Equity Agreement Statement For Property In Alameda

Description

Form popularity

FAQ

Preferred equity is part of the real estate capital stack — in other words, a type of financing a sponsor or developer will employ as part of the aggregate capital raise for a given real estate project.

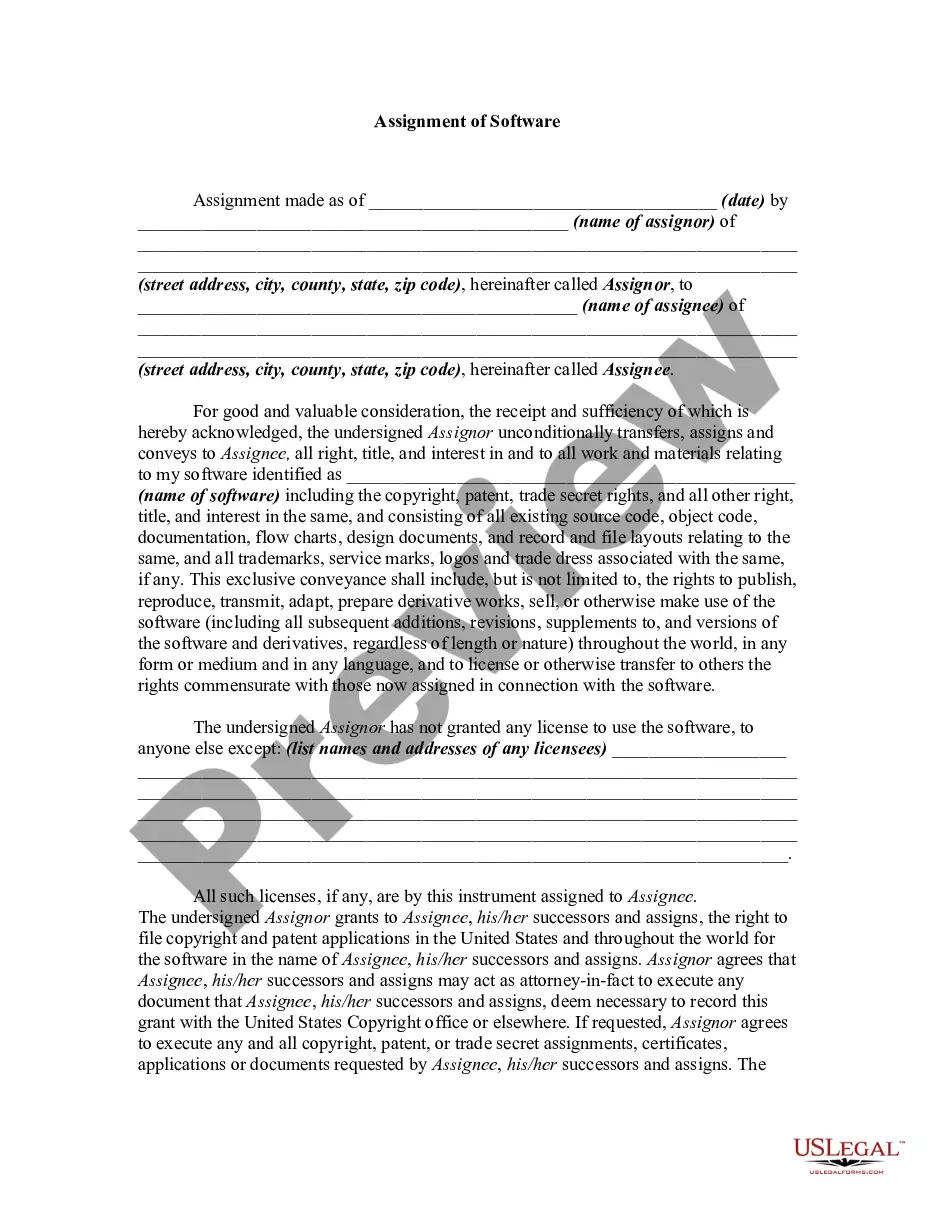

Equity agreements commonly contain the following components: Equity program. This section outlines the details of the investment plan, including its purpose, conditions, and objectives. It also serves as a statement of intention to create a legal relationship between both parties.

Property ownership information can be requested from the County Registrar-Recorder or County Clerk for the county where the property resides. The downside to getting property data through the County Assessor's office is that each county has a different process for doing so.

Visit The Local Assessor's Office If you're scouting out a property, one of the first places you can try for owner information is your local tax assessor's office.

For real estate documents like deeds and mortgages, request them online, by mail, or in person at the clerk-recorder's office. To request a public record at the clerk-recorder's Office, one will need an instrument number, book and page number, or reel and image number.

No. Legal title to a tax-defaulted property subject to the Tax Collector's power to sell can only be obtained by becoming the successful bidder at the county tax sale. Paying the outstanding property taxes on such property will only benefit the current owner.

Section 6-58.55 of the Alameda Municipal Code requires that landlords provide an initial registration statement for each rental unit, including landlords of units that are subsidized through the Housing Choice Voucher (Section 8) program.

On June 4, 2024, the Board of Supervisors passed a motion to extend the temporary cap on rent increases of 4% effective through December 31, 2024, for fully covered rental units.