Promissory Note Template Texas For Vehicle

Description

How to fill out Texas Installments Fixed Rate Promissory Note Secured By Commercial Real Estate?

Whether for corporate reasons or personal matters, everyone will have to manage legal issues at some point in their lives.

Completing legal documents requires careful consideration, beginning with selecting the appropriate form template.

Select the document format you prefer and download the Promissory Note Template Texas For Vehicle. Once it is saved, you can either fill out the form using editing software or print it and complete it manually. With an extensive US Legal Forms catalog available, you never have to waste time searching for the correct template online. Utilize the library’s simple navigation to find the right form for any situation.

- For example, if you select an incorrect version of a Promissory Note Template Texas For Vehicle, it will be declined when you submit it.

- It is essential to find a reliable provider of legal documents like US Legal Forms.

- If you want to obtain a Promissory Note Template Texas For Vehicle template, adhere to these straightforward steps.

- Locate the template you need using the search bar or catalog navigation.

- Review the form’s details to ensure it fits your situation, state, and locality.

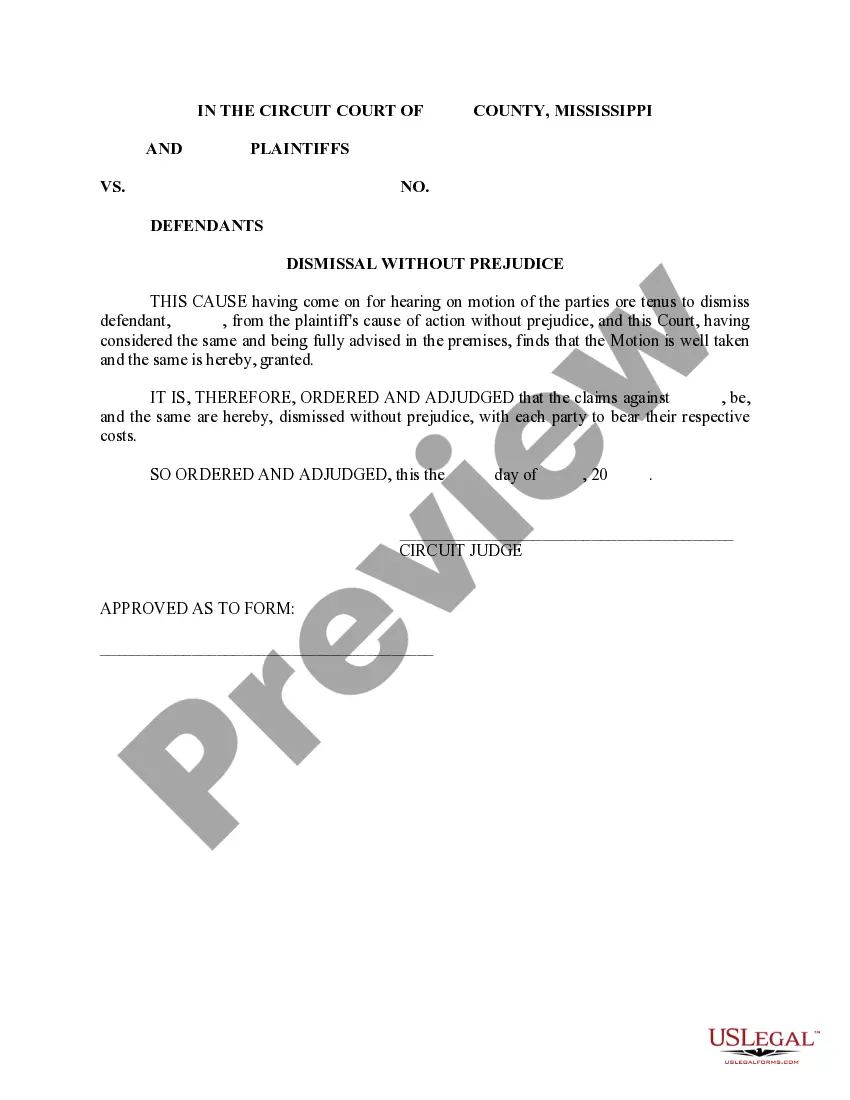

- Click on the form’s preview to view it.

- If it is the incorrect document, return to the search feature to find the Promissory Note Template Texas For Vehicle sample you need.

- Download the document if it fulfills your needs.

- If you have a US Legal Forms account, click Log in to access previously saved templates in My documents.

- If you do not have an account yet, you may purchase the form by clicking Buy now.

- Select the appropriate pricing option.

- Complete the account registration form.

- Choose your payment method: use a credit card or PayPal account.

Form popularity

FAQ

Yes, you can use a promissory note to buy a car. This arrangement allows you to take possession of the vehicle while agreeing to make payments over time. A promissory note template for Texas for vehicle purchases simplifies this process by providing a clear framework for your agreement. Using such a template helps you establish a formal record of your payment commitments, ensuring both parties are aligned on expectations.

Texas Secured Promissory Note The date of inception of the note. The names and addresses of all the parties involved as well as the information of the witness that gives the document validity. The loan amount and the details of how and when payment will occur.

A Texas promissory note template is a document that records the major details regarding a money lending transaction between a lender and a borrower. The documents are signed by all parties involved as well as a witness to give it legal validity.

A Promissory Note is a contract between a borrower and a lender. In the note, the borrower promises to repay the loan ing to the terms of agreement specified within the note. If the borrower fails to repay the loan ing to the agreed terms, the borrower may be liable for breach of note.

At its most basic, a promissory note should include the following things: Date. Name of the lender and borrower. Loan amount. Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral? ... Payment amount and frequency. Payment due date. Whether the loan has a cosigner, and if so, who.

An action to enforce the obligation of a party to pay a note payable at a definite time must be commenced within six years after the due date or dates stated in the note or, if a due date is accelerated, within six years after the accelerated due date. Tex.