False Us Withholding In Oakland

Description

Form popularity

FAQ

Oakland sales tax details The minimum combined 2024 sales tax rate for Oakland, California is 10.25%. This is the total of state, county, and city sales tax rates.

Oakland City Sales Tax Rate 2024 Tax JurisdictionSales Tax Rate State Tax 6.25% County Tax 1.00% Special Tax 3.00% Combined Rate 10.25%

TBID funds are used to increase revenues for assessed businesses by helping to bolster a year-round economy, offset tourism impacts and provide support for local businesses. The TBID is a 1% assessment of all gross revenues on tourism related businesses.

Oakland sales tax details The minimum combined 2025 sales tax rate for Oakland, California is 10.25%. This is the total of state, county, and city sales tax rates. The California sales tax rate is currently 6.0%.

The tax rate for guest rooms is: 14% of room rate | Oakland TBID Tax: $1.50 per night, per room | California Tourism Tax: 0.195% of room rate.

Oakland sales tax details The minimum combined 2025 sales tax rate for Oakland, California is 10.25%. This is the total of state, county, and city sales tax rates.

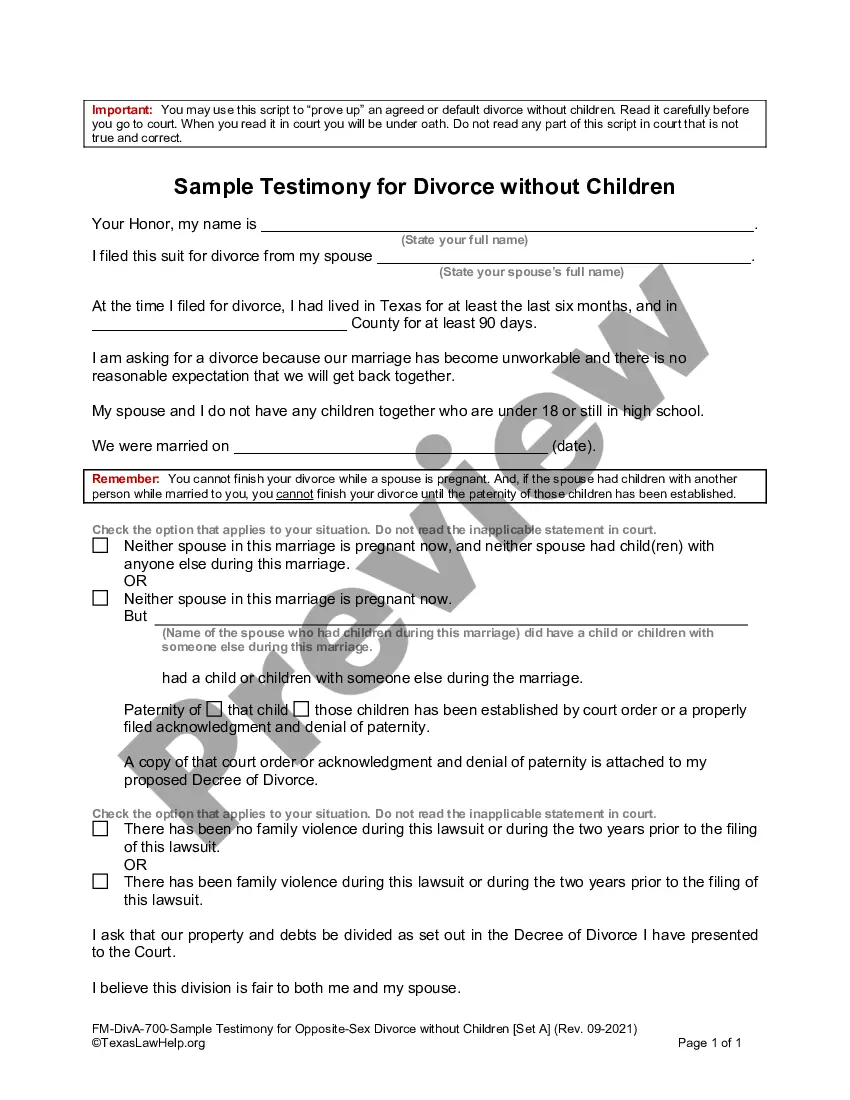

All persons ('withholding agents') making US-source fixed, determinable, annual, or periodical (FDAP) payments to foreign persons generally must report and withhold 30% of the gross US-source FDAP payments, such as dividends, interest, royalties, etc.

To change your tax withholding you should: Complete a new Form W-4, Employee's Withholding Allowance Certificate, and submit it to your employer. Complete a new Form W-4P, Withholding Certificate for Pension or Annuity Payments, and submit it to your payer.

For electronic filing, submit your file using the SWIFT process as outlined in FTB Pub. 923, Secure Web Internet File Transfer (SWIFT) Guide for Resident, Nonresident, and Real Estate Withholding. For the required file format and record layout for electronic filing, get FTB Pub.

An employee can also use Form W-4 to tell you not to withhold any federal income tax. To qualify for this exempt status, the employee must have had no tax liability for the previous year and must expect to have no tax liability for the current year.