This is a generic Affidavit to accompany a Motion to amend or strike alimony provisions of a divorce decree because of cohabitation by dependent spouse. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Affidavit Motion Amend Withholding Tax In Wayne

Description

Form popularity

FAQ

If the amount under/over withheld is deemed too excessive, the IRS can send a lock-in letter notifying the employer how to adjust withholding regardless of the employee's W4 requests. If a W-4 error is caught before filing, individuals can correct this relatively easily by refiling a W-4 with their employer.

In most cases, you still owe the taxes to the IRS even if your employer or payroll department was the one who messed up by not withholding enough taxes during the year. The one exception is if your employer either intentionally or accidentally misclassified you as an independent contractor when you are an employee.

How do I complete abatement form 843? Line 1 is the tax year the abatement is for. Line 2 is the total fees/penalties you are asking the IRS to remove. Line 3 is generally going to be Income (tax). Line 4 is the Internal Revenue Code section. Line 5a is the reason you are requesting the abatement.

On Form 1040-X, enter your income, deductions, and credits from your return as originally filed or as previously adjusted by either you or the IRS, the changes you are making, and the corrected amounts. Then, figure the tax on the corrected amount of taxable income and the amount you owe or your refund.

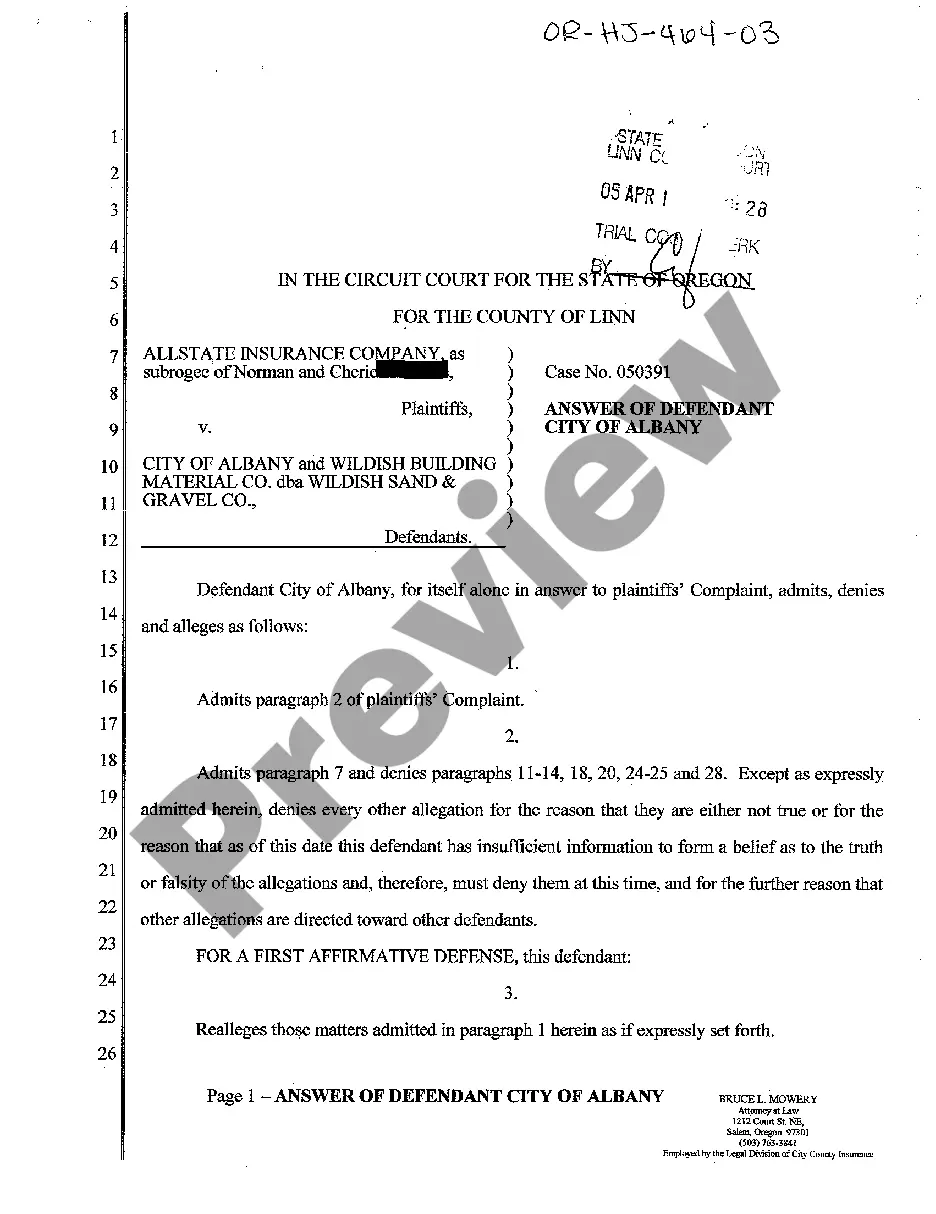

The written response must be made within 20 days of personal service, or within 30 days of the time when service by any other means is complete. If the defendant fails to respond he or she is in default and plaintiff may be able to obtain a default judgment against the defendant.

A summons with notice is a type of summons. The summons with notice is not served with the complaint. It contains all of the information described above for the summons, plus a brief description of the type of case and the relief the plaintiff is asking the court to grant.

``Being served with a summons'' formally notifies you of the legal action against you and gives you the opportunity to respond to the allegations in court. Failure to respond appropriately may result in a default judgment being entered against you.

After a summons with notice is served, the defendant will demand that the plaintiff serve a complaint. The plaintiff must then have the complaint served within 20 days after being served with the demand, or the case may be dismissed.

Form NYS-45-X, Amended Quarterly Combined Withholding, Wage Reporting, and Unemployment Insurance Return, is only available as a paper form.

Mail your return to: NYS CORPORATION TAX, PROCESSING UNIT, PO BOX 1909, ALBANY NY 12201-1909. Private delivery services: See page 3 in the instructions.