Repossession Form Statement With Join In Cuyahoga

Category:

State:

Multi-State

County:

Cuyahoga

Control #:

US-000265

Format:

Word;

Rich Text

Instant download

Description

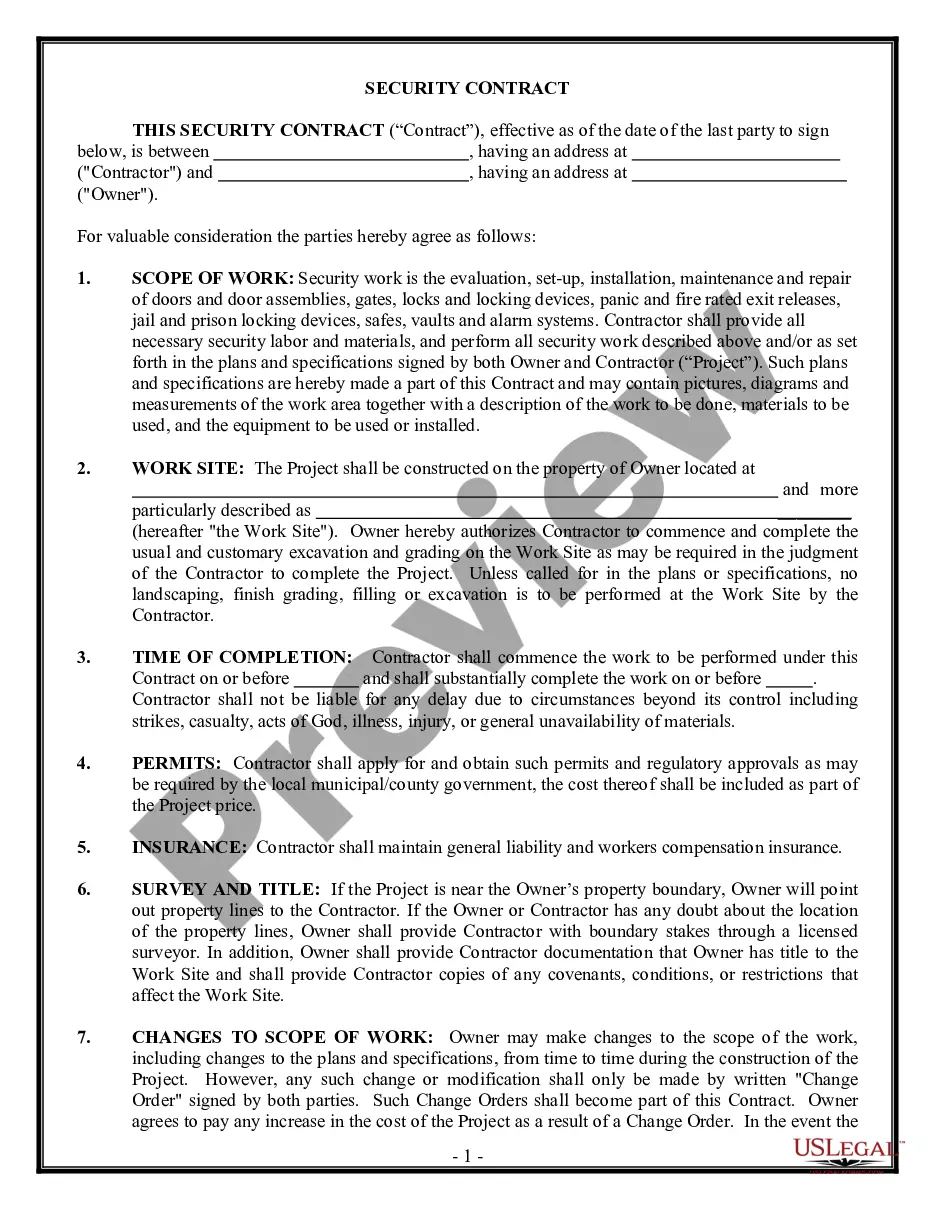

The Repossession Form Statement with Join in Cuyahoga serves as a Verified Complaint for Replevin, allowing a party to reclaim property unlawfully held by another. This document outlines jurisdiction and venue details, lists the involved parties, and provides a comprehensive background on significant contracts, including Retail Installment Contracts and Commercial Loan Agreements related to multiple vehicles. Key features include specific terms indicating the indebtedness regarding these vehicles, along with supporting documentation requirements through attached exhibits. Filling instructions emphasize the need for accurate data entry, especially regarding vehicle identification and amounts owed. This form is particularly useful for attorneys, partners, and legal assistants involved in debt recovery and repossession cases, as it guides them through legal proceedings to reclaim collateral. Moreover, paralegals and associates may utilize this document to streamline the process of preparing legal filings, ensuring compliance with local regulations in Cuyahoga. The form also holds relevance for owners and parties in similar contractual disputes, providing a structured approach to address wrongful detention of property.

Free preview

Form popularity

FAQ

To attach the lien, the creditor files the judgment with the clerk of court of common pleas in any Ohio county where the debtor owns real estate (a home, land, etc.) now or may own real estate in the future.

The Clerk of Courts title office in any county will be able to record a lien. The owner's title and the security agreement or the owner's title and a properly executed application with the VIN and lien holder stated and $15.00 will enable the county title office to record a lien.

Cuyahoga County sales tax details The minimum combined 2024 sales tax rate for Cuyahoga County, Ohio is 8.0%. This is the total of state, county, and city sales tax rates. The Ohio sales tax rate is currently 5.75%. The Cuyahoga County sales tax rate is 2.25%.