Alimony Calculator In Nevada

Description

How to fill out Affidavit Of Defendant Spouse In Support Of Motion To Amend Or Strike Alimony Provisions Of Divorce Decree Because Of Obligor Spouse's Changed Financial Condition?

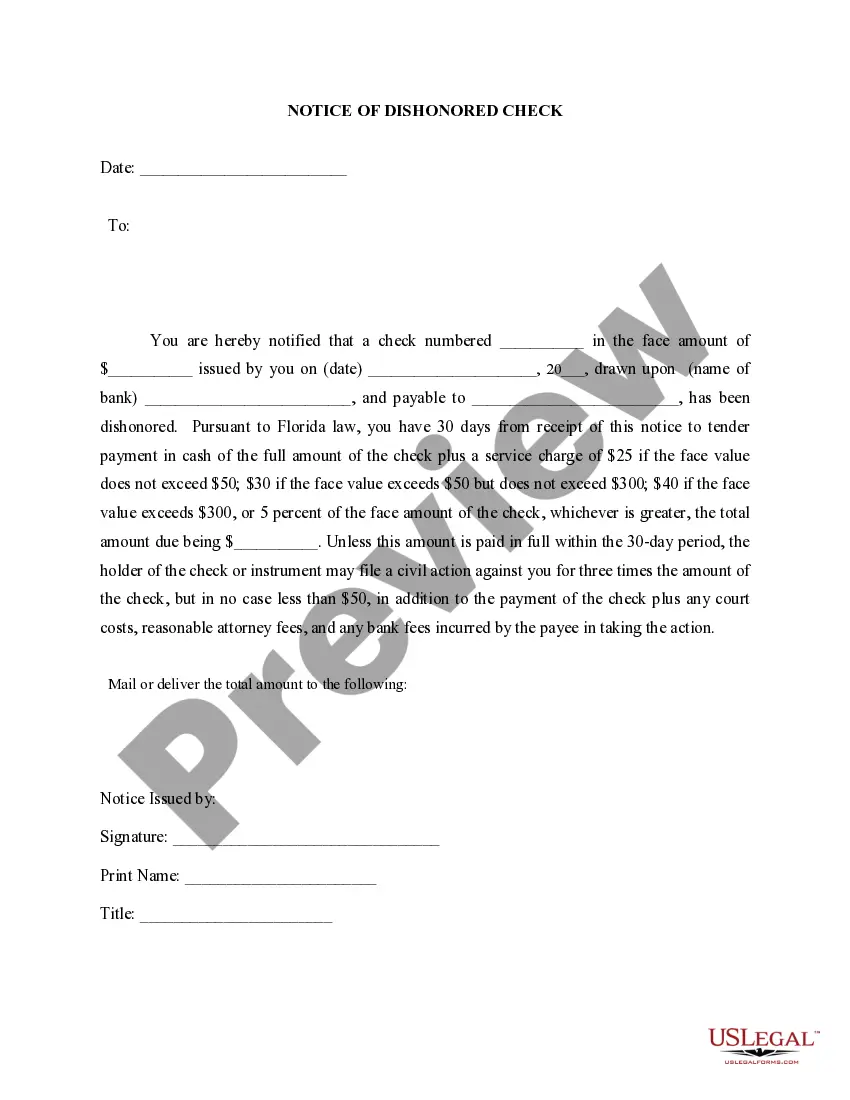

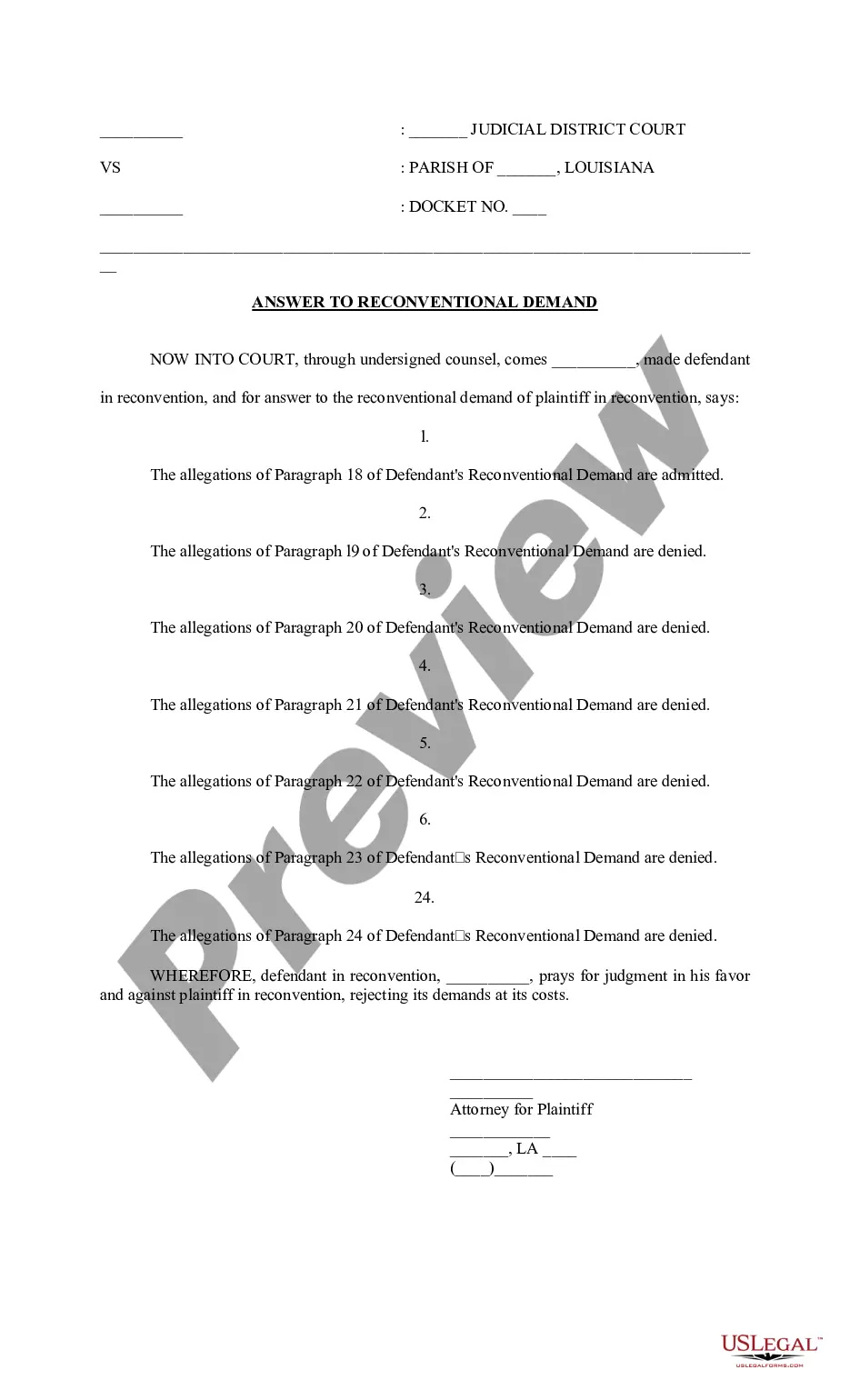

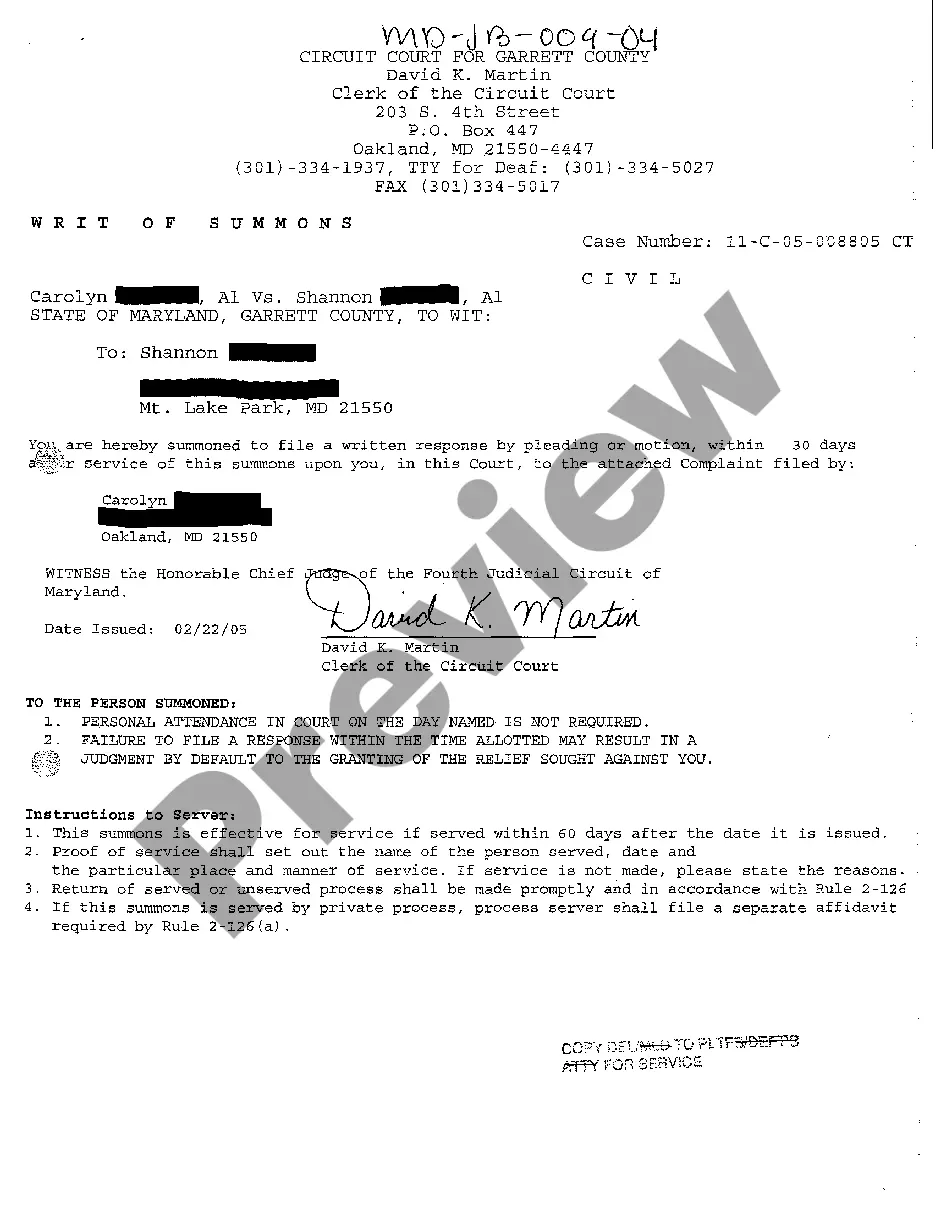

Handling legal paperwork and operations might be a time-consuming addition to the day. Alimony Calculator In Nevada and forms like it often require you to search for them and understand how to complete them properly. Therefore, if you are taking care of economic, legal, or individual matters, having a thorough and practical web catalogue of forms at your fingertips will help a lot.

US Legal Forms is the top web platform of legal templates, featuring more than 85,000 state-specific forms and a variety of resources to help you complete your paperwork easily. Discover the catalogue of appropriate documents available to you with just a single click.

US Legal Forms offers you state- and county-specific forms offered by any moment for downloading. Shield your papers managing operations having a top-notch support that allows you to put together any form within minutes with no additional or hidden fees. Just log in in your profile, locate Alimony Calculator In Nevada and acquire it immediately from the My Forms tab. You can also gain access to previously saved forms.

Is it your first time using US Legal Forms? Sign up and set up up your account in a few minutes and you will have access to the form catalogue and Alimony Calculator In Nevada. Then, follow the steps listed below to complete your form:

- Be sure you have the correct form using the Review feature and looking at the form information.

- Pick Buy Now as soon as ready, and choose the monthly subscription plan that is right for you.

- Press Download then complete, eSign, and print the form.

US Legal Forms has 25 years of experience assisting consumers manage their legal paperwork. Obtain the form you want today and streamline any operation without having to break a sweat.

Form popularity

FAQ

Additionally, the payor must report alimony payments on their federal income tax return, and the rate of taxation for alimony in Nevada is determined by the IRS. However, the payee will not have to pay taxes on it. It's important to understand these factors before proceeding with a divorce.

If the marriage is from 3 to 20 years, alimony could be granted for as many years as half of the length of the marriage, e.g, if married for 10 years, alimony is paid for five years. If the marriage was longer than 20 years then permanent alimony is highly possible, and even likely.

Calculators cannot determine your right to alimony. You will put in as few as two factors, typically income and the duration of the marriage, or more than a dozen factors before a calculator spits out a number.

Alimony awards made after December 31, 2017, are no longer taxable for the recipient or deductible for the payer. The IRS states that you can't deduct alimony or separate maintenance payments made under a divorce or separation agreement executed after 2018.

As we said, there is no formula in Nevada for calculating alimony. Likewise, there is no set time length of marriage in order to get alimony. Each case is different and alimony is decided by each judge on a case-by-case basis.