Startup Equity Agreement Without In Maricopa

Description

Form popularity

FAQ

What does the Co-Founder Agreement cover? Co-founder details; Project description; Equity breakdown and initial capital contributions; Roles and responsibilities of each co-founder; Management and approval rights; Non-compete, confidentiality and intellectual property; and.

As a rule of thumb, a non-founder CEO joining an early-stage startup (that has been running less than a year) would receive 7-10% equity. Other C-level execs would receive 1-5% equity that vests over time (usually 4 years).

In summary, 1% equity can be a good offer if the startup has strong potential, your role is significant, and the overall compensation package is competitive. However, it could also be seen as low depending on the context. It's essential to assess all these factors before making a decision.

Angel and venture capital investors are great, but they must not take more shares than you're willing to give up. On average, founders offer 10-20% of their equity during a seed round. You should always avoid offering over 25% during this stage. As you progress beyond this stage, you will have less equity to offer.

Startup equity is distributed among employees as a form of compensation to attract and retain talent, and the amount allocated often varies based on the company's stage, the employee's role and the potential growth of the startup.

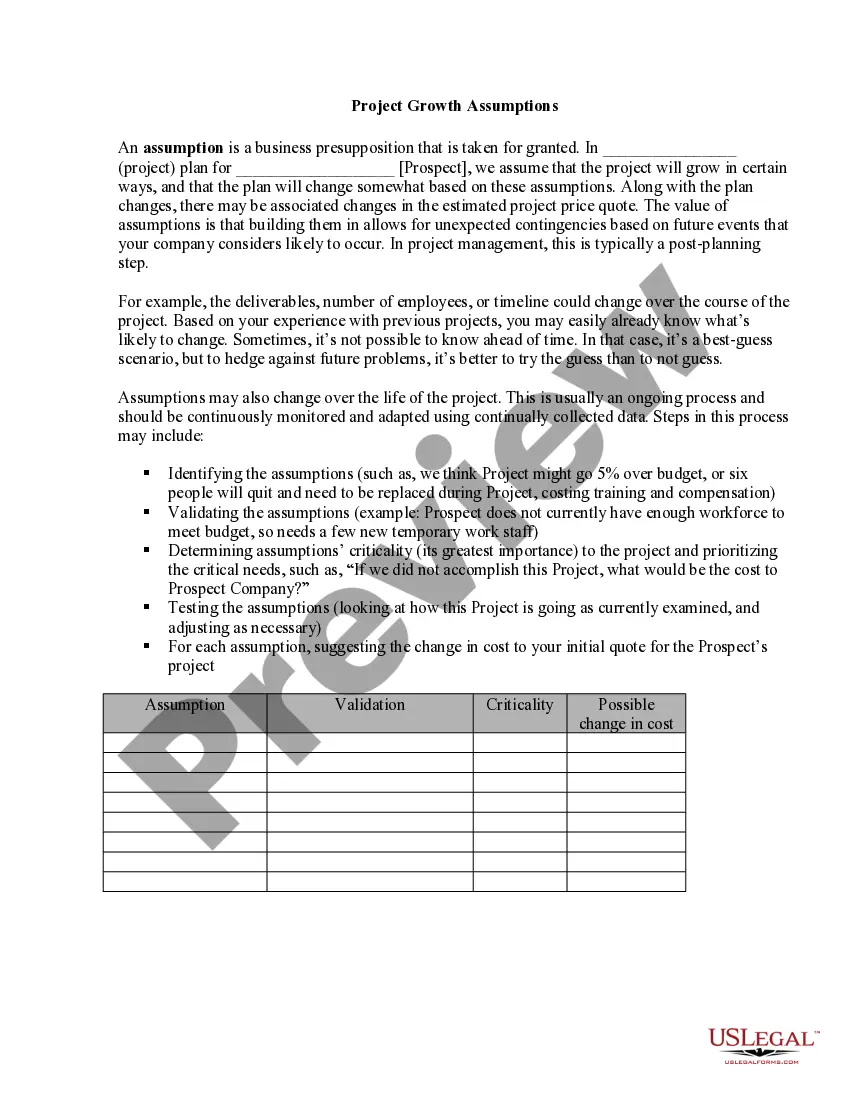

Equity agreements are a cornerstone for startups, providing a solid foundation for their business endeavors while ensuring fairness and clarity in equity distribution. Understanding the legal aspects and best practices of equity agreements is crucial for the long-term success and stability of startups.

A company provides you with a lump sum in exchange for partial ownership of your home, and/or a share of its future appreciation. You don't make monthly repayments of principal or interest; instead, you settle up when you sell the home or at the end of a multi-year agreement period (typically between 10 and 30 years).

If the investment is an equity investment in a partnership or LLC, you'll need to sign the LLC operating agreement and update the members' schedule to evidence your investment. A debt investment in any structure is typically evidenced by a promissory note which is signed by you and the company.

Timing is important. Wait until the company has achieved some key milestones or metrics that demonstrate its potential. Quantify your value. Propose an equity split that aligns with industry norms. Frame it as an investment in the company's future. Be willing to negotiate. Time it appropriately.