Using Debt To Pay Off Debt In Bexar

Description

Form popularity

FAQ

File (turn in) your completed answer form with the court. To file online, go to E-File Texas ( ) 11 and follow the instructions. To file in person, take your answer (and copies) to the district clerk's office in the county where the plaintiff filed the case.

In Texas, the small claims limit is set at $20,000, which is the maximum amount you can sue for.

Small Claims Cases in Texas The limit to the amount that a person can sue for in small claims cases is $20,000. Justice courts can also settle landlord/tenant disputes such as evictions and repairs.

When it comes to credit card debt relief, it's important to dispel a common misconception: There are no government-sponsored programs specifically designed to eliminate credit card debt. So, you should be wary of any offers claiming to represent such government initiatives, as they may be misleading or fraudulent.

The minimum combined 2024 sales tax rate for Bexar, Texas is 8.25%. This is the total of state, county, and city sales tax rates. The Texas sales tax rate is currently 6.25%. The Bexar sales tax rate is 0%.

SAN ANTONIO – The Bexar County Commissioners Court unanimously voted on Tuesday to adopt a $2.8 billion budget for fiscal year 2024-2025. Public safety, community policing and basic services were priorities of the budget.

Bexar County's population increased 12 out of the 12 years between year 2010 and year 2022. Its largest annual population increase was 2% between 2013 and 2014. Between 2010 and 2022, the county grew by an average of 1.5% per year.

Members of the San Antonio City Council unanimously approved a $3.96 billion budget for the 2025 fiscal year on Thursday — a 5.8% increase from this year's $3.7 billion budget.

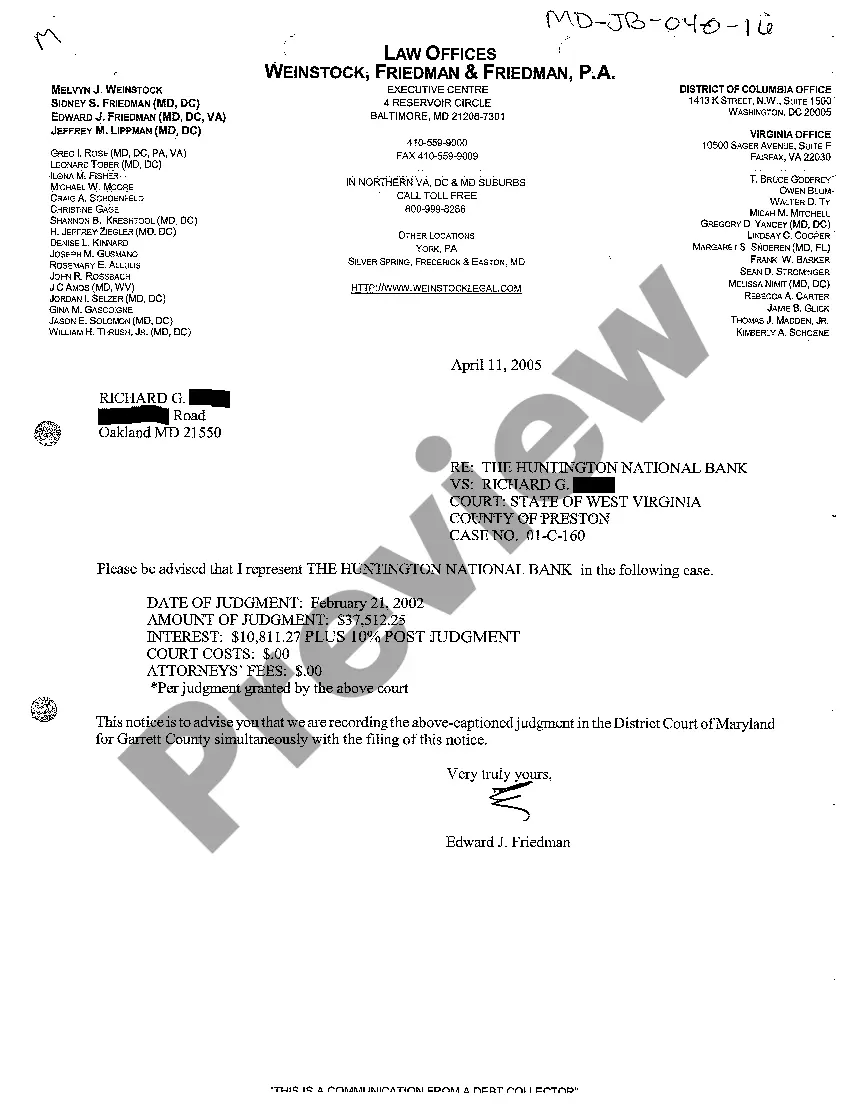

In Texas, you can attach a property lien to a debtor's real estate to collect a court judgment. In a civil court case, after a judge or jury hands down a verdict -- or after a court-approved settlement -- a judgment is entered by the court.

Under California law, debt collectors have the right to place a lien on a person's home once they get a judgment. California law then lets the debt collector force the sale of a person's home to collect the judgment, even if that property is the debtor's only home.