Child Support Alimony Calculator With Steps

Description

How to fill out Affidavit Of Defendant Spouse In Support Of Motion To Amend Or Strike Alimony Provisions Of Divorce Decree Because Of Obligor Spouse's Changed Financial Condition?

Creating legal documents from the ground up can frequently be overwhelming.

Certain situations may require extensive research and substantial financial expenditure.

If you’re looking for a more straightforward and economical method of generating a Child Support Alimony Calculator With Steps or any additional documents without unnecessary complications, US Legal Forms is always available for you.

Our online catalog of more than 85,000 current legal documents encompasses nearly every aspect of your financial, legal, and personal matters. With just a few clicks, you can instantly access state- and county-specific forms meticulously prepared by our legal professionals.

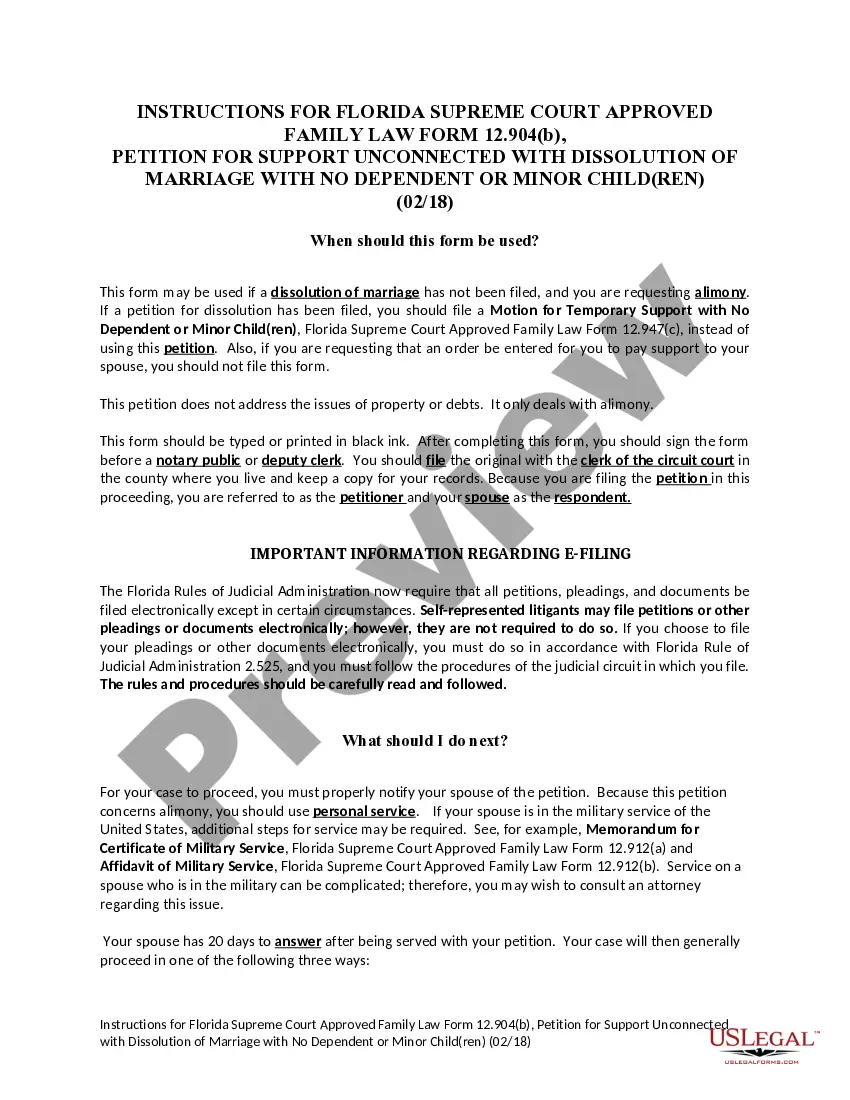

Examine the form preview and descriptions to ensure you have the correct form you are searching for. Verify that the selected form complies with your state and county regulations and laws. Choose the most suitable subscription plan to obtain the Child Support Alimony Calculator With Steps. Download the file. Then complete, sign, and print it out. US Legal Forms has an impeccable reputation and over 25 years of experience. Join us today and transform document completion into a seamless and straightforward process!

- Utilize our platform whenever you require a dependable and trustworthy service through which you can swiftly find and download the Child Support Alimony Calculator With Steps.

- If you’re a returning user and have established an account with us previously, simply Log In to your account, find the template, and download it or re-download it anytime in the My documents section.

- Not registered yet? No worries. It only takes a few minutes to sign up and browse the catalog.

- But before directly downloading the Child Support Alimony Calculator With Steps, adhere to these suggestions.

Form popularity

FAQ

The alimony amount is determined by evaluating several factors, including the length of the marriage, the standard of living during the marriage, and the financial situation of both parties. Courts may look at the recipient's needs and the payer's ability to provide support. Utilizing a Child support alimony calculator with steps can provide clarity and insights into potential alimony amounts based on specific details of your situation. This approach can help you feel more confident in the negotiation process.

Alimony is generally not included in child support calculations, as these two financial obligations serve different purposes. Child support focuses on the needs of the children, while alimony supports the lower-earning spouse. However, understanding both is essential, and the Child support alimony calculator with steps can help you navigate these complex issues. This tool offers a clear way to separate and calculate each obligation.

In Delaware, eligibility for alimony primarily depends on the financial situation of both spouses and the length of the marriage. Factors like the recipient's need for support and the payer's ability to provide it also play a crucial role. A Child support alimony calculator with steps can assist you in understanding how these factors might influence your alimony situation. By analyzing your specific circumstances, you can determine your eligibility more clearly.

Yes, there is a general formula to calculate alimony, although it can differ significantly by jurisdiction. The formula typically considers the difference in income between spouses and the duration of the marriage. To make this calculation easier, you can use a Child support alimony calculator with steps. This tool can guide you through the formula, ensuring you take all relevant factors into account.

The 1 3 1 3 1 3 rule suggests a method for calculating alimony based on a combination of factors, including the duration of the marriage and the income of both parties. This rule provides a straightforward framework for understanding how alimony may be determined. Utilizing a Child support alimony calculator with steps can help you apply this rule effectively to your situation. This approach gives you a better grasp of potential outcomes.

The formula to calculate alimony varies by state, but generally, it factors in the income of both spouses, the length of the marriage, and the recipient's needs. You can use a Child support alimony calculator with steps to estimate potential alimony payments. This tool simplifies the process, providing a clearer picture of financial obligations. By entering specific details, you can arrive at a more accurate figure.

Finally, there is the Ginsburg formula, where the payor's income after the payment of alimony should equal the total of the payor's income and the payee's income divided by 1.8. Or, in other words, alimony equals the payor's income minus that amount.

Alimony is usually around 40% of the paying party's income. This number is different in different states and different situations.

Calculators cannot determine your right to alimony. You will put in as few as two factors, typically income and the duration of the marriage, or more than a dozen factors before a calculator spits out a number.

Texas child support laws provide the following Guideline calculations: one child= 20% of Net Monthly Income (discussed further below); two children = 25% of Net Monthly Income; three children = 30% of Net Monthly Income; four children = 35% of Net Monthly Income; five children = 40% of Net Monthly Income; and six ...