Alimony Form For Taxes In Riverside

Description

Form popularity

FAQ

There is no “Ten Year Rule” in California requiring spousal support to last indefinitely for marriages of more than ten years. However, ten years is an important milestone that could affect the court's ability to revisit the issue of spousal support later. Divorce is difficult. We can help make it easier for you.

The courts in many California counties use a formula as a guideline for calculating the amount of temporary spousal support. These guidelines vary, but one common formula for the monthly amount of support is 40% of the high earner's net monthly income minus 50% of the low earner's net monthly income.

Report alimony received on Form 1040 or Form 1040-SR (attach Schedule 1 (Form 1040) PDF) or on Form 1040-NR, U.S. Nonresident Alien Income Tax Return (attach Schedule NEC (Form 1040-NR) PDF).

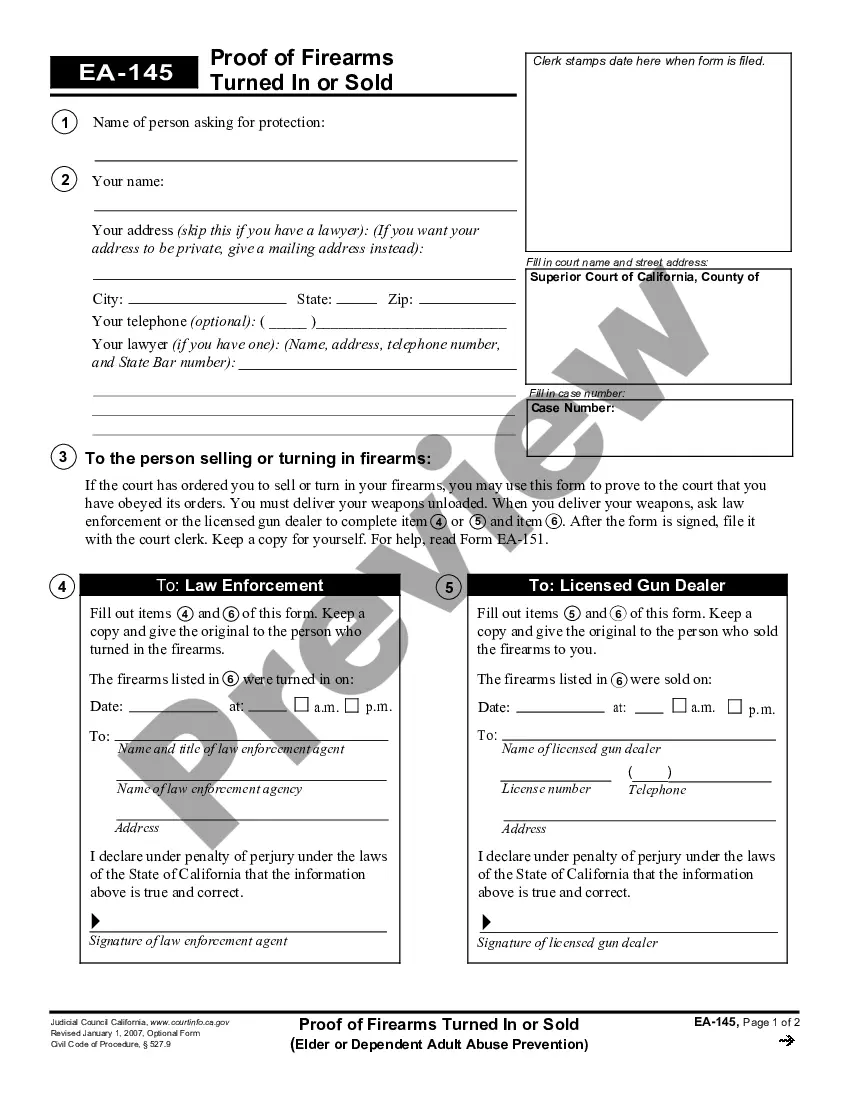

Bank statements or copies of checks deposited for the most recent 12 months or applicable period showing receipt of payments. Both must indicate the originating entity.

California determines alimony based on the recipient's “marital standard of living,” which aims to allow the spouse to continue living in a similar manner as during the marriage.

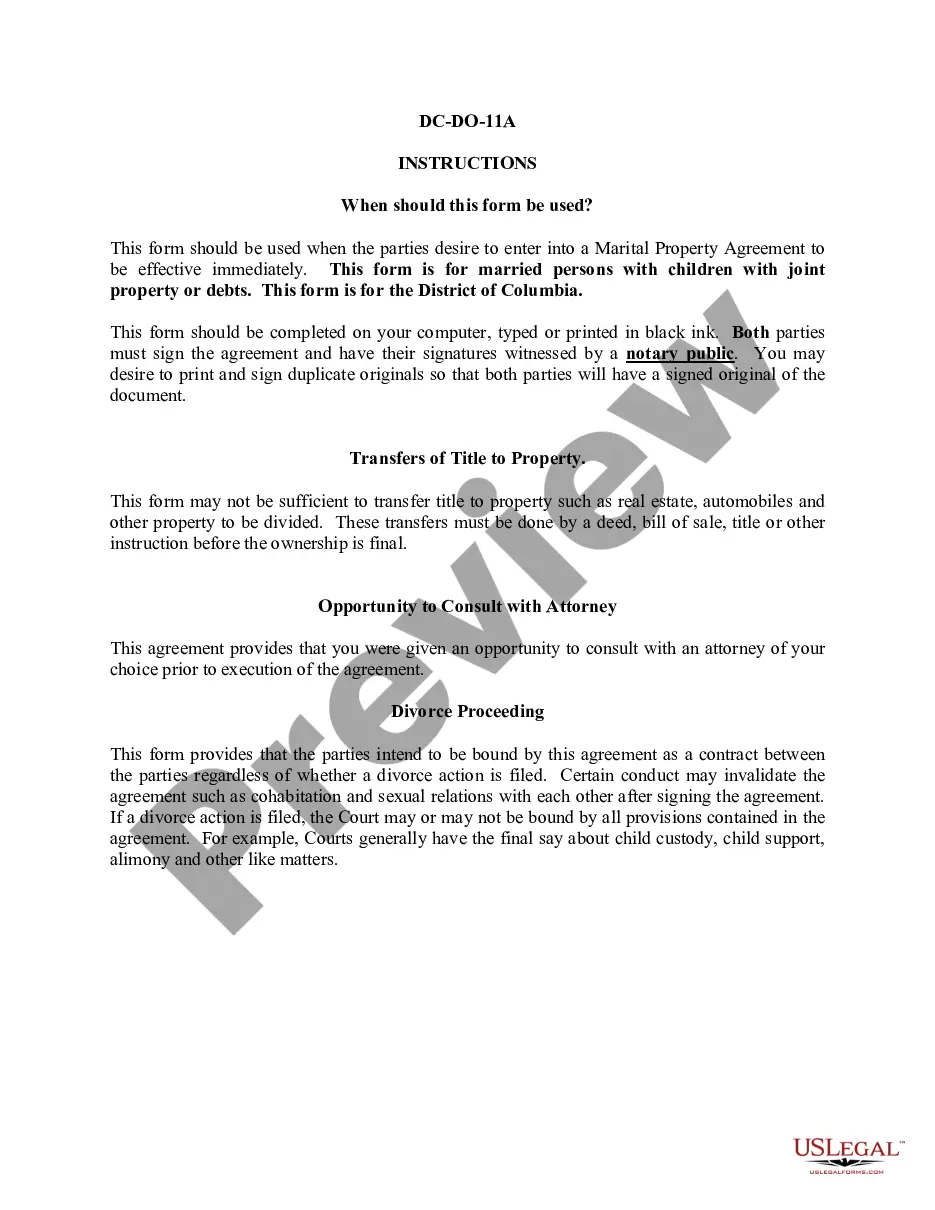

What do I do if I want alimony? You can ask for alimony as part of a divorce proceeding. If you and your spouse reach an agreement about alimony, you can ask the judge to make the agreement a part of the court order. If you cannot reach an agreement, the judge will decide whether you are entitled to alimony.

Reporting taxable alimony or separate maintenance Deduct alimony or separate maintenance payments on Form 1040, U.S. Individual Income Tax Return or Form 1040-SR, U.S. Tax Return for Seniors (attach Schedule 1 (Form 1040), Additional Income and Adjustments to Income PDF).

Alimony payments you receive are taxable to you in the year received, ing to the IRS. The amount is reported on line 11 of Form 1040. You cannot use Form 1040A or Form 1040EZ.

Alimony Tax Deduction For individuals participating in alimony payments, it is helpful to know that, unlike other provisions of the legislation, this change is a permanent one. In other words, once the TCJA expires at the end of 2025, there will be no reversions back to the pre-TCJA deductibility of alimony payments.

In the state of California, alimony payments are subject to both federal and state income taxes. While federal tax laws have undergone significant changes in recent years, California continues to follow its own tax regulations when it comes to alimony.