Closing Real Estate For Dummies

Description

How to fill out Texas Special Or Limited Power Of Attorney For Real Estate Purchase Transaction By Purchaser?

Handling legal documents and processes can be an exhausting addition to your whole day.

Closing Real Estate For Dummies and similar forms typically necessitate searching for them and grasping the most effective method to complete them correctly.

Therefore, whether you're managing financial, legal, or personal issues, utilizing a comprehensive and straightforward online resource of templates readily available will greatly assist you.

US Legal Forms is the premier online service for legal templates, offering over 85,000 state-specific documents and a variety of tools to help you finish your paperwork swiftly.

Is this your first experience with US Legal Forms? Register and create an account in just a few minutes to gain access to the template library and Closing Real Estate For Dummies. Then, follow the steps outlined below to finalize your form.

- Explore the collection of relevant documents accessible with just a click.

- US Legal Forms supplies you with state- and county-specific templates available for download at any moment.

- Safeguard your document management tasks using a reliable service that allows you to create any document in minutes without extra or concealed fees.

- Simply Log In to your account, find Closing Real Estate For Dummies, and obtain it immediately in the My documents section.

- You can also retrieve forms you've downloaded before.

Form popularity

FAQ

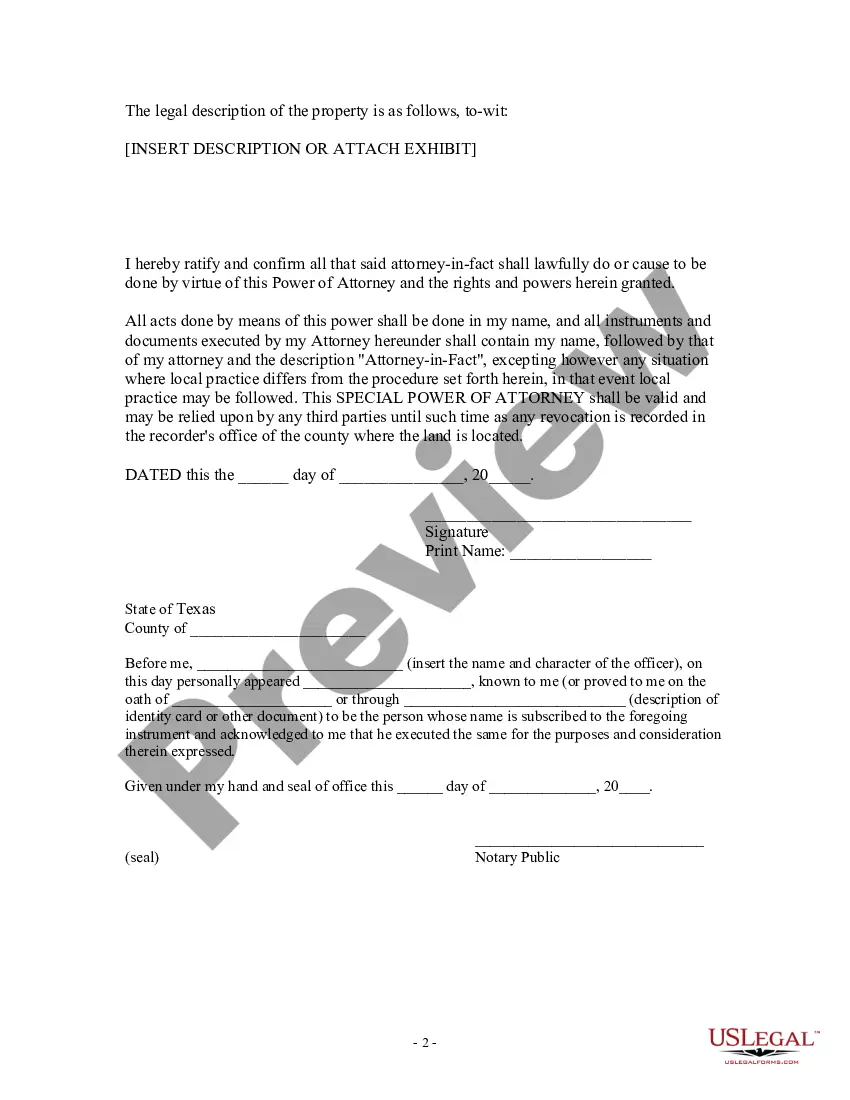

Closing real estate for dummies involves several key steps. First, you gather all necessary documents and finalize your financing options. Next, both the buyer and seller will review and sign the closing documents, including the settlement statement and deed. Finally, funds are transferred, and the property ownership changes hands, marking the successful completion of the transaction.

Step 1 Starting the Process A sales contract is signed by the buyer and seller and delivered to the closing agent, usually with a deposit check. The escrow is accepted by the escrow agent, often by written notation on the contract. The escrow agent starts the closing process by opening a title order.

The closing process involves four steps to make that happen. Close revenue accounts to Income Summary. Income Summary is a temporary account used during the closing process. ... Close expense accounts to Income Summary. ... Close Income Summary to Retained Earnings. ... Close dividends to Retained Earnings.

Step 1 Starting the Process A sales contract is signed by the buyer and seller and delivered to the closing agent, usually with a deposit check. The escrow is accepted by the escrow agent, often by written notation on the contract. The escrow agent starts the closing process by opening a title order.

What Happens at Closing? On closing day, the ownership of the property is transferred to you, the buyer. This day consists of transferring funds from escrow, providing mortgage and title fees, and updating the deed of the house to your name.

The steps leading up to the closing date include: Purchase agreement acceptance. Optional buyer home inspection. Loan origination. Lender home appraisal and credit underwriting. Loan Approval. Homeowner and title insurance. Closing disclosures.