Complaint For Foreclosure In Hennepin

Description

Form popularity

FAQ

The sale is followed by a redemption period, which is usually six months. ingly, assuming there is no bankruptcy filing, a typical foreclosure by advertisement (including the typical six month redemption period) generally takes around eight to nine months.

Call us. Call 612-348-3000, Monday through Friday, 8 a.m. to p.m.

Many courts will accept an answer in general letter form of a reply to the foreclosure complaint. Although there are formalities in answering which lawyers know, most courts will accept an answer in letter form. It should simply admit or deny the allegations of each paragraph of the complaint.

After the inspection contingency is removed, there is typically 4-6 weeks until the closing happens.

Key Takeaways. In general, a lender won't begin foreclosure until you've missed four consecutive mortgage payments. Timing can vary from lender to lender, as well as the state of the housing market at the time. Lenders generally prefer to avoid foreclosure because it is costly and time-consuming.

The sale is followed by a redemption period, which is usually six months. ingly, assuming there is no bankruptcy filing, a typical foreclosure by advertisement (including the typical six month redemption period) generally takes around eight to nine months.

For homeowners facing immediate foreclosure, filing for bankruptcy or obtaining a temporary restraining order (TRO) can be effective solutions. Chapter 7 or Chapter 13 bankruptcy creates an “automatic stay,” which temporarily halts all collection activities, including foreclosure auctions.

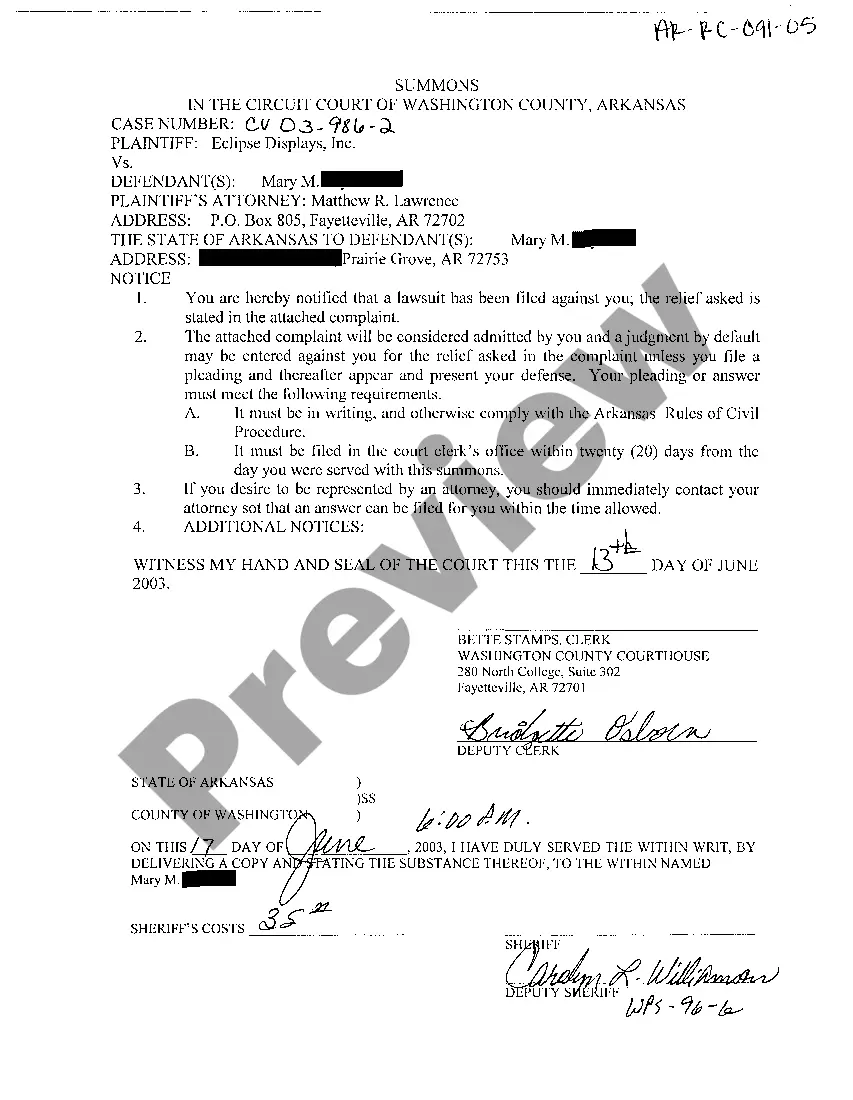

One way to attack a foreclosure is to argue that the foreclosing party does not have standing to foreclose. If the foreclosing party cannot produce the promissory note on which the loan is based, the court likely will dismiss the case.

If you are behind in your payments, consider the following tips: Find a reputable housing counselor. Request a loan modification. Refinance with a new loan. Consider reinstatement. Ask for a forbearance. Set up a repayment plan with the lender. Ask the lender to waive fees or penalties. Explore selling the home.