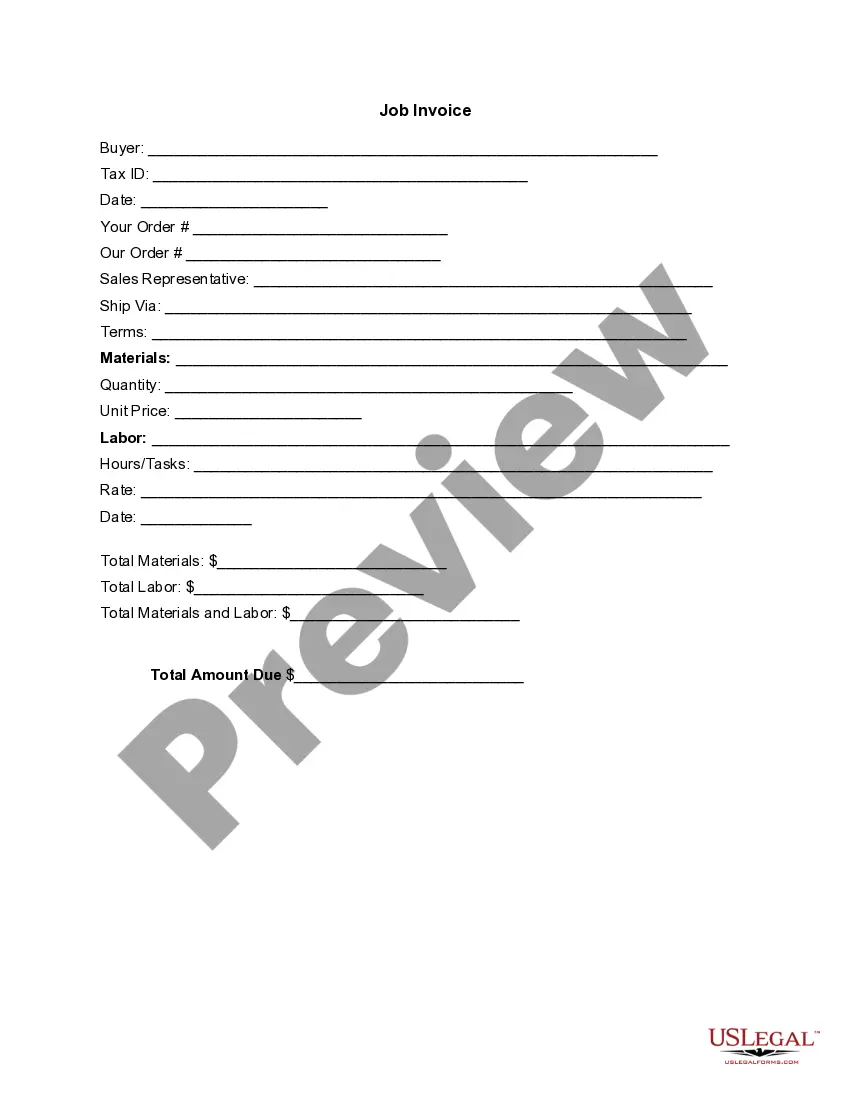

To secure this Agreement, the Debtor hereby agrees to provide the Secured Party with full right and title of ownership to the following property as collateral (the “Collateral”) to secure the debt listed in the “Debt” section of this Agreement: (Property name, address)

Examples of collateral documents are a security agreement, guarantee and collateral agreement, pledge agreement, deposit account control agreement, securities account control agreement, mortgage, and UCC-1s.