Sample Contract Agreement For Business Partners In Palm Beach

Description

Form popularity

FAQ

Once you (and the other LLC Members, if applicable) sign the Operating Agreement, then it becomes a legal document. Can I write my own Operating Agreement? Yes, but we recommend using an Operating Agreement template. An Operating Agreement is a legal document.

Generally, a partnership agreement does not need to be notarized — you only need to sign the document to make it legally enforceable.

Operating agreements spell out a company's operational and financial rules and provisions. Think of them as a how-to guide for how the business should be operated and managed. Specifically, an operating agreement should include: Portion of members' ownership, often expressed as ownership percentages.

An operating agreement functions in the same way as a partnership agreement and is a legally binding document. It outlines the ownership stakes (percentages) of its members and how the company is managed, including when meetings are held, naming managers and even dropping or adding members.

How to Write a Partnership Agreement Define Partnership Structure. Outline Capital Contributions and Ownership. Detail Profit, Loss, and Distribution Arrangements. Set Decision-Making and Management Protocols. Plan for Changes and Contingencies. Include Legal Provisions and Finalize the Agreement.

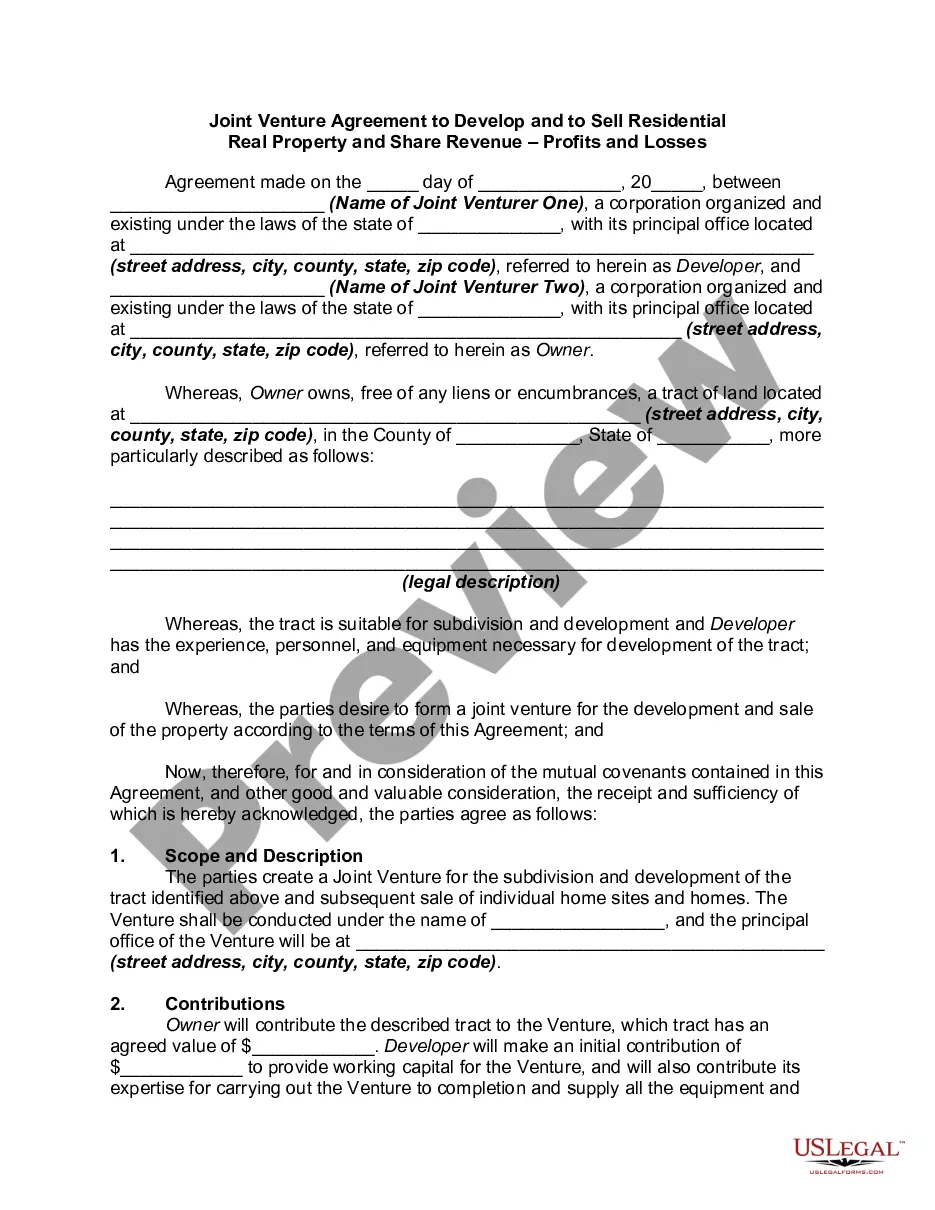

The partnership agreement spells out who owns what portion of the firm, how profits and losses will be split, and the assignment of roles and duties. The partnership agreement will also typically spell out how disputes are to be adjudicated and what happens if one of the partners dies prematurely.

How do I create a Partnership Agreement? Provide partnership details. Start by specifying the industry you're in and what type of business you'll run. Detail the capital contributions of each partner. Outline management responsibilities. Prepare for accounting. Add final details.

General partnerships are less expensive to form compared to a corporation. They are pass-through entities where profits or losses are passed directly to partners, who report them on their personal tax returns.

Many contracts, such as simple sales agreements or employment agreements, do not need to be notarized to be legally binding. The requirement varies based on the contract type and jurisdiction. However, some contracts like real estate transfers or powers of attorney may require notarization by law.