Texas Trust Code Beneficiary Rights

Description

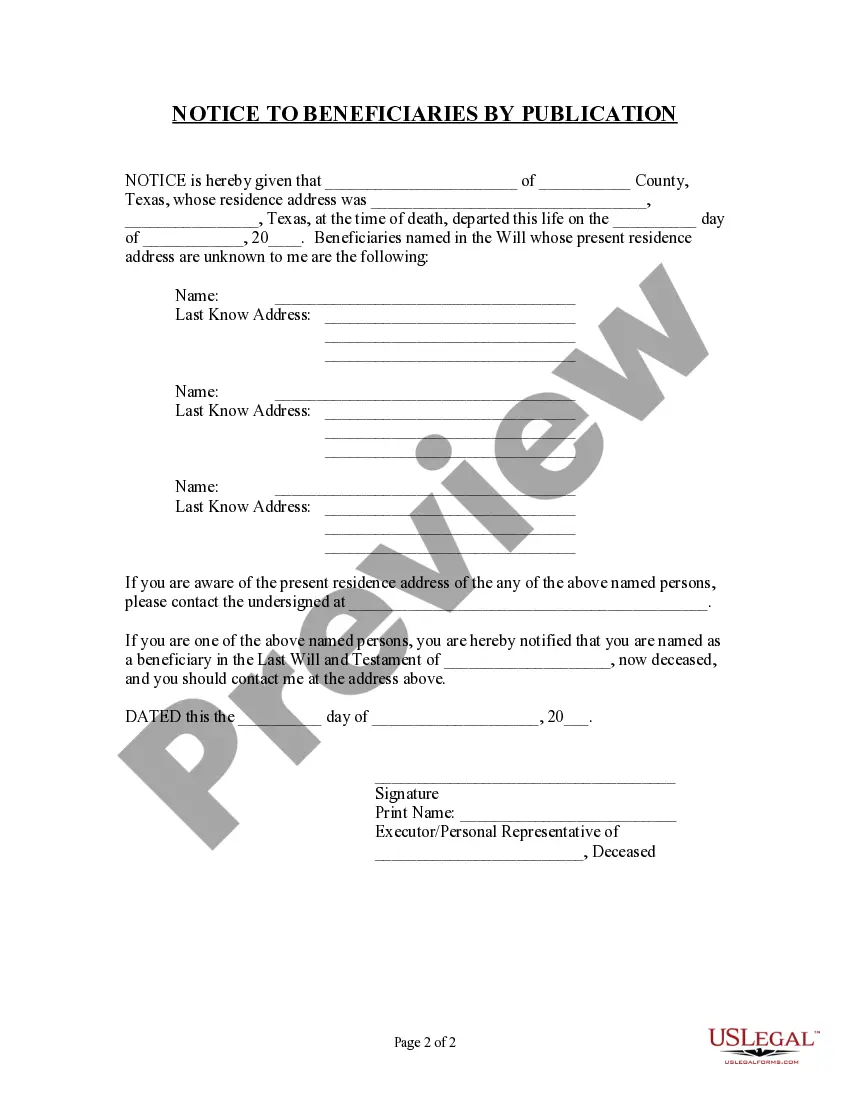

How to fill out Texas Notice To Beneficiaries Of Being Named In Will?

It’s well-known that you cannot instantly become a legal specialist, nor can you efficiently learn to draft Texas Trust Code Beneficiary Rights without possessing a unique set of abilities.

Creating legal documents is a lengthy task that demands specific training and expertise.

So why not entrust the development of the Texas Trust Code Beneficiary Rights to the professionals.

Click Buy now. Once your purchase is complete, you can access the Texas Trust Code Beneficiary Rights, fill it out, print it, and send it to the appropriate individuals or organizations.

You can return to your documents from the My documents tab whenever you need. If you’re an existing user, simply Log In, and find and download the template from the same tab.

- Visit our website to find the document you need in just a few minutes.

- Use the search feature located at the top of the page to identify the form you’re looking for.

- If available, preview it and review the accompanying description to determine if Texas Trust Code Beneficiary Rights is right for you.

- If you require another document, start your search anew.

- Create a free account and select a subscription plan to acquire the form.

Form popularity

FAQ

To leave property to your living trust, name your trust as beneficiary for that property, using the trustee's name and the name of the trust. For example: John Doe as trustee of the John Doe Living Trust, dated January 1, 20xx.

Know your rights as a Beneficiary As an interested person, you are entitled to full disclosure of the trustee's handling of the estate. You have the right to seek accountings, file suit, complain and inquire about distributions. Texas Prop. Code Ann.

Right to an Accounting The proper Trust accounting format will allow each beneficiary to see the total starting assets, all income and gains received by the Trust, all expenses paid, all distributions made to Trust beneficiaries, and a listing of the ending assets on hand.

A trustee may be responsible for administering, managing, and distributing trust assets. A trustee has a fiduciary responsibility to conduct their duties in a way that adheres to the rules of the trust and benefits the beneficiaries of the trust. A trustee must typically be at least 18 years of age and of sound mind.

To leave property to your living trust, name your trust as beneficiary for that property, using the trustee's name and the name of the trust. For example: John Doe as trustee of the John Doe Living Trust, dated January 1, 20xx.