Equity Split Agreement Template For Commercial Property In Maryland

Description

Form popularity

FAQ

Essential Formulas Used in the Income Approach: Net Operating Income (NOI) = Potential Income – Operating Expenses. Capitalization Rate (Cap Rate) = Net Operating Income / Property Value. Value = Net Operating Income / Capitalization Rate.

Tenancy by the Entirety Each spouse owns an undivided interest in the real property, and there is a right of survivorship. Maryland has a presumption that property held by a married couple is held as tenants by the entireties. The presumption applies to property acquired by the married couple.

Using public records. Searching public records can also give you access to the property history of commercial properties that fall within a specific location—usually delegated to a county. Online, those records will typically include transaction history, ownership history, mortgage information, liens, or so on.

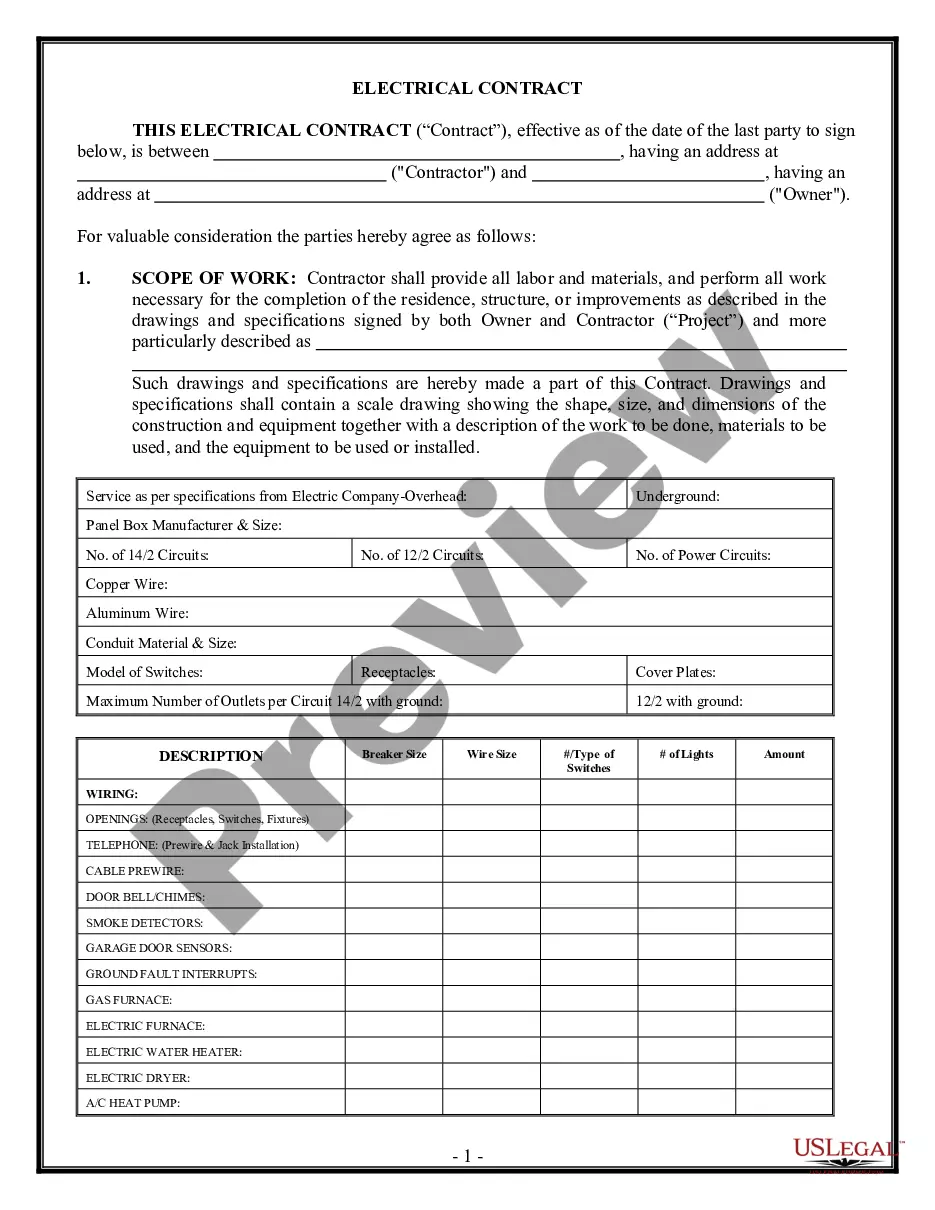

How to write a business contract Determine why you need a contract. Define all applicable parties. Include all essential elements of a contract. Select the appropriate governing law and jurisdiction. Write everything in plain language. Use repeatable language and formats when possible. Use tables, lists, and other tools.

In commercial real estate, equity financing involves pooling funds from multiple investors who become equity partners in the venture. These investors provide capital in exchange for a share of ownership and potential profits generated by the property.

A property agreement is a legal document that outlines the terms and conditions of a real estate transaction. It is an essential tool in any real estate case because it serves as a reference for all parties involved in the transaction.

1) Tenants in Common In this type of tenancy, two or more co-tenants can hold title in unequal shares (e.g. 60/40, 90/10 etc.). In Maryland, title is presumed to be held as tenants in common unless the owners are married or unless it is specified that the parties will hold as Joint Tenants with Rights of Survivorship.