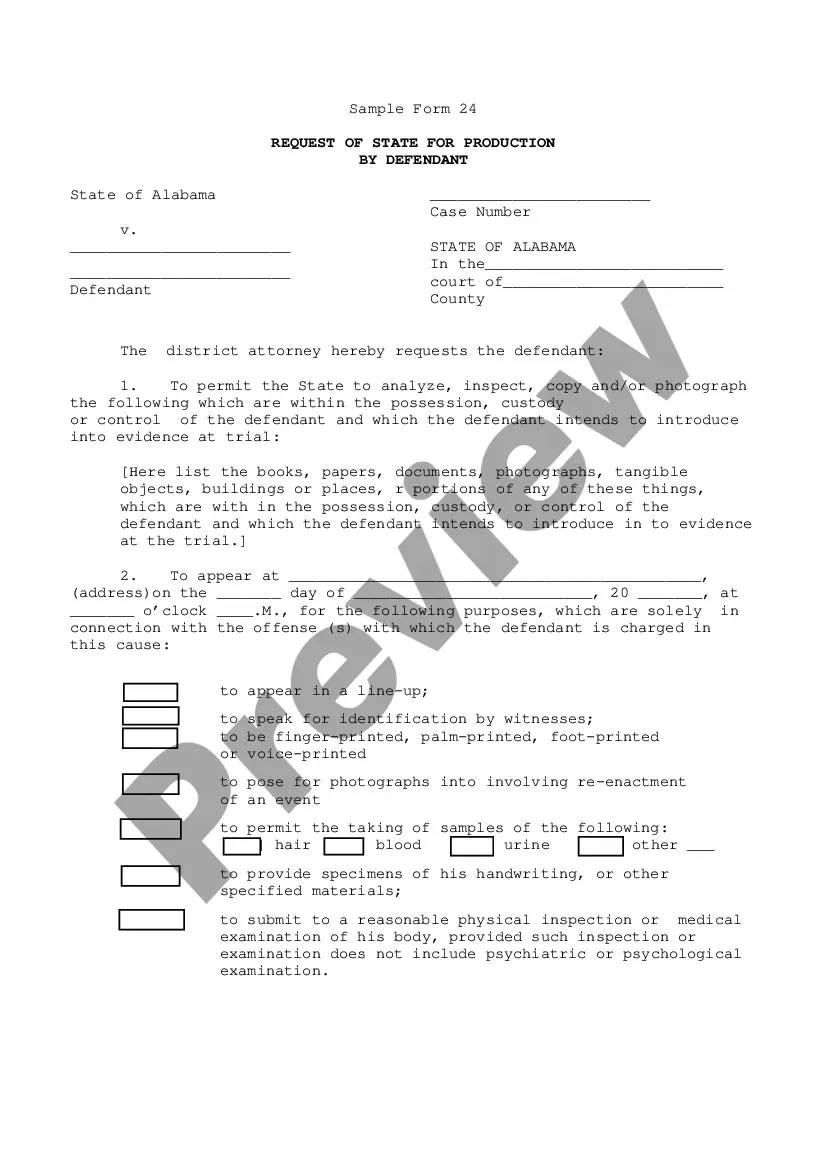

This form is a Verfied Complaint for Replevin. The plaintiff has filed this action against defendant in order to replevy certain property in the defendant's possession.

Repo Form Bought With Cash In Philadelphia

Description

Form popularity

FAQ

Trying to reinstate or redeem your auto loan typically has to happen within a short time period, such as about two weeks, so you could have your car back soon after it's repossessed. You may have to wait longer, perhaps several months, if the car is sold at auction due to the time of the auction process.

Typically, you can miss two to three car payments before facing repossession, but the exact number can vary depending on your lender's policies and the terms of your loan agreement. Many lenders initiate the repossession process after about 60 to 90 days of missed payments.

Repossession, colloquially repo, is a "self-help" type of action in which the party having right of ownership of a property takes the property in question back from the party having right of possession without invoking court proceedings.

Under Pennsylvania law, lenders can repossess a borrower's car if they default on the loan. Though this could mean letting your insurance lapse, most repos happen because borrowers get behind on their car payments. Your loan agreement will outline exactly what default means to your lender.

To add, remove, or change a name on a deed, have a lawyer, title company, or other real estate professional prepare the deed. Then, record the new deed with the Department of Records. Note: We recommend that you do not prepare a deed on your own. We also recommend that you get title insurance.

What Happens If the Repo Agent Doesn't Find Your Car? But if you make it hard for the repo agent to get it, then the creditor may use another method to get the car back, called "replevin." Replevin can be just as costly as a repossession, if not more so.

Contact your DMV. They can run the VIN and see who has the lien. The lien holder can request a duplicate title from the DMV. The bank cannot request the title if they have not recorded the lien. This is where it gets complex when chasing titles especially across state lines.

T he law in PA does not require you let them do so. The law does allow them to enter the property for the purposes of taking the property back so long as they don't "breach the peace," but otherwise, you don't have to let them on the land voluntarily.

News from Pennsylvania Legal Aid Network (PLAN) You also have options available to try and obtain the return of the vehicle itself, including paying off the amount due, making a new loan agreement with the lender, or filing for bankruptcy to get rid of the debt.

Under Pennsylvania law, lenders can repossess a borrower's car if they default on the loan. Though this could mean letting your insurance lapse, most repos happen because borrowers get behind on their car payments. Your loan agreement will outline exactly what default means to your lender.