Notice Beneficiary Form For Inheritance

Description

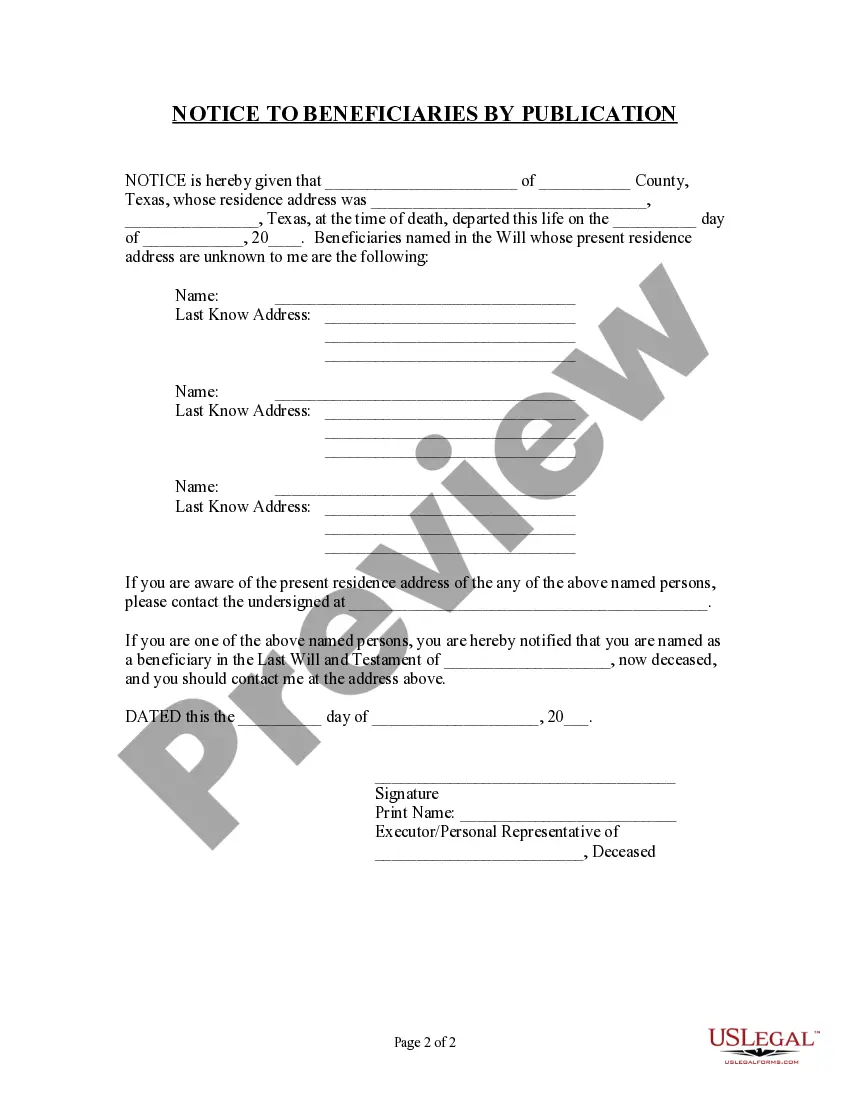

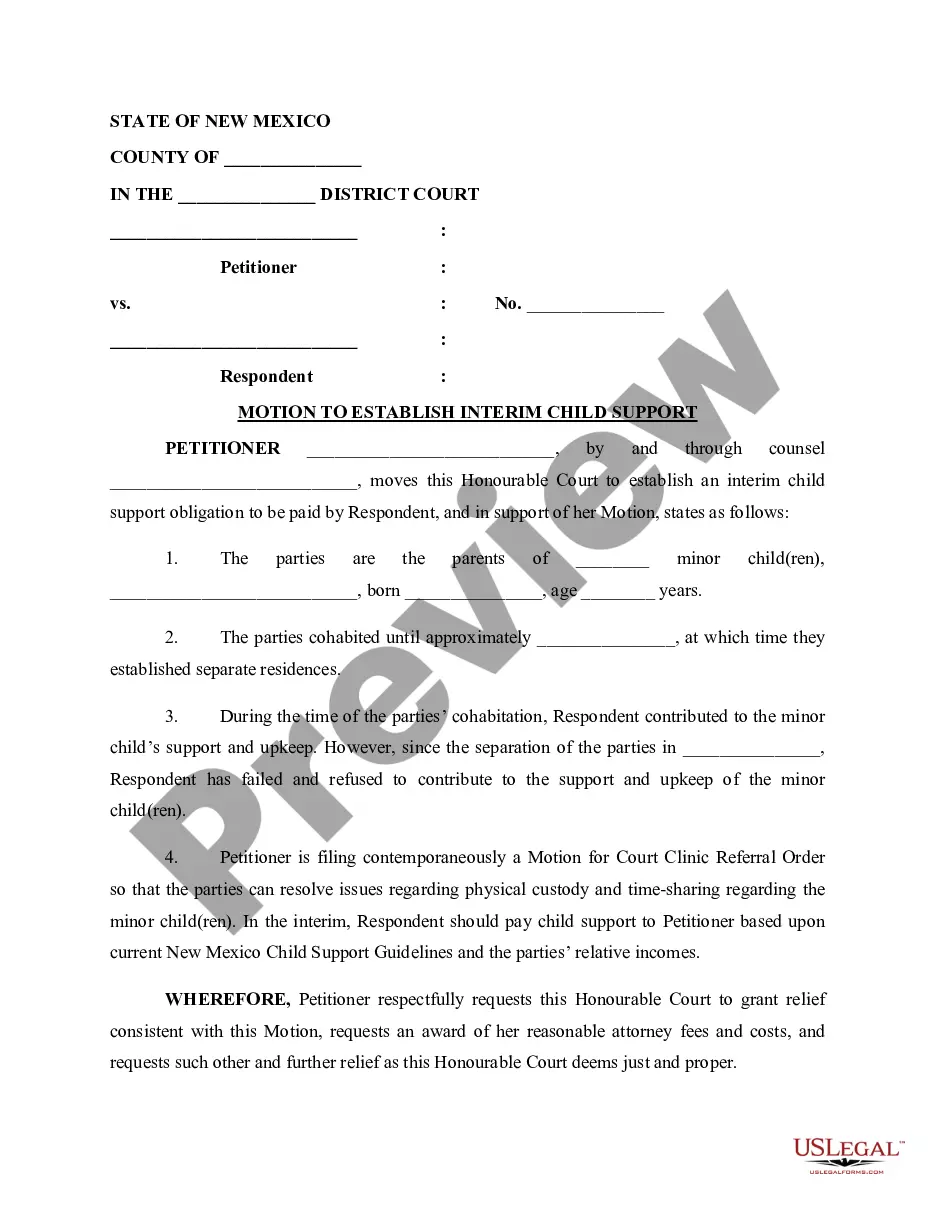

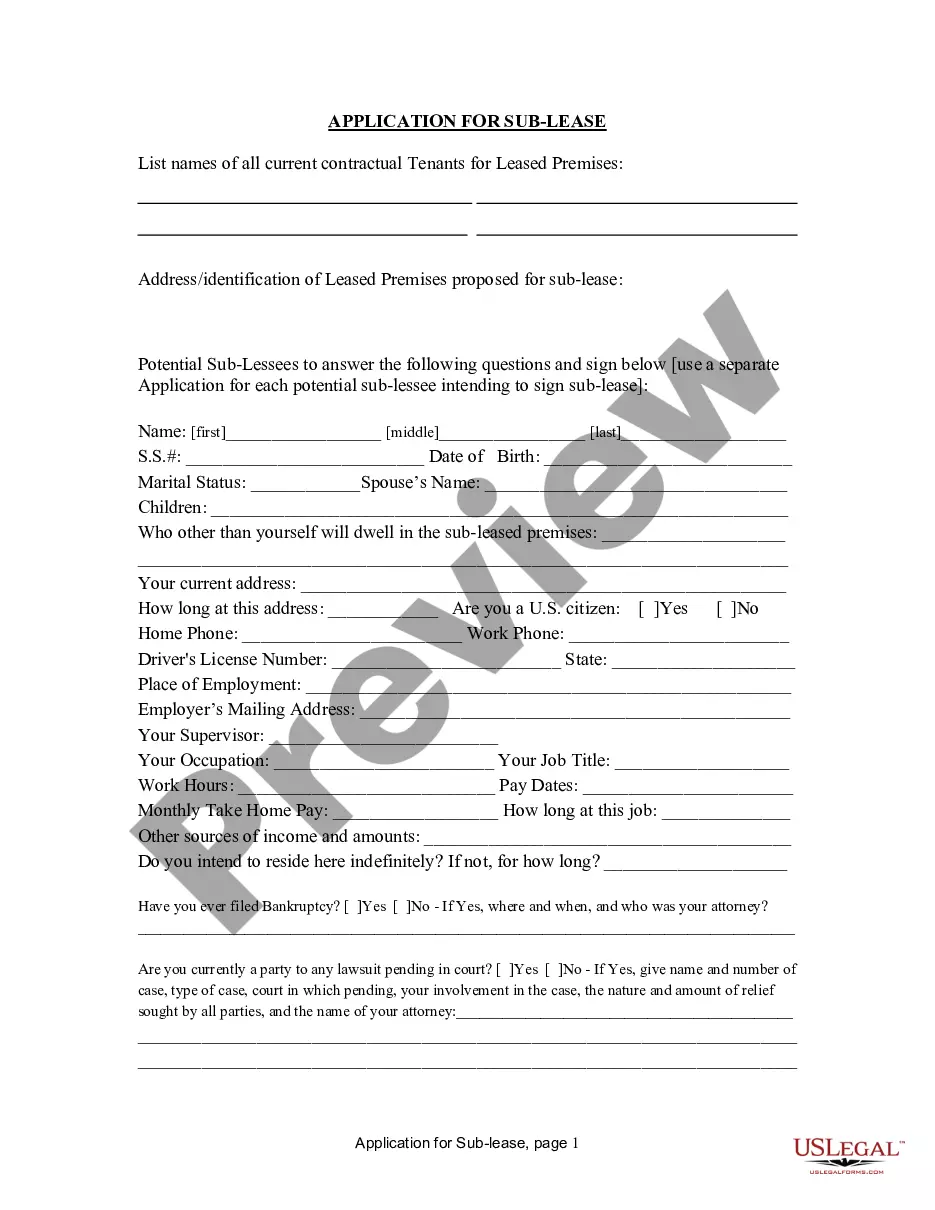

How to fill out Texas Notice To Beneficiaries Of Being Named In Will?

Finding a reliable source for the latest and suitable legal templates is a significant part of navigating bureaucracy.

Identifying the appropriate legal documents requires precision and careful consideration, which is why it's crucial to obtain samples of the Notice Beneficiary Form For Inheritance exclusively from reputable sources, such as US Legal Forms. An incorrect template can squander your time and delay your circumstances.

Once you obtain the form on your device, you can modify it using the editor or print it out and fill it in by hand. Eliminate the hassle associated with your legal documentation. Explore the extensive US Legal Forms catalog to discover legal templates, verify their applicability to your situation, and download them right away.

- Utilize the catalog navigation or search bar to locate your sample.

- Review the form’s description to determine if it meets the criteria of your state and area.

- Examine the form preview, if available, to confirm that it is the form you need.

- Continue searching and find the correct template if the Notice Beneficiary Form For Inheritance does not align with your needs.

- Once you are confident about the form’s applicability, download it.

- If you are a registered user, click Log in to verify and access your chosen templates in My documents.

- If you do not yet have an account, click Buy now to acquire the form.

- Select the pricing option that suits your needs.

- Proceed with the registration to complete your purchase.

- Finalize your purchase by selecting a payment method (credit card or PayPal).

- Choose the file format for downloading the Notice Beneficiary Form For Inheritance.

Form popularity

FAQ

Most beneficiary designations will require you to provide a person's full legal name and their relationship to you (spouse, child, mother, etc.). Some beneficiary designations also include information like mailing address, email, phone number, date of birth and Social Security number.

Use Schedule K-1 to report a beneficiary's share of the estate's or trust's income, credits, deductions, etc., on your Form 1040 or 1040-SR. Keep it for your records.

If you decide to have more than one beneficiary, you will allocate a percentage of the death benefit for each, so that the total allocation equals 100%. A simple example of this would be allocating 50% to your partner, and 25% to each of your two children, for a total of 100%.

When to file K-1s. A trust needs to file a tax return if it has a gross income of $600 or more during the trust tax year or there is a nonresident alien beneficiary or if there is any taxable income. An estate needs to file a tax return if it has a gross income of $600 or there is a nonresident alien beneficiary.

Spouse, partner, children, parents, brothers and sisters, business partner, key employee, trust and charitable organization.