Good Faith Estimate Template Excel Format In Harris

Description

Form popularity

FAQ

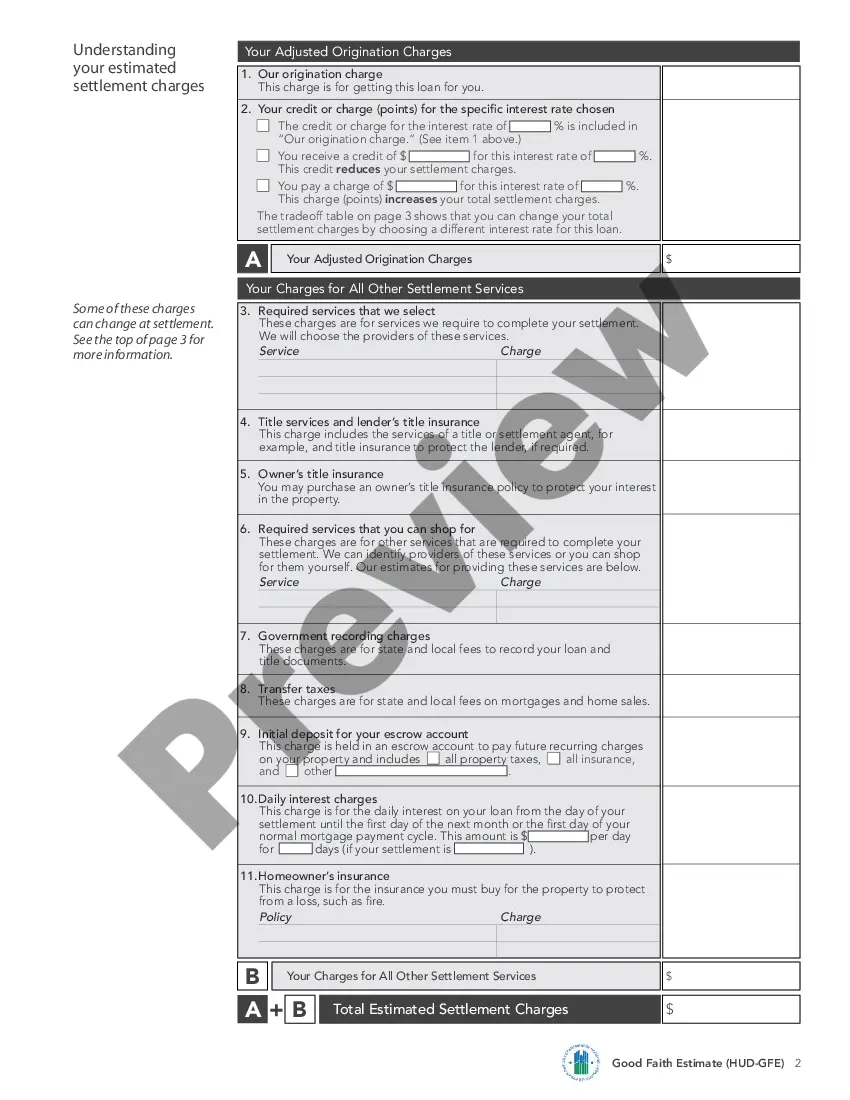

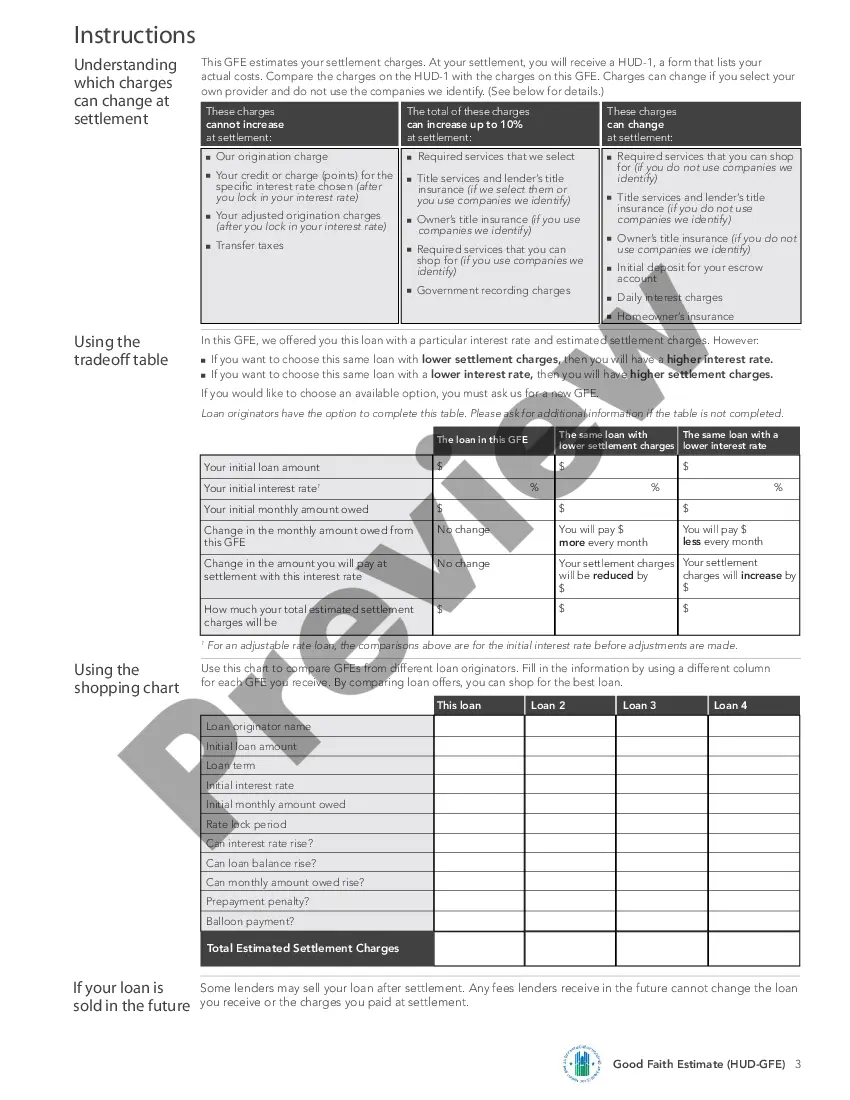

Good faith estimates only list expected charges for a single provider or facility. You may get an estimate from both your provider and facility, or from multiple providers. The estimate must: Include an itemized list with specific details and expected charges for items and services related to your care.

A good faith estimate should include expected charges for the scheduled health care items and services, including facilities fees, hospital fees, and room and board provided by the provider or facility. Good faith estimates only list expected charges for a single provider or facility.

A Good Faith Estimate, also called a GFE, is a document that a lender must provide when you apply for a reverse mortgage.

A good faith estimate should include expected charges for the scheduled health care items and services, including facilities fees, hospital fees, and room and board provided by the provider or facility. Good faith estimates only list expected charges for a single provider or facility.

What's included in a good faith estimate? A good faith estimate should include expected charges for the scheduled health care items and services, including facilities fees, hospital fees, and room and board provided by the provider or facility.

Client signatures aren't required on either the consent document or the Good Faith Estimate. However, if the client chooses not to sign, the provider can opt out of providing care and the client can proceed to find an in-network provider instead.

IMPORTANT: You aren't required to sign this form and shouldn't sign it if you didn't have a choice of health care provider before scheduling care.

Make sure your health care provider gives you a Good Faith Estimate in writing at least 1 business day before your medical service or item. You can also ask your health care provider, and any other provider you choose, for a Good Faith Estimate before you schedule an item or service.