Closing Real Estate With Salary

Description

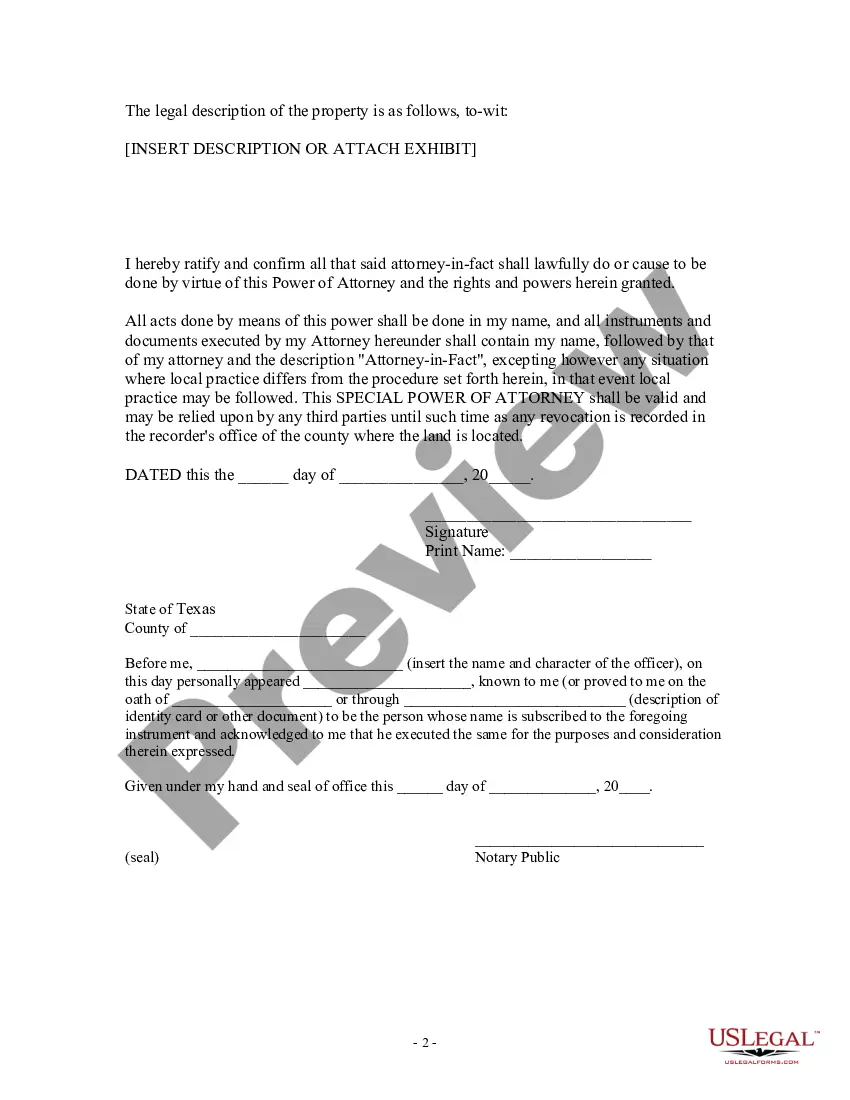

How to fill out Texas Special Or Limited Power Of Attorney For Real Estate Purchase Transaction By Purchaser?

It’s widely recognized that you cannot instantly become a legal authority, nor can you swiftly learn how to prepare Closing Real Estate With Salary without possessing specific expertise.

Drafting legal documents is a labor-intensive task that necessitates specialized education and proficiency. Therefore, why not entrust the development of the Closing Real Estate With Salary to the experts.

With US Legal Forms, featuring one of the largest libraries of legal documents, you will discover everything from court filings to templates for internal correspondence. We understand the importance of compliance with federal and state regulations.

You can retrieve your documents at any time from the My documents section. If you are a current customer, simply Log In, and find and download the template from the same section.

Regardless of the reason for your paperwork—whether it is financial, legal, or personal—our website has everything you need. Experience US Legal Forms today!

- Locate the document you require using the search function at the top of the page.

- View it (if this feature is available) and review the accompanying description to verify if Closing Real Estate With Salary meets your needs.

- If you need a different form, restart your search.

- Create a free account and choose a subscription plan to acquire the template.

- Select Buy now. Once your payment is finalized, you can download the Closing Real Estate With Salary, complete it, print it, and either send it or post it to the appropriate recipients or entities.

Form popularity

FAQ

Step 1: Understanding Your Documents. Taking inventory of your closing documents will ensure you and your lender have everything that's required for closing. ... Step 2: Selecting A Homeowners Insurance Plan. ... Step 3: Preparing Your Finances For Closing Day. ... Step 4: Planning What To Bring To The Table.

Cash to close includes the total closing costs minus any fees that are rolled into the loan amount. It also includes your down payment, and subtracts the earnest money deposit you might have made when your offer was accepted, plus any seller credits.

In New Mexico, the customary practice is to hand over keys to the buyer upon RECORDING and FUNDING. Closing occurs when both parties sign. The Buyer and Seller will close separately, with separate closing appointments. For the Buyer the paperwork for the loan is signed as well as required disclosures and tax documents.

Packing and cleaning needs: As we've discussed above, you'll want to get a head start on packing, cleaning and arranging moving logistics in the days before your official closing.

Your Real Estate Lawyer will meet you 2 to 3 days before the purchase closing date to sign your purchase and mortgage documents. The Lawyer will review them with you and would make you sign all the legal papers. You will have to take any deposit money or down payment that is required to close the purchase at this time.