Partnering Angel Investor With Little Money In Palm Beach

Category:

State:

Multi-State

County:

Palm Beach

Control #:

US-00016DR

Format:

Word;

Rich Text

Instant download

Description

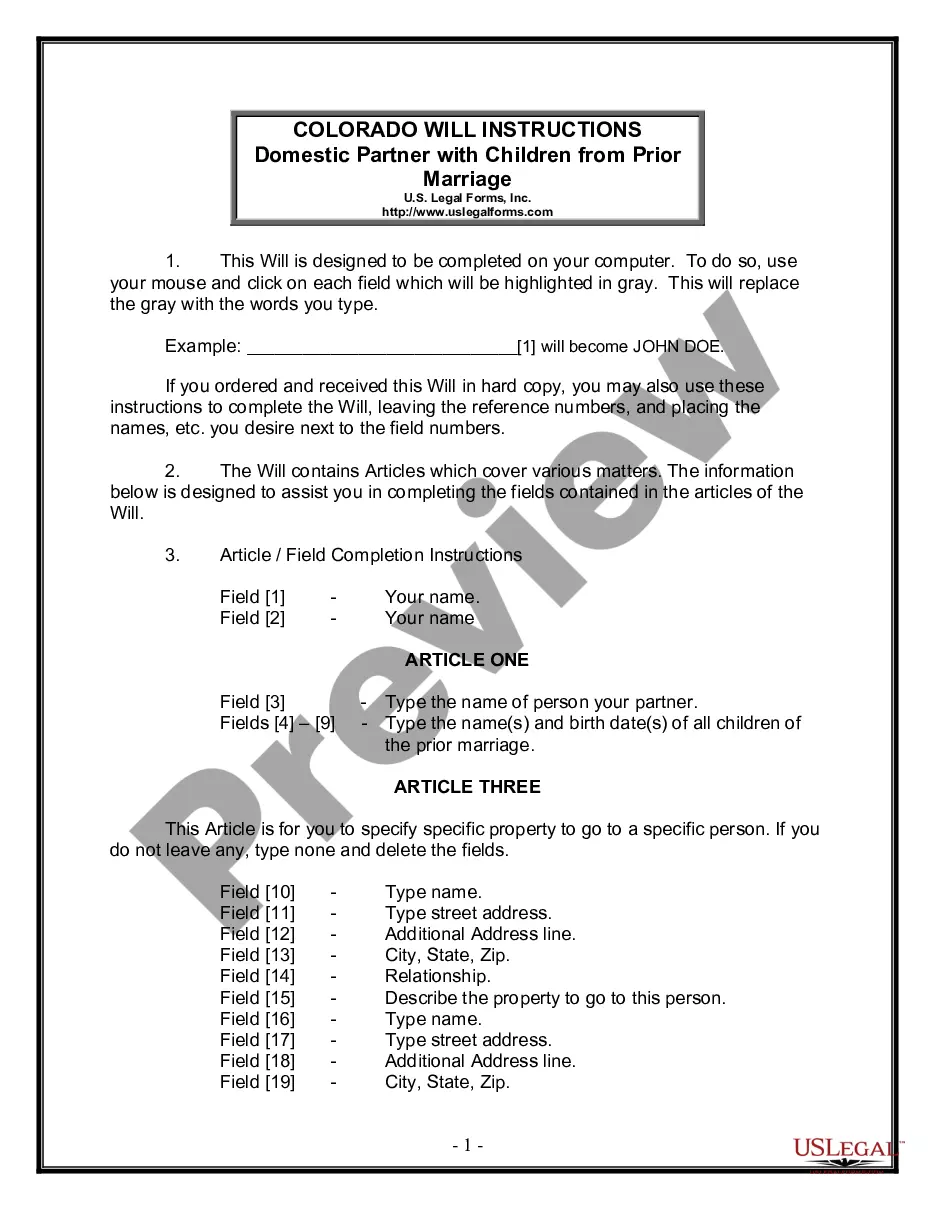

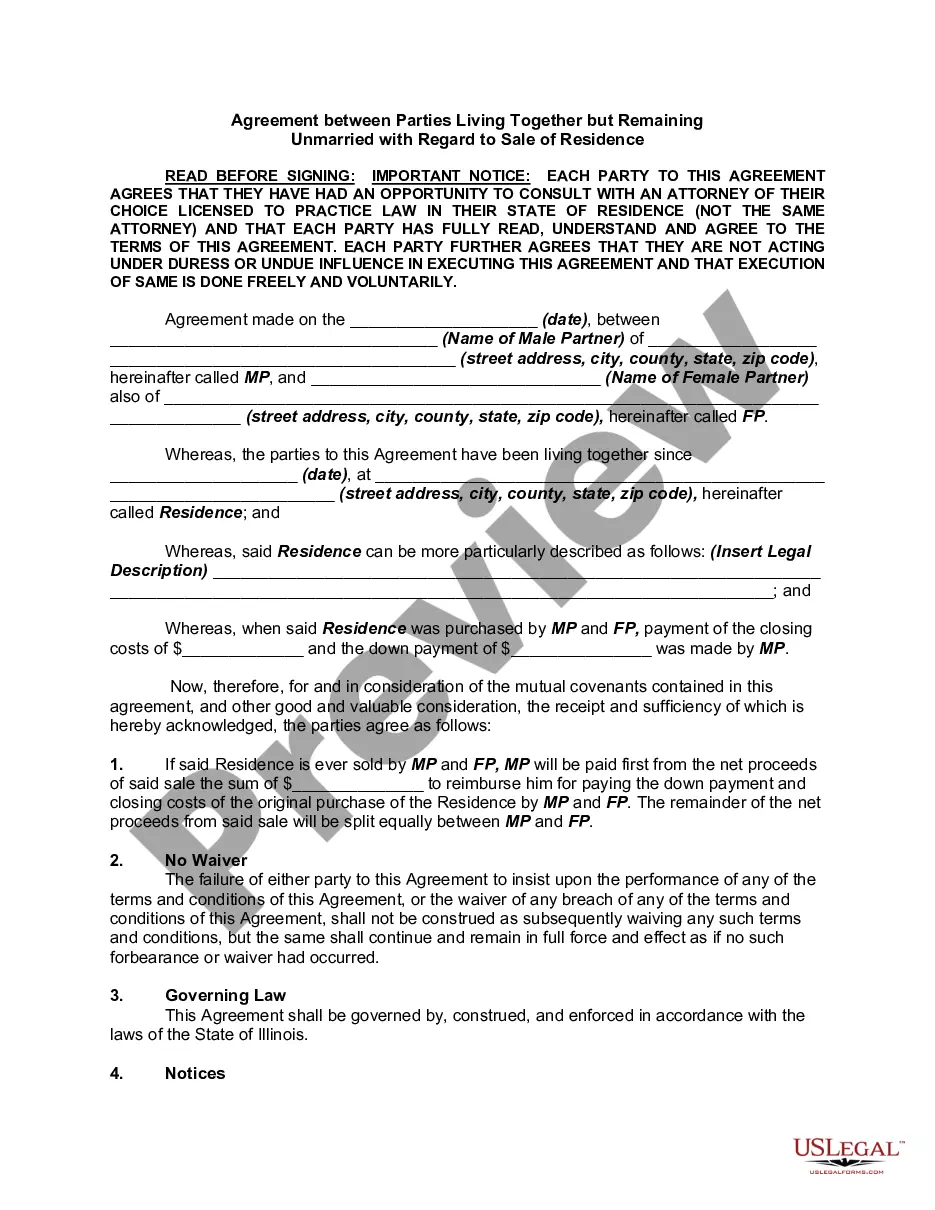

The Angel Investment Term Sheet serves as a crucial document for outlining the terms and conditions relevant to the financing through Series A Preferred Stock for startups in Palm Beach, particularly for those interested in partnering with angel investors who may have limited funds. The term sheet delineates essential features such as the minimum amount of offering, number of shares, purchase price, and key rights, preferences, and privileges associated with the investment. For users like attorneys, partners, and business owners, the form provides clear instructions for filling out the necessary information, ensuring compliance with legal standards. It highlights specific use cases including dividend entitlement, liquidation preferences, voting rights, and redemptions, making it comprehensive for legal professionals and investors alike. The form also incorporates protective provisions, ensuring that investor rights are safeguarded, which is especially important when engaging with individuals contributing modest amounts. Thus, this term sheet is an invaluable tool for facilitating discussions between companies and potential investors, fostering transparent and secure investment agreements.

Free preview

Form popularity

FAQ

Angel investors typically seek a 10%-30% equity stake in a company. This percentage is negotiated based on your startup's valuation, the funding amount and the perceived risk. It's essential to strike a balance that reflects your company's current value and future potential.

High Net Worth Individuals The typical angel investor is someone who's net worth is likely in excess of $1 million or who earns over $200,000 per year.

It's typically between around 10% and 25% but it can be as much as 40% or more. Angel investment is most suitable if your business has growth potential, and you're willing to give up part ownership in return for investment.