Alimony Calculator In Virginia In Clark

Description

Form popularity

FAQ

There is no fixed rule or set duration that automatically makes one spouse eligible or ineligible for alimony payments. However, marriage length is a crucial factor judges consider when determining whether to award alimony and, if so, how much and for how long.

The formula stated in § 16.1-278. is: (a) 30% of the gross income of the payor less 50% of the gross income of the payee in cases with no minor children and (b) 28% of the gross income of the payor less 58% of the gross income of the payee in cases where the parties have minor children in common.

One of the most significant disqualifying factors for alimony in Virginia is adultery. If you've been unfaithful during your marriage, you may lose your right to receive spousal support. Other fault-based grounds for divorce, such as cruelty or desertion, can also impact alimony decisions.

California determines alimony based on the recipient's “marital standard of living,” which aims to allow the spouse to continue living in a similar manner as during the marriage.

Two of the biggest alimony factors in Virginia when awarding spousal support are the financial need of the party asking for support and the ability of the person paying to supplement the income of the requesting spouse to meet their needs.

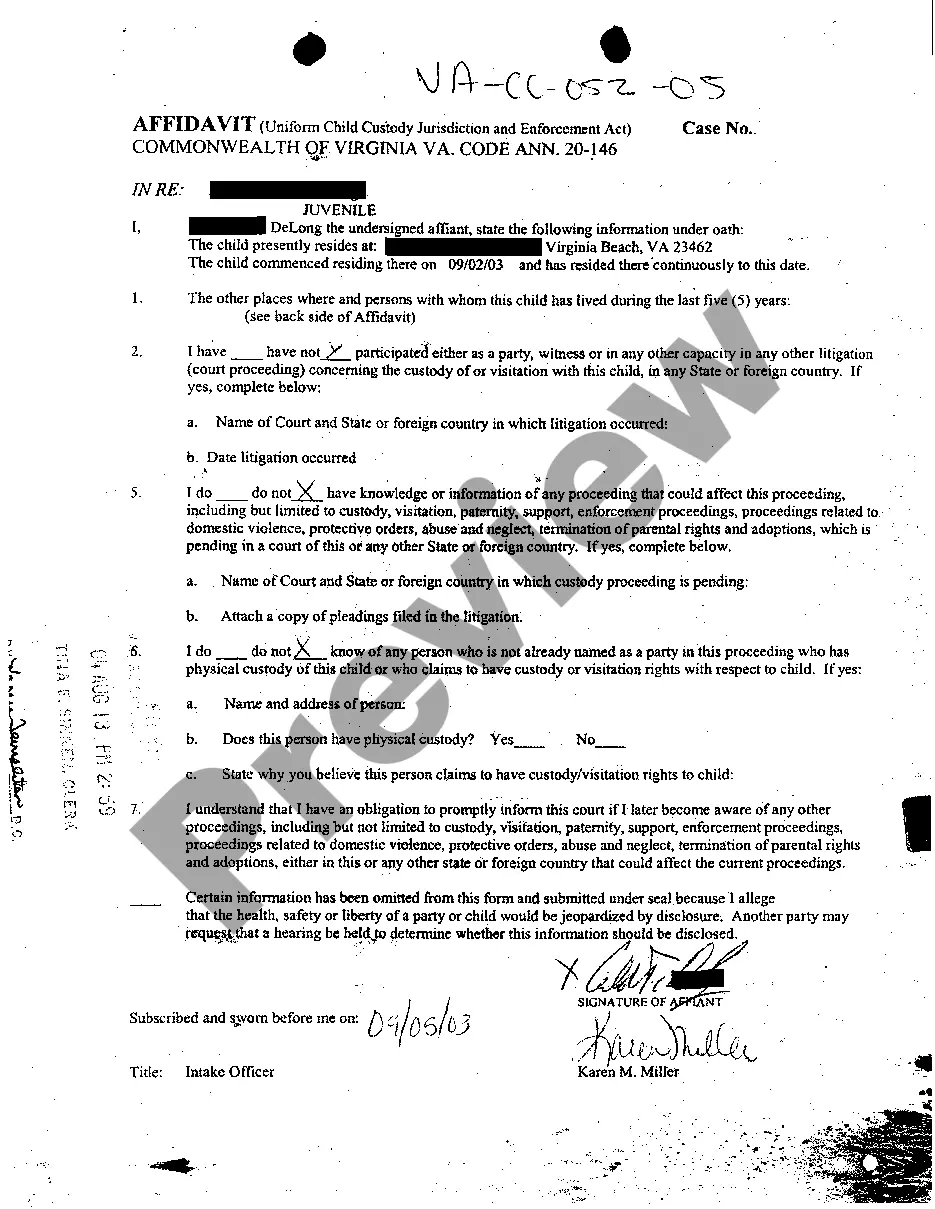

You can start a spousal support case in Virginia Juvenile & Domestic Relations district courts by filing a petition. Find your local J&DR district court at this page, with links to each local court. The local J&DR district court can provide you more information about how to file a spousal support petition.

What is a wife entitled to in a divorce in Virginia? Neither party in the marriage is automatically entitled to anything until it is determined by the court based on their unique situation. Division of property is also determined by the court based on each spouse's financial situation and assets.

The formula is simple: Divide the Wife's annual amount by the interest rate: $100,000 divided by . 10 = $1 million. The formula is known as the present value of a perpetuity because it continues in perpetuity.

40% of the high earner's net monthly income minus 50% of the low earner's net monthly income. For instance, if Spouse A earns $5,000 per month and Spouse B earns $2,500 per month, temporary spousal support might be calculated as follows: 40% of $5,000 = $2,000. 50% of $2,500 = $1,250.

The formula stated in § 16.1-278. is: (a) 30% of the gross income of the payor less 50% of the gross income of the payee in cases with no minor children and (b) 28% of the gross income of the payor less 58% of the gross income of the payee in cases where the parties have minor children in common.