Repossession Form Statement With Lienholder In Collin

Description

Form popularity

FAQ

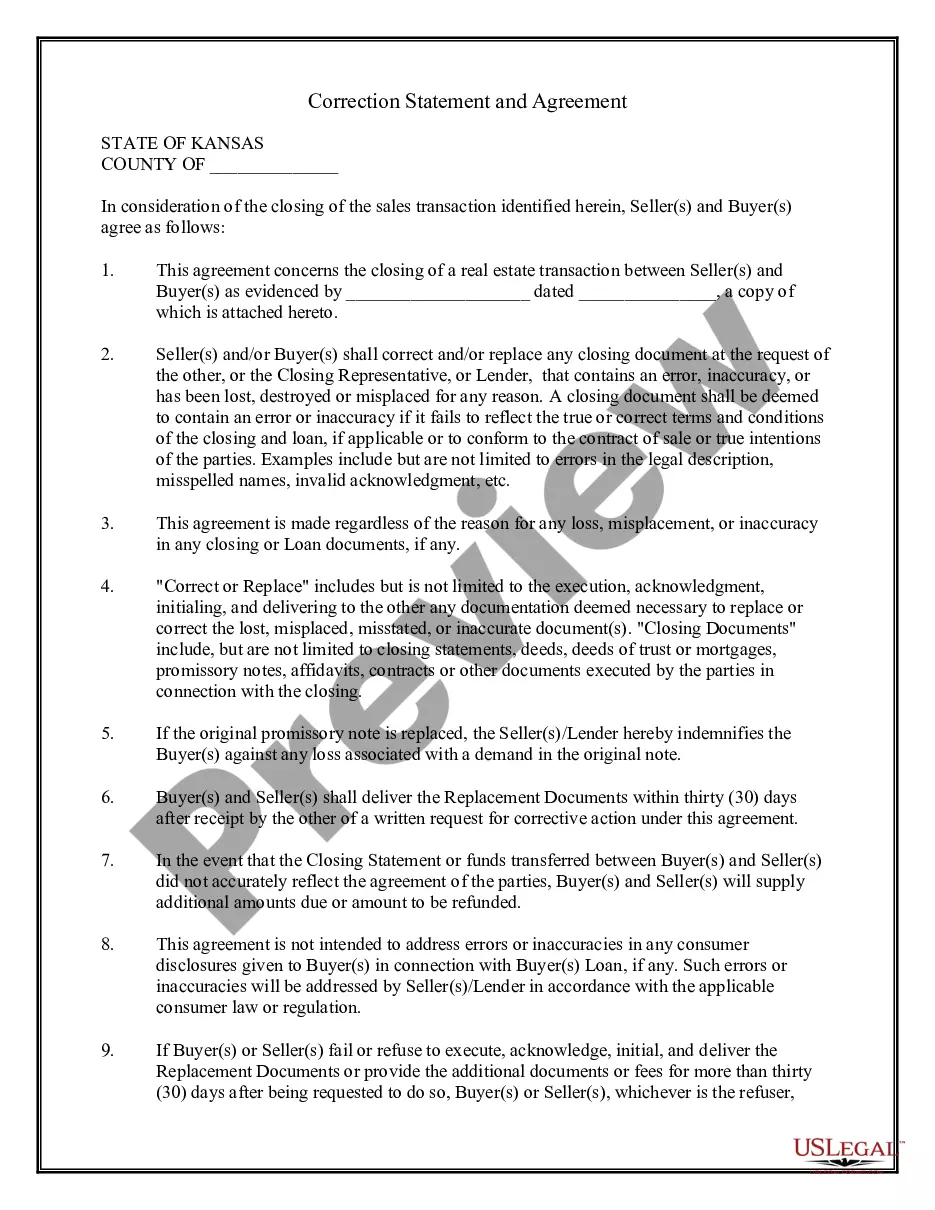

You are hereby notified that your description of motor vehicle, year, make, model and VIN #, was lawfully repossessed on Date because you defaulted on your loan with Credit Union Name. The vehicle is being held at location address of vehicle. be sold at public sale. A sale could include a lease or license.

Good afternoon, I hope that you are doing well. Yes, it is possible to negotiate a settlement for the remaining balance of a car loan after it is repossessed. And it is also possible that you can negotiate a settlement for less than the full amount owed.

A repossession affidavit is a legal statement filed with the Department of Motor Vehicles when you repossess a car from a customer. This document provides details about the repossession such as why and how the vehicle was repossessed. It also informs government authorities that the vehicle has been repossessed.

After repossession, a consumer may have the option to redeem the vehicle before it is sold by paying the entire outstanding balance of the car loan, including interest, costs, and fees.

Initiate a formal dispute with all necessary credit reporting agencies (CRAs) that issued the report containing the repossession. You can dispute a repossession online with all three credit reporting agencies, and this is the most efficient way to pursue removal: Experian. Equifax.

You can also use websites like Carfax, Auto Trader, Buy It Now, eBay and CarsDirect. All these websites provide information about repossessed cars.

Dear Borrower Name: You are hereby notified that your description of motor vehicle, year, make, model and VIN #, was lawfully repossessed on Date because you defaulted on your loan with Credit Union Name. The vehicle is being held at location address of vehicle. be sold at public sale.

Contact your DMV. They can run the VIN and see who has the lien. The lien holder can request a duplicate title from the DMV. The bank cannot request the title if they have not recorded the lien. This is where it gets complex when chasing titles especially across state lines.

Dear Borrower Name: You are hereby notified that your description of motor vehicle, year, make, model and VIN #, was lawfully repossessed on Date because you defaulted on your loan with Credit Union Name. The vehicle is being held at location address of vehicle. be sold at public sale.

If a lender repossesses your collateral, your credit scores are likely to drop. Repossessions are typically reported to the three nationwide consumer reporting agencies (Equifax®, Transunion® and Experian®). Once they're recorded on your credit reports, they can impact your credit scores for up to seven years.