Financed House Lend Formation In Chicago

Description

Form popularity

FAQ

Illinois first-time homebuyer qualifications You'll need to maintain a minimum credit score of 640 and keep your DTI below 50%. You must also complete a homebuyer education course and have your $1,000 contribution ready.

For a $600,000 home, you'll likely need a very good to excellent credit score: 760+: Best rates and terms. 740-759: Slightly higher rates.

Passed on Sept. 14, 2021, the Lending Equity Ordinance increases transparency and public input in selecting the city's banking partners. This initiative is a response to data and community reports that unequal access to mortgage loans is still a major barrier to household wealth and neighborhood growth.

A 700 credit score is considered “very good” and opens doors to the best mortgage options available. Conventional loans offer highly competitive rates and terms at this credit level. Government-backed loans like FHA are available but may be less advantageous compared to conventional options.

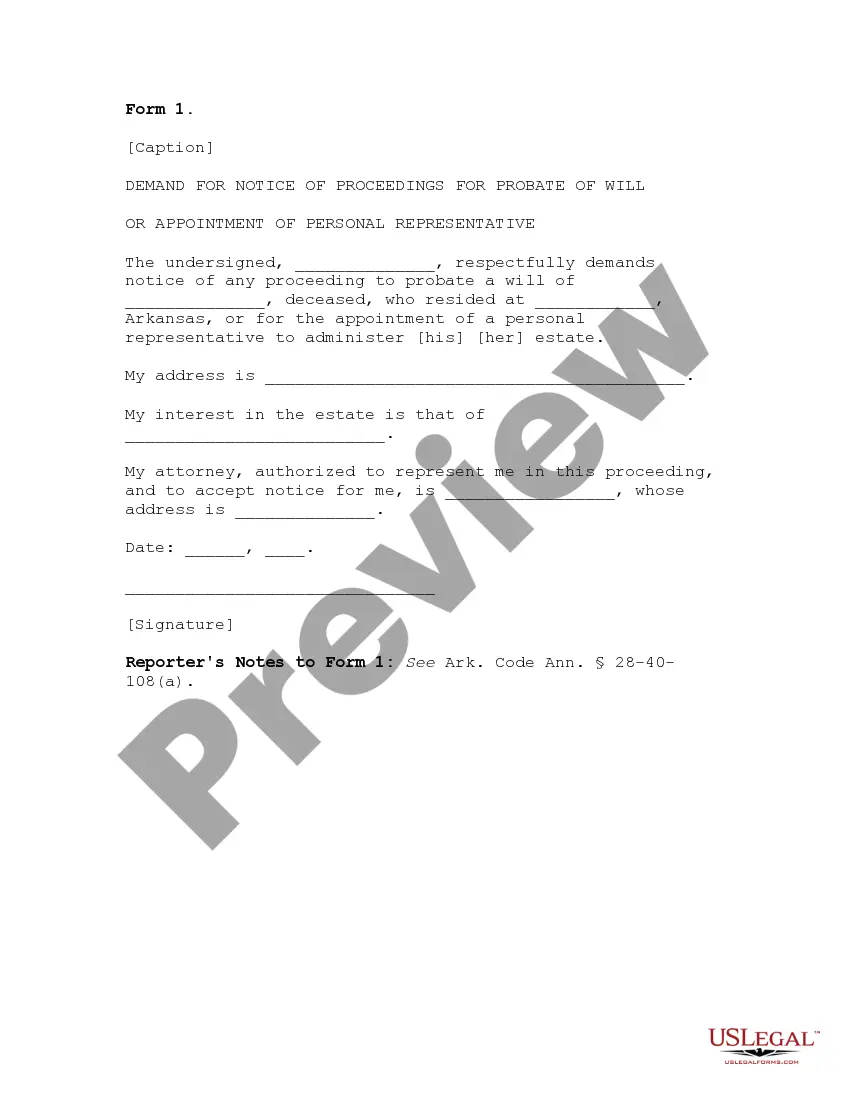

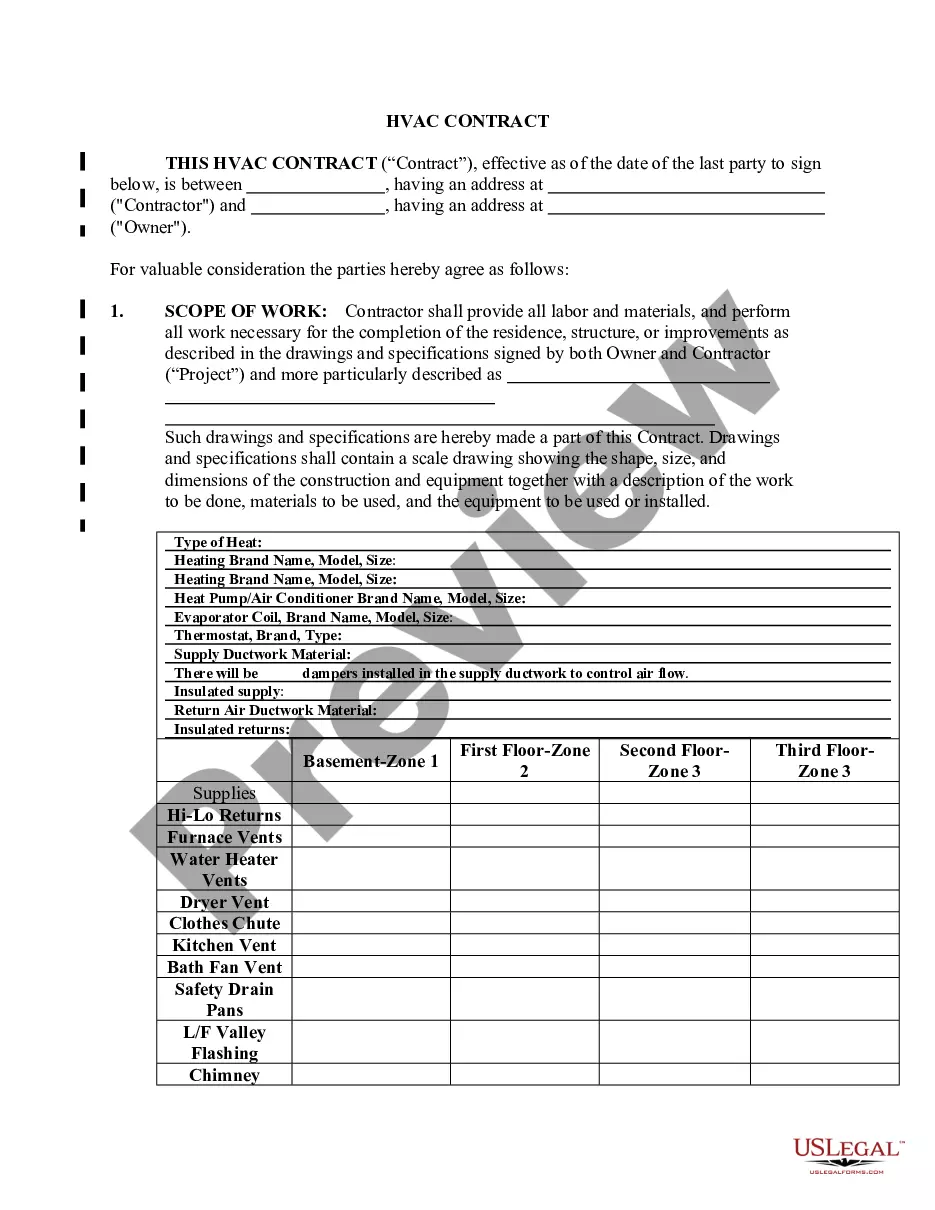

The steps to writing a financial contract are as follows: The document's title. List your contact details. Specify the date. Include the contact information for the recipient. Address the person directly. Write a paragraph for the introduction. Write your body. Close the deal on the contract.