Acceptance Corporate Office Withdrawal In Pennsylvania

Description

Form popularity

FAQ

Your public/private school may have a withdrawal form available for you to submit. If your school does not, you can submit a simple letter stating that you are withdrawing. Visit our Forms page for samples. When you file your affidavit, you are notifying your district of your intent to homeschool.

To dissolve your corporation in Pennsylvania, you provide the completed Articles of Dissolution-Domestic (DSCB: 15-1977/5877) form to the Department of State, Corporation Bureau, by mail or in person. You may fax file if you have a customer deposit account with the Bureau.

The paperwork processing only takes a few days, but the other aspects of the dissolution process can take several weeks or months. This includes the time it takes to finalize business obligations, settle your debts, comply with state regulations, notify the IRS, and more.

To dissolve your corporation in Pennsylvania, you provide the completed Articles of Dissolution-Domestic (DSCB: 15-1977/5877) form to the Department of State, Corporation Bureau, by mail or in person. You may fax file if you have a customer deposit account with the Bureau.

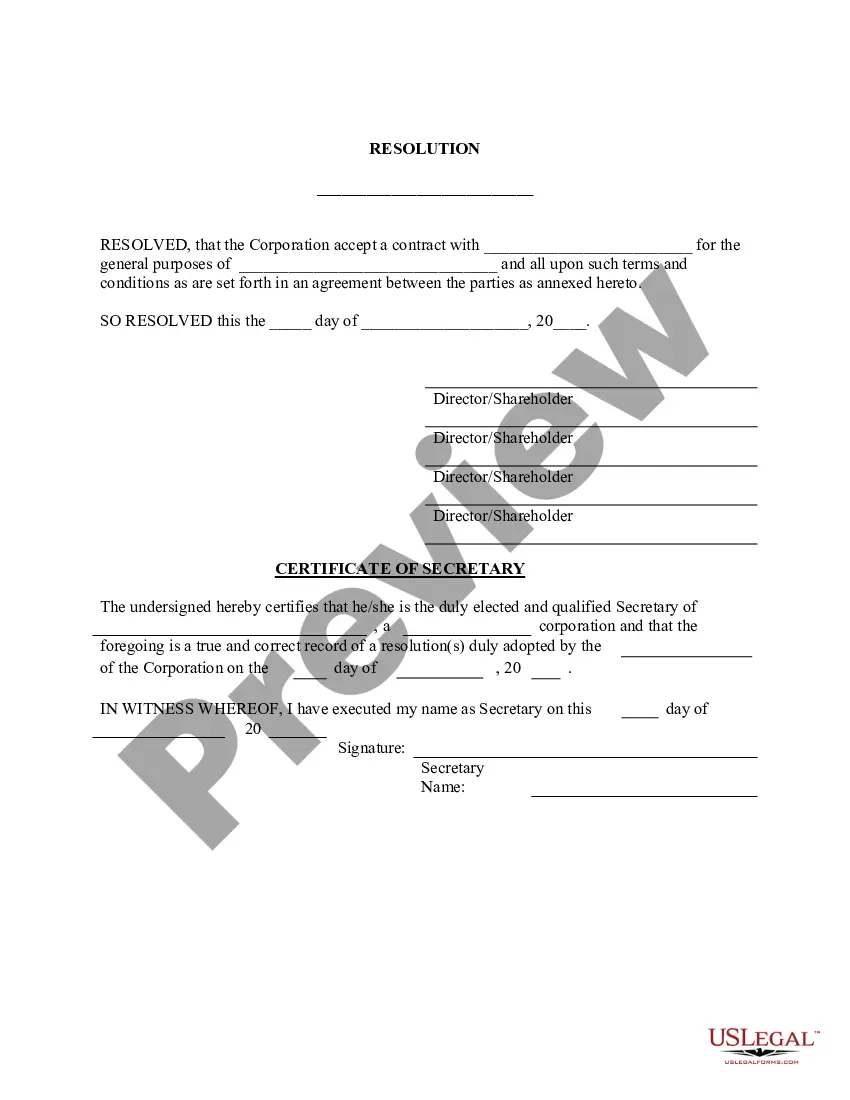

Hold a board meeting Unlike a sole proprietorship, a corporation is required to appoint a board of directors. The board will need to hold a vote to dissolve the company. While some states don't require a minimum vote, others might require that a majority or two-thirds of the board vote in favor of dissolution.

LLC ownership is personal property to its members. Therefore the operating agreement and Pennsylvania state laws declare the necessary steps of membership removal. To remove a member from your LLC, a withdrawal notice, a unanimous vote, or a procedure depicted in the articles of organization may entail.

When a company that is filed in multiple states decides to close in one of those states, a LLC or corporation withdrawal is needed. A corporate withdrawal tells the state, “We are not going to operate or have a location in your state anymore but the company is still active in other states.

Complete and file a Certificate of Surrender of Authority with the Department of State. The Certificate of Surrender of Authority requires the consent of the New York State Tax Commission. To request consent, call the New York State Tax Commission at (518) 485-2639.

To cancel a foreign LLC, just submit form L-109, Certificate of Cancellation to the New Jersey Division of Revenue. To withdraw a foreign corporation, file form C-124P, Certificate of Withdrawal with the Division of Revenue.