Constitution Amendment For Gst In Florida

Category:

State:

Multi-State

Control #:

US-000280

Format:

Word;

Rich Text

Instant download

Description

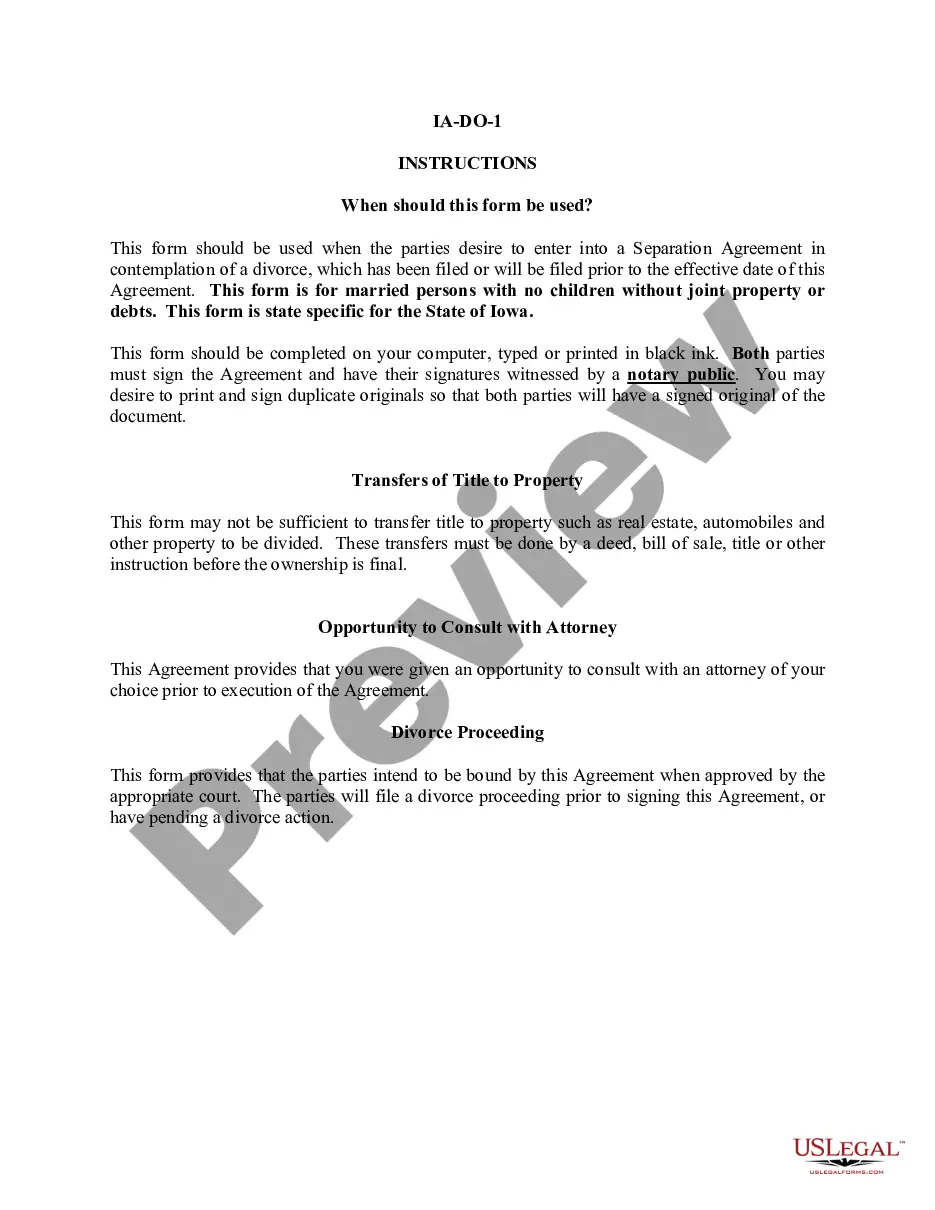

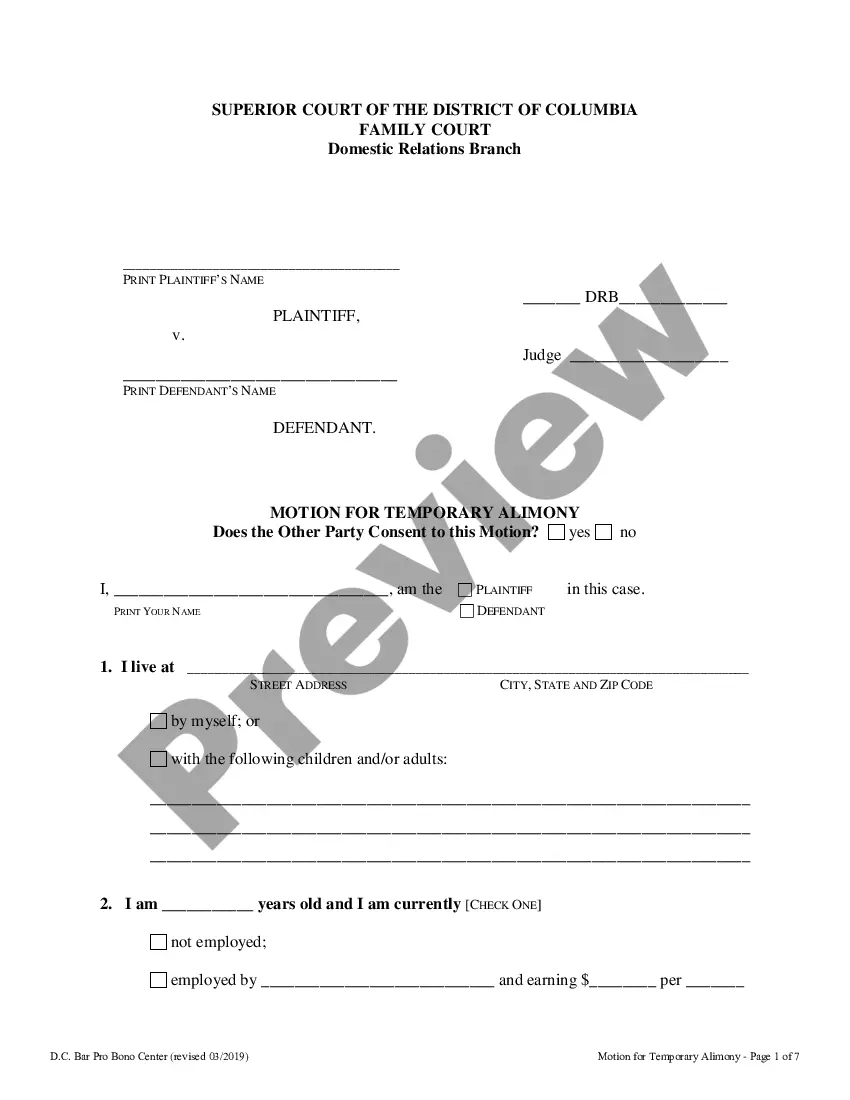

The Constitution amendment for gst in Florida seeks to address the legislative framework surrounding the Goods and Services Tax. This amendment outlines key features, including the modification of tax rates, the allocation of funds, and the mechanisms for enforcing compliance. Attorneys and legal professionals should focus on the specific legal terminology involved to ensure accurate representation and understanding of the amendment’s implications. Partners and owners may find the filling and editing instructions useful, as they guide users through the precise documentation needed for effective tax compliance. Paralegals and legal assistants can benefit from familiarizing themselves with this form as it entails various use cases, such as advising clients on tax liability and preparation for audits. The amendment’s clarity on tax assessments aims to prevent disputes and bolster legal protections for taxpayers. Overall, this document serves as a vital resource for legal practitioners advising clients on financial obligations and rights under Florida's tax system.

Free preview