Equity Agreement Form Contract For Debt In Harris

Description

Form popularity

FAQ

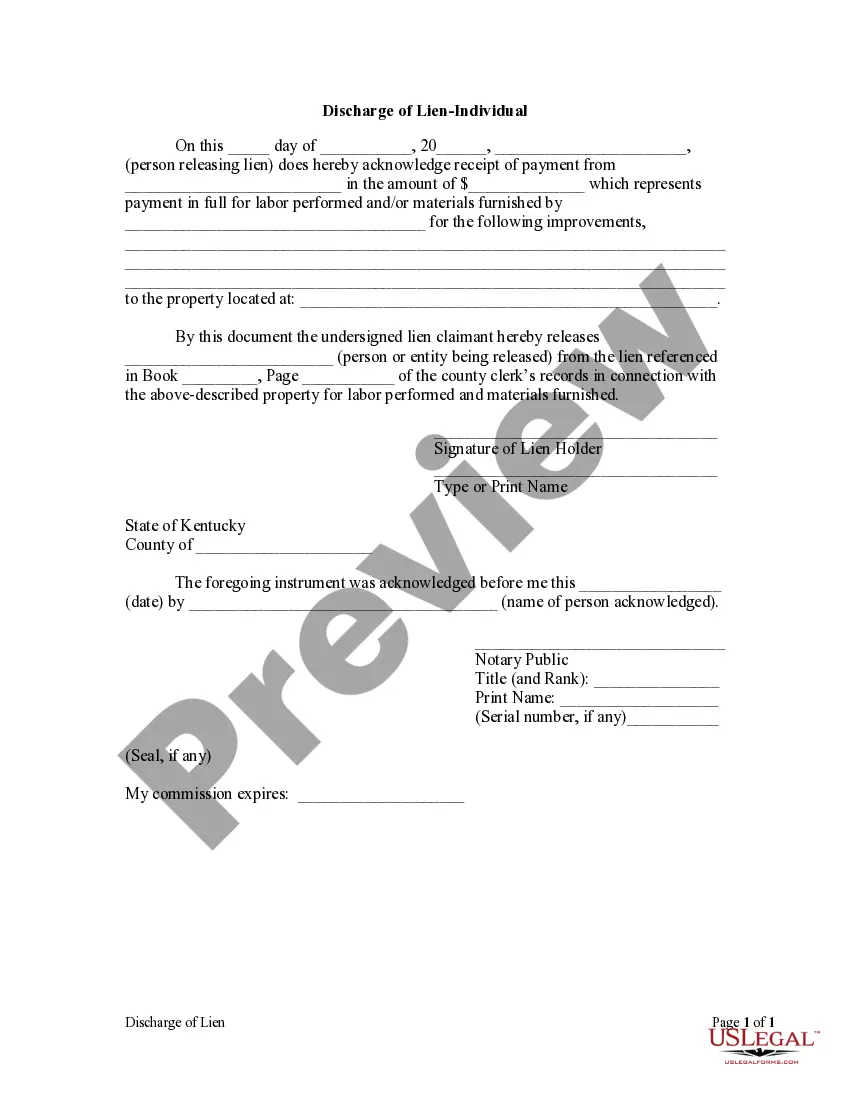

What Does a Debt Settlement Agreement Have To Include? The original creditor and/or debt collector's company name. Your full name. Your account number. The amount of the debt you owe. The settlement amount that was agreed upon.

Some contracts need to be notarized, such as real estate contracts, wills, trusts, or debt agreements. If this type of contract isn't notarized, it may be considered an unenforceable contract.

A debt/equity swap is a transaction in which the obligations or debts of a company or individual are exchanged for something of value, namely, equity. In the case of a publicly-traded company, this generally entails an exchange of bonds for stock.

Let's say your home has an appraised value of $250,000, and you enter into a contract with one of the home equity agreement companies on the market. They agree to provide a lump sum of $25,000 in exchange for 10% of your home's appreciation. If you sell the house for $250,000, the HEA company is entitled to $25,000.

The parties therefore agree as follows: PAYMENTS. (a) Settlement Amount. CREDITOR'S RELEASE. (a) Credit Reporting Agencies. CREDITOR'S REPRESENTATIONS. The Creditor states that. EFFECTIVE TIME OF RELEASES. GOVERNING LAW. AMENDMENTS. COUNTERPARTS; ELECTRONIC SIGNATURES. SEVERABILITY.

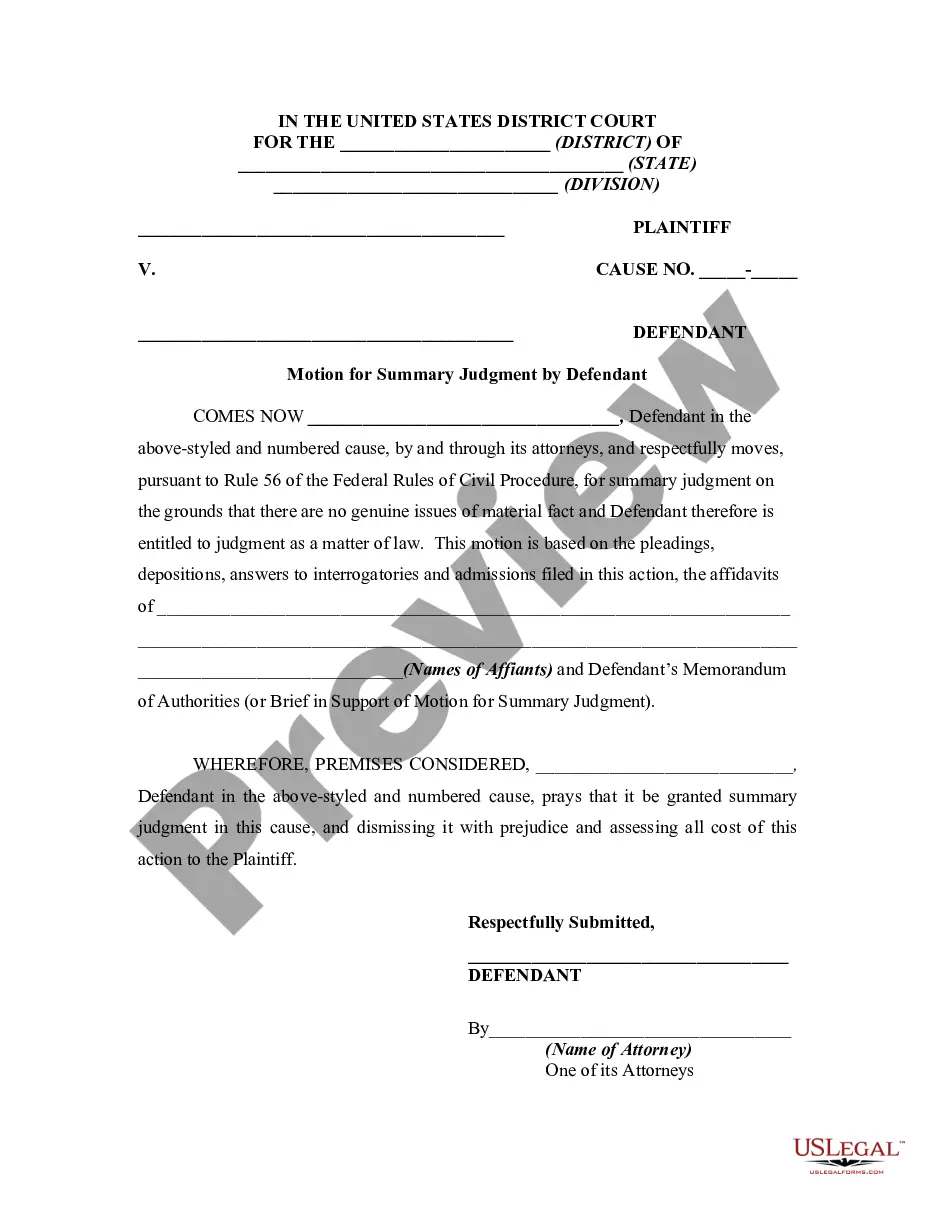

Draft the equity agreement, detailing the company's capital structure, the number of shares to be offered, the rights of the shareholders, and other details. Consult legal and financial advisors to ensure that the equity agreement is in line with all applicable laws and regulations.

Some collectors want 75%–80% of what you owe. Others will take 50%, while others might settle for one-third or less. So, it makes sense to start low with your first offer and see what happens. And be aware that some collectors won't accept anything less than the total debt amount.

Debt exchange offers can help companies reduce existing debt, modify the terms of existing debt, or reduce interest payments by exchanging higher rate debt for lower rate debt. Companies may decide to exchange their existing debt securities for new debt securities in a debt-for-debt exchange offer.