Equity Agreement Document For Lease In Harris

Description

Form popularity

FAQ

Here are 16 steps on how to make a lease agreement: Include the contact information of both parties. Include property details. Outline property utilities and services. Define the lease term. Disclose the monthly rent amount and due date. Detail the penalties and late fees. Describe any additional or services fees.

Equity agreements allow entrepreneurs to secure funding for their start-up by giving up a portion of ownership of their company to investors. In short, these arrangements typically involve investors providing capital in exchange for shares of stock which they will hold and potentially sell in the future for a profit.

State laws on leases and rental agreements can vary, but a landlord or property management company should provide you with a copy of your signed lease upon request. You should make your request in writing, so you have proof if there is a dispute later.

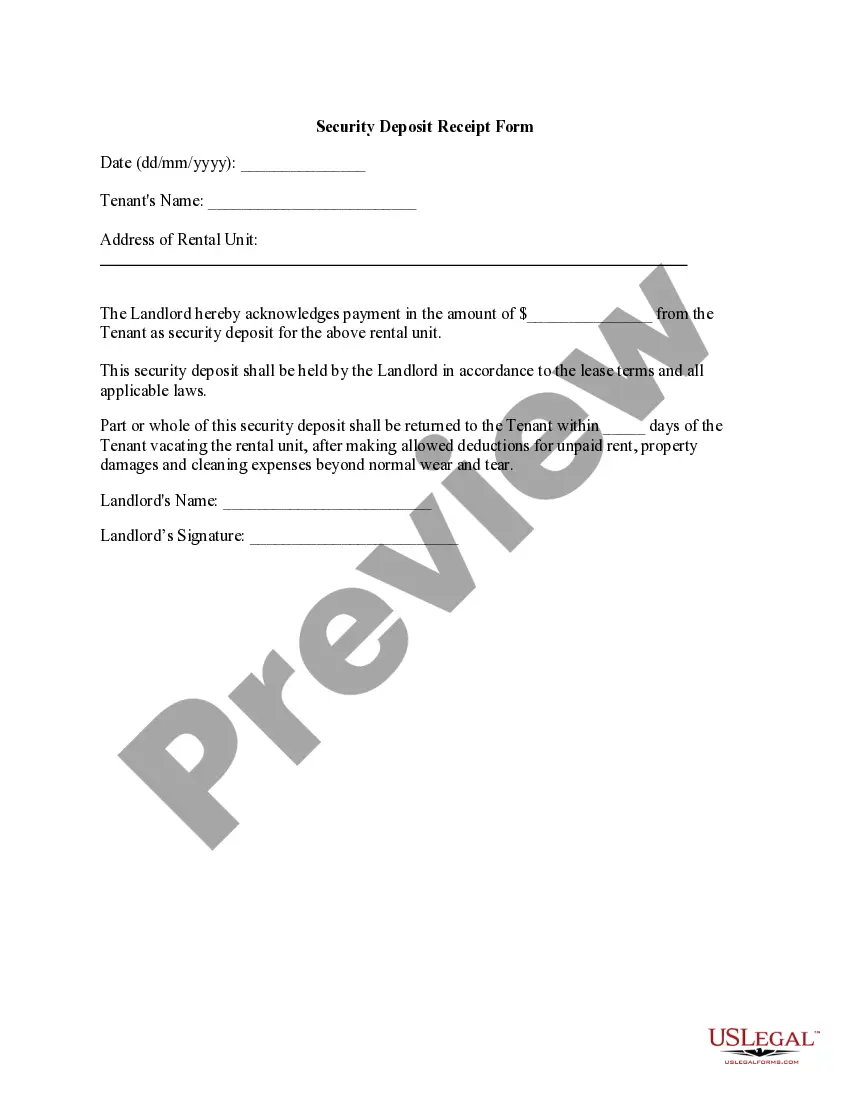

Here's a list of standard fields that you should include in your lease agreement: Tenant information. Include each tenant's full name and contact information. Rental property description. Security deposit. Monthly rent amount. Utilities. Lease term. Policies. Late fees.

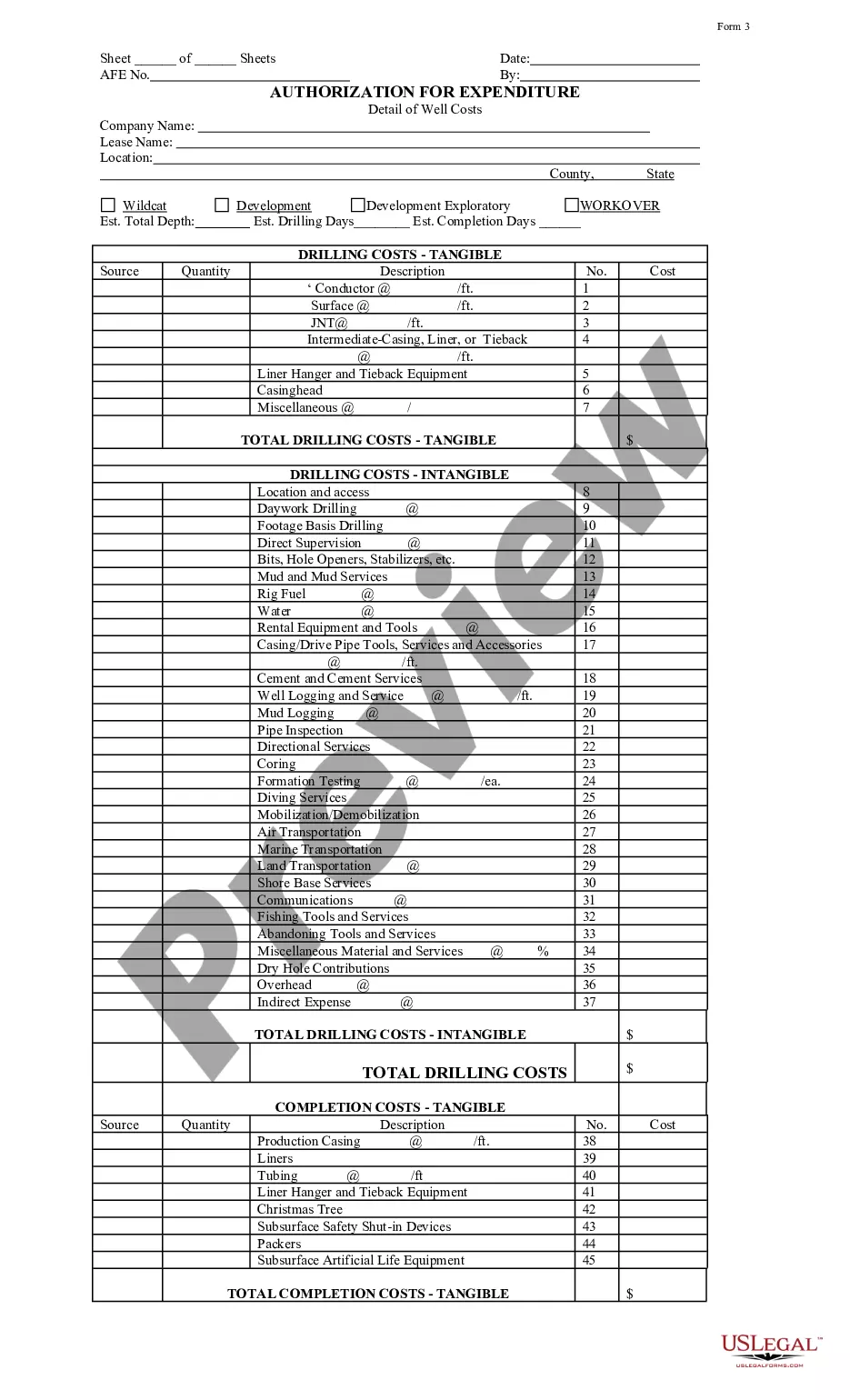

What are the most important steps for drafting a commercial lease agreement? Identify the parties and the property. Determine the rent and the term. Negotiate the improvements and the maintenance. Allocate the taxes and the insurance. Include the clauses and the contingencies. Review and sign the agreement.

Lease agreements are a contract. But you don't necessarily need to hire a lawyer to write good lease agreements, you can do it yourself. But you're a first-time landlord or simply don't have the time to write a lease, you can hire a property management company to do it for you.

A company provides you with a lump sum in exchange for partial ownership of your home, and/or a share of its future appreciation. You don't make monthly repayments of principal or interest; instead, you settle up when you sell the home or at the end of a multi-year agreement period (typically between 10 and 30 years).

An Equity Transfer occurs when you merge, consolidate or issue additional Equity Interests in a transaction which would have the effect of diluting the voting rights or beneficial ownership of your owners' combined Equity Interests in the surviving entity to less than a majority.

A Equity Interest Transfer Agreement is a legal document used to transfer ownership of equity interests in a company.