Shared Ownership Agreement In Principle In Broward

Description

Form popularity

FAQ

Nevertheless, the Florida homestead exemption can be lost by transferring title to a limited liability company or by abandonment.

In some states, you only apply for the exemption once before it automatically renews each year.

Do I need to re-apply for my Homestead Exemption every year? No, you do not. The Property Appraiser mails out in January an “Automatic Residential Renewal Receipt” to every homesteaded property owner. If you do not have any changes, you can keep the receipt as proof that you are eligible for the automatic renewal.

Please contact the PACE provider for specific information. Don't see your question, send us an email resilience@broward or give us a call 954-519-1270.

Homestead Exemption: Every person who has legal or equitable title to real property in the State of Florida and who resides thereon and in good faith makes it his or her permanent home is eligible to receive a homestead exemption of up to $50,000. The first $25,000 applies to all property taxes.

Non-Profit, Religious, Educational & Governmental Exemptions - Click here to learn more. Homestead Exemption does not transfer from property to property. If you had this exemption last year on another property and moved, you must file a new application for your new residence.

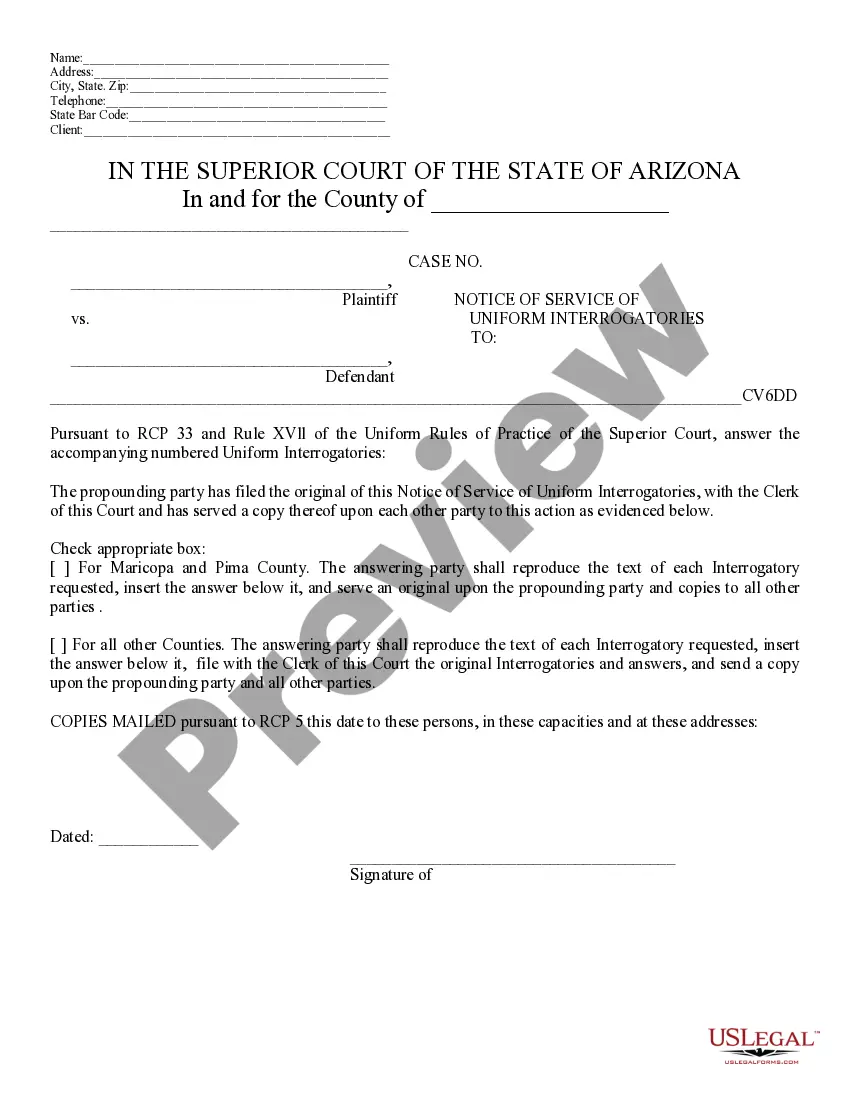

How do I submit documents to be issued in Broward County? Summons, writs, subpoenas and other documents that are issued by the clerk should be E-Filed. Choose the appropriate Document Group type from the dropdown list and then choose the appropriate Document Type for that group.

The requirements for adverse possession are very strict: (1) the person claiming adverse possession must possess the land openly, notoriously, and in a visible manner such that it is in conflict with the owner's right to the property; (2) this person must either have some sort of title on which to base claim of title ...

Eviction Steps: Step 1 — Issue Notice. Pursuant to Florida Statues Chapter 83.56 a notice is required prior to filing an eviction. Step 2 — Fill out Forms. Step 3 — Service the Tenant. Step 4 — Judgment & Writ of Possession.

In Florida, 'Tenancy by Entirety' is a way to own property jointly in Florida but is only available to married couples. The married couple is considered a unit, instead of individual owners. So instead of each holding a separate interest, they are considered one and own the property as one.