Finance For Land Document In Miami-Dade

Description

Form popularity

FAQ

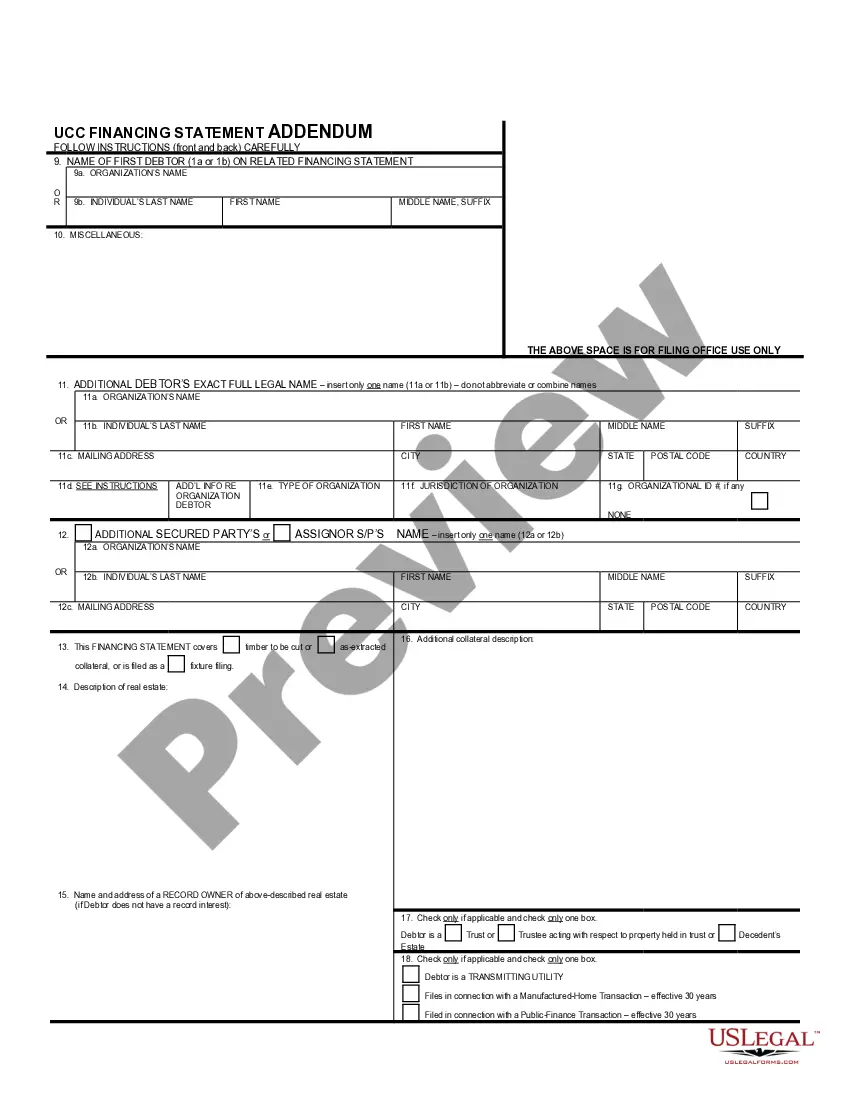

Section 713.08 of the Florida Statutes, provides the proper form and specific requirements to complete the claim of lien document such as: name and address of lienor, statement of labor and materials provided, description of the property, name of property owner, lien amount, proof of service and the proper warning to ...

Steps to file a mechanics lien in Miami-Dade County Step 1: Get The Right Form & Meet Margin Requirements. Step 2: Calculating Your Miami-Dade County Filing Fees. Step 3: Serve the Mechanics Lien. Step 4: File your lien with the Miami-Dade County Clerk.

The Office of the Property Appraiser reviews all ownership changes, properly recorded in the Clerk of Courts Recorder's Office. The ownership transfer is typically processed between 4 and 8 weeks, but may take up to 12 weeks.

Steps to file a mechanics lien in Miami-Dade County Step 1: Get The Right Form & Meet Margin Requirements. Step 2: Calculating Your Miami-Dade County Filing Fees. Step 3: Serve the Mechanics Lien. Step 4: File your lien with the Miami-Dade County Clerk.

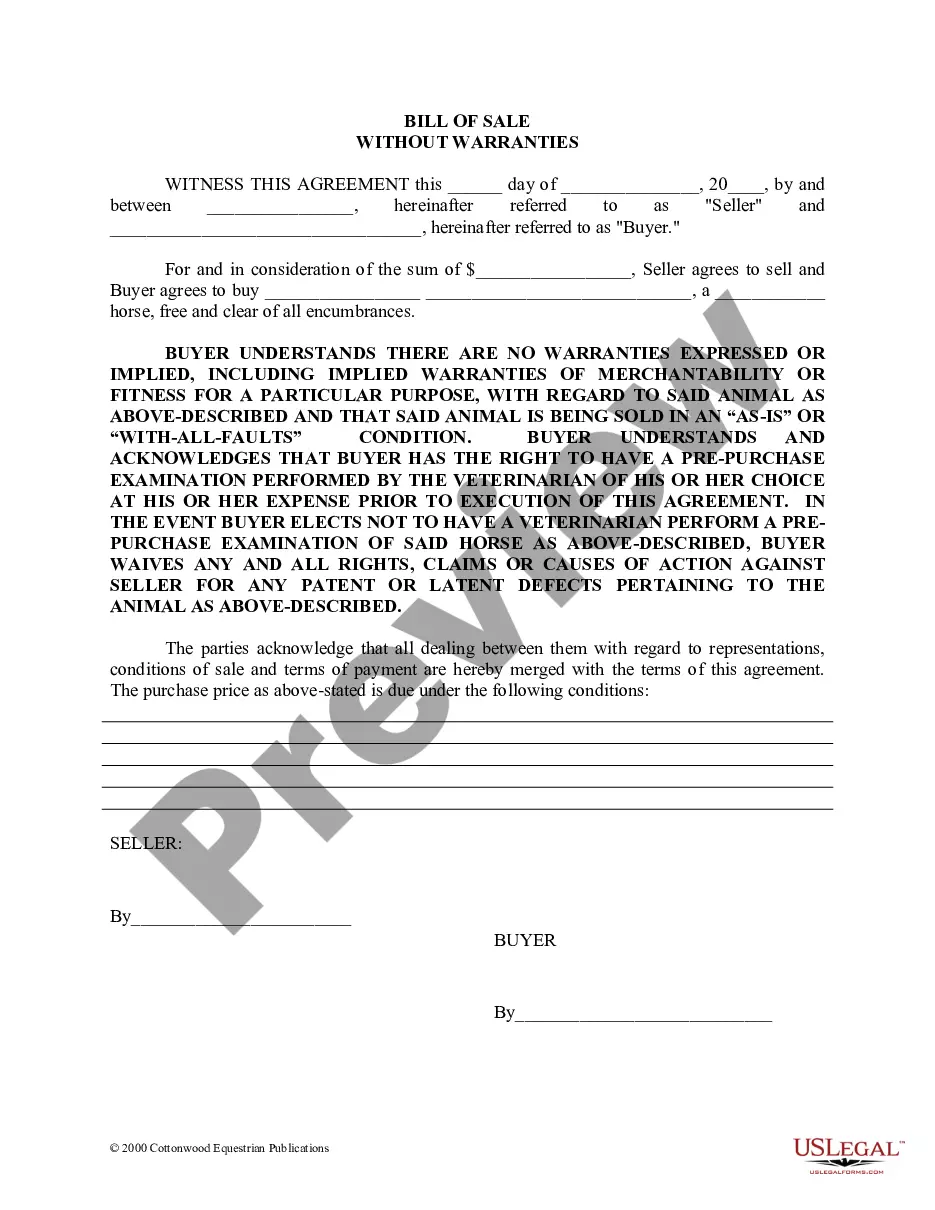

The tax rate for Miami-Dade County is 60 cents on each $100, or portion thereof, of the total consideration. Miami-Dade County also has a surtax of 45 cents on each $100, or portion thereof, of the total consideration. The surtax is not due on a document that transfers only a single-family dwelling.

Public Records Requests However, if you are unable to locate the records online, you may submit a Public Records Request form. This form may be submitted by mail to Records Management, Miami-Dade County Clerk of Courts, P.O. Box 14695, Miami, FL 33101 or by email to cocpubreq@miamidade.

We will not record an uncertified copy of any document, with or without changes. If you need to record a document which has changes from the original, please provide either a new document or make the modification to the original document.

The tax rate for Miami-Dade County is 60 cents on each $100, or portion thereof, of the total consideration. Miami-Dade County also has a surtax of 45 cents on each $100, or portion thereof, of the total consideration. The surtax is not due on a document that transfers only a single-family dwelling.

3. How do documents get recorded in the Recorder of Deeds Office? All papers presented to us for recording must be original documents, properly executed, signed, dated and acknowledged before a Notary Public with the notary's signature and date of expiration of the commission, before they can be accepted for recording.