Declaratory Judgment Illinois Insurance Coverage In Montgomery

Description

Form popularity

FAQ

What is duty to defend? A duty to defend insurance policy gives your insurance company the right to defend your business against any lawsuits that might be covered by your commercial general liability policy. It empowers your insurer to decide which lawyers to hire and whether to settle or take the case to court.

They are generally requested when a lawsuit is threatened but before the lawsuit is actually filed, when a conflict might exist between a party's or parties' rights under law or under contract and as a way to prevent multiple lawsuits from the same plaintiff.

The duty to settle arises when a claim has been made against the insured and there is a reasonable probability of recovery in excess of policy limits, and a reasonable probability of a finding against the insured.

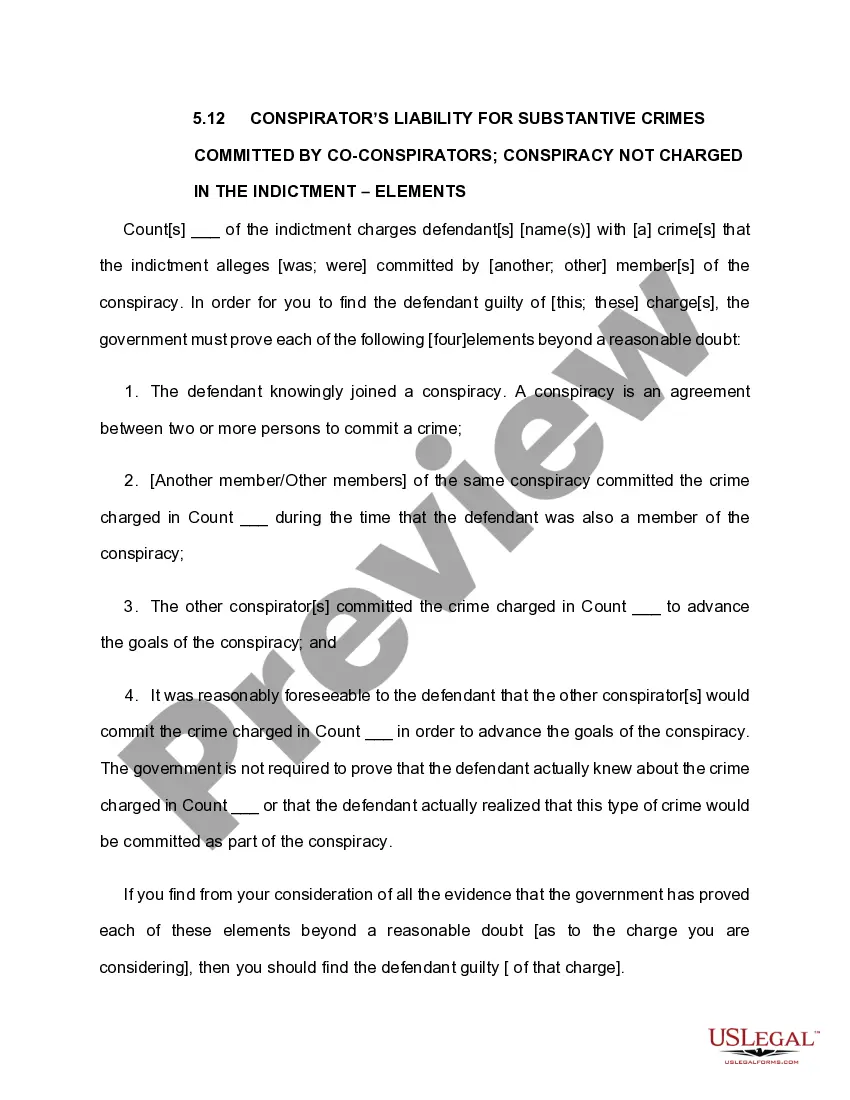

"The essential requirements of a declaratory judgment action are: (1) a plaintiff with a legal tangible interest; (2) a defendant having an opposing interest; and (3) an actual controversy between the parties concerning such interests. Citations.

The duty to defend is a crucial obligation imposed on insurance companies. When an insured party faces a claim or lawsuit covered by their insurance policy, the insurer has a duty to provide legal defense for the insured.

If some of the geographical connections underlying the relationship between an insurer and its insured fall outside of Illinois, a court may be called upon to make a “choice of law” decision, which means that the court must decide whether to apply the law of Illinois or another state's law to decide the insurance ...