Equity Share Purchase For Long Term In Clark

Description

Form popularity

FAQ

If you're just buying stock, you can usually set reasonable floors and limit stops so that you can only lose a certain amount. As long as you play nice and stay reasonably safe, margin is fine to use. It only gets bad when you start investing in extremely risky stocks or options.

One way to determine whether a stock is a good long-term buy is to evaluate its past earnings and future earnings projections. If the company has a consistent history of rising earnings over a period of many years, it could be a good long-term buy.

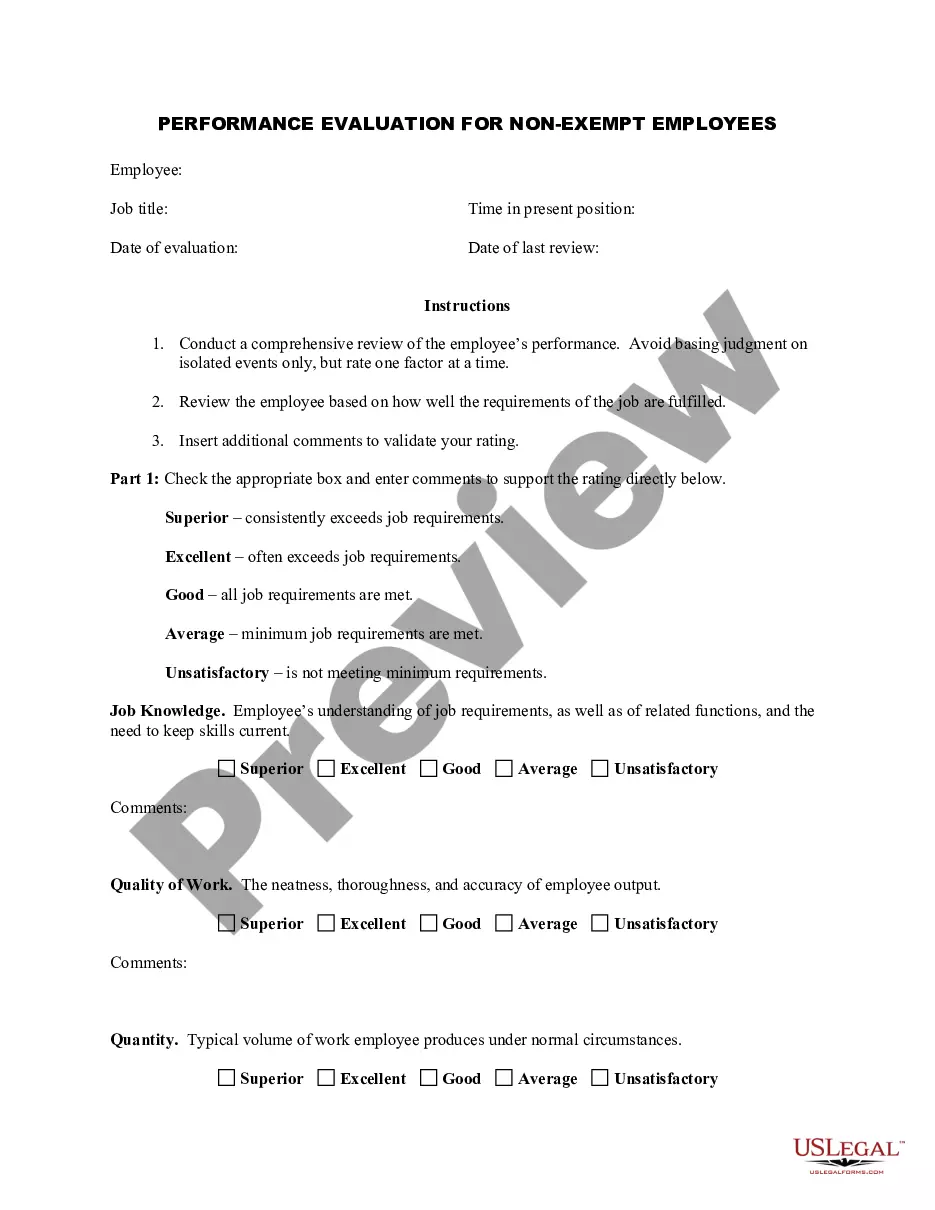

Equity shares, also called common shares, are a long-term financing source for companies. Issued to the public and non-redeemable, they represent ownership in the company. Shareholders can vote, share in profits, and claim company assets.

Margin rates are never worth it over the longer term. Markets can decline pretty fast and margin calls are painful when you have to sell a stock even at a loss. They are only useful if you have to trade short-term. When you consider margin and taxes you are eroding your returns big time.

Therefore, buying on margin is mainly used for short-term investments. The longer you hold an investment, the greater the return that is needed to break even. If you hold an investment on margin for a long period of time, the odds that you will make a profit are stacked against you.

Best long term stocks S.No.NameCMP Rs. 1. Ksolves India 995.35 2. Waaree Renewab. 1391.60 3. Tips Music 735.15 4. Network People 2546.9522 more rows

Here is how investors can invest in long term stocks in India: Open a Demat/Trading/Brokerage account. Conduct thorough research into the stocks that may seem suitable to you for the leng term. Place a 'Buy' order on the long term stocks of your choosing. Monitor your investments regularly.

Procedure to buy shares online Getting a PAN Card : A Permanent Account Number (PAN) is mandatory to buy shares online. Open a Demat Account : Demat account is the most important aspect of investing or buying shares online. Open a Trading Account : Trading account runs simultaneously to your demat account.

HOW TO EARN A 10% ROI: TEN PROVEN WAYS Paying Off Debts Is Similar to Investing. Stock Trading on a Short-Term Basis. Art and Similar Collectibles Might Help You Diversify Your Portfolio. Junk Bonds. Master Limited Partnerships (MLPs) ... Investing in Real Estate. Long-Term Investments in Stocks. Creating Your Own Company.

Investing in equity shares is a great idea. The reason is that an equity share indicates that you have a certain percentage of equity in the company. Thus, the returns you get are directly linked to the profits of the company. This makes it a great option as the opportunity to earn a good return is high.