Repo Form Bought With Cash In Salt Lake

Description

Form popularity

FAQ

What Happens If the Repo Agent Doesn't Find Your Car? But if you make it hard for the repo agent to get it, then the creditor may use another method to get the car back, called "replevin." Replevin can be just as costly as a repossession, if not more so.

A creditor can repossess your automobile, but only if it can be done peacefully. The creditor cannot trick you into bringing your car to the shop in order to repossess it. The creditor cannot use any force or threats of violence to repossess your car.

This means if you default on your payments, the creditor has the right to repossess the collateral to recover their losses. In Utah, repossession laws allow creditors to take back property without warning, often leading to unpleasant surprises and added stress.

Trying to reinstate or redeem your auto loan typically has to happen within a short time period, such as about two weeks, so you could have your car back soon after it's repossessed. You may have to wait longer, perhaps several months, if the car is sold at auction due to the time of the auction process.

If you can't make your car payments, there are some clear advantages to voluntary surrender compared with involuntary repossession: You can avoid some of the penalties and fees imposed during an involuntary surrender, like towing and storage fees.

Utah formerly required a public notary for titles, but no longer does. However, the instructions on the back of the document indicate that the seller should retain a copy of the document.

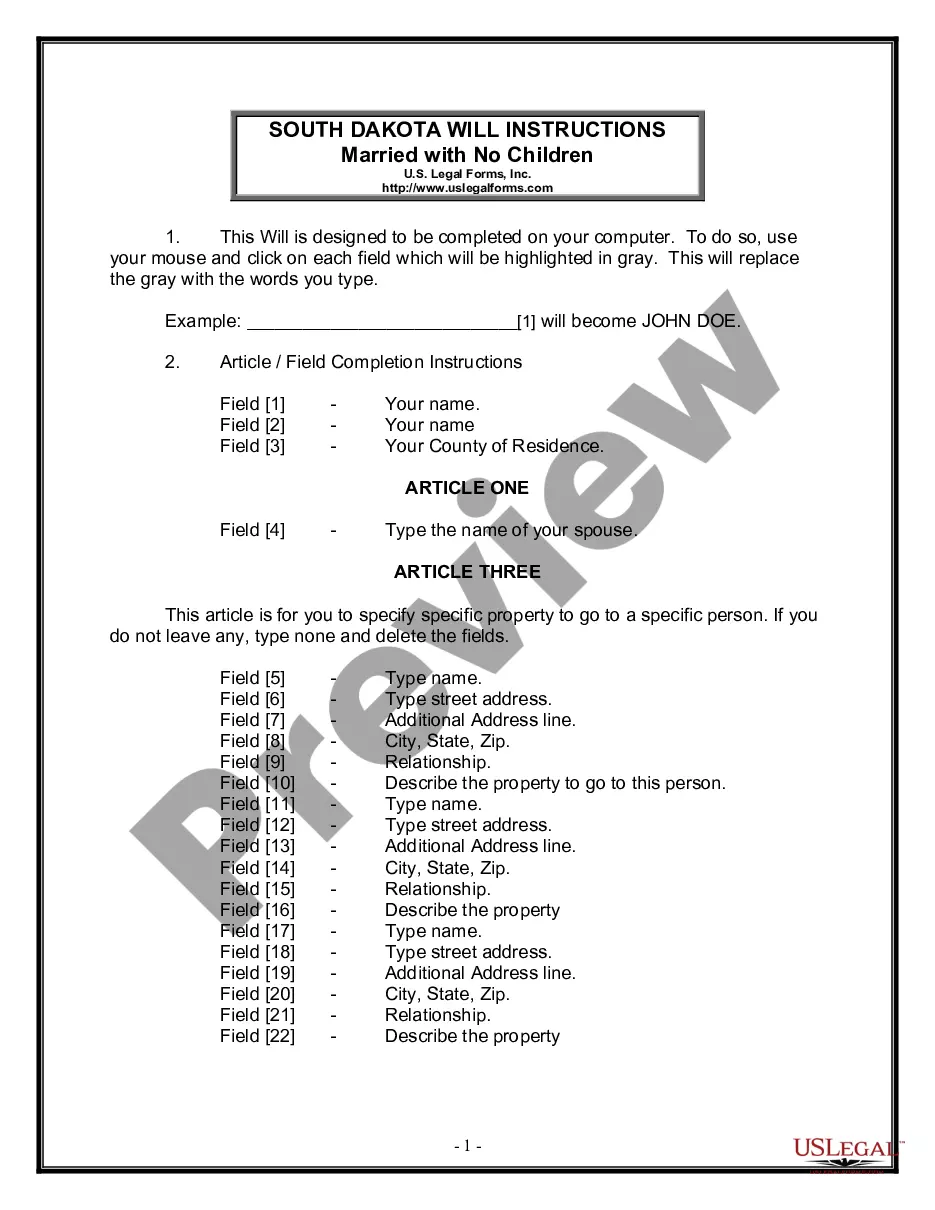

Price here next print your full name here. And in this field write your entire. Address includingMorePrice here next print your full name here. And in this field write your entire. Address including street. Address city state and zip. After that sign and put the date on this line.

But, if the repossession company can't access your car because it is hidden, blocked, or locked up, your lender goes to court to get a replevin.