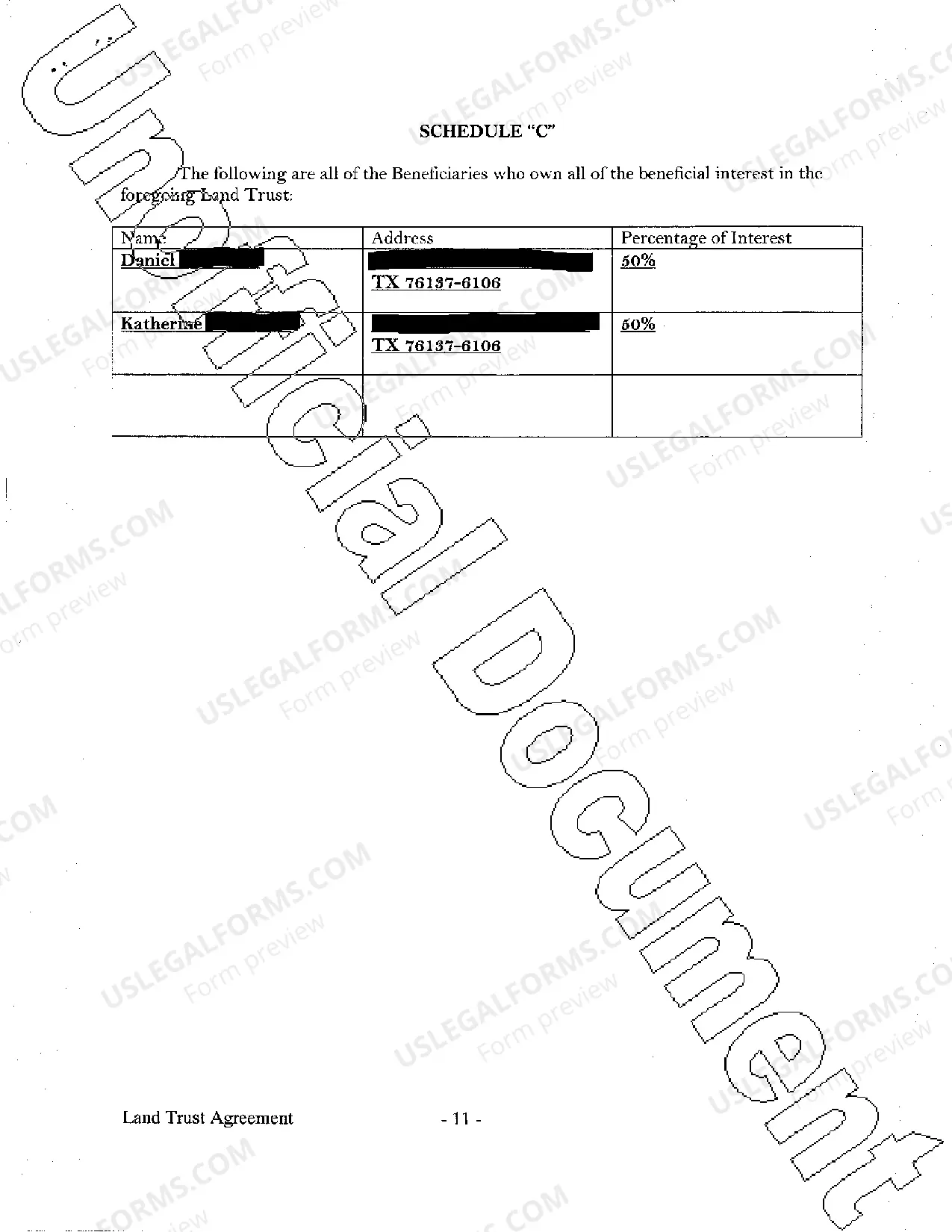

Texas Land Trust Agreement Format

Description

How to fill out Texas Land Trust Agreement?

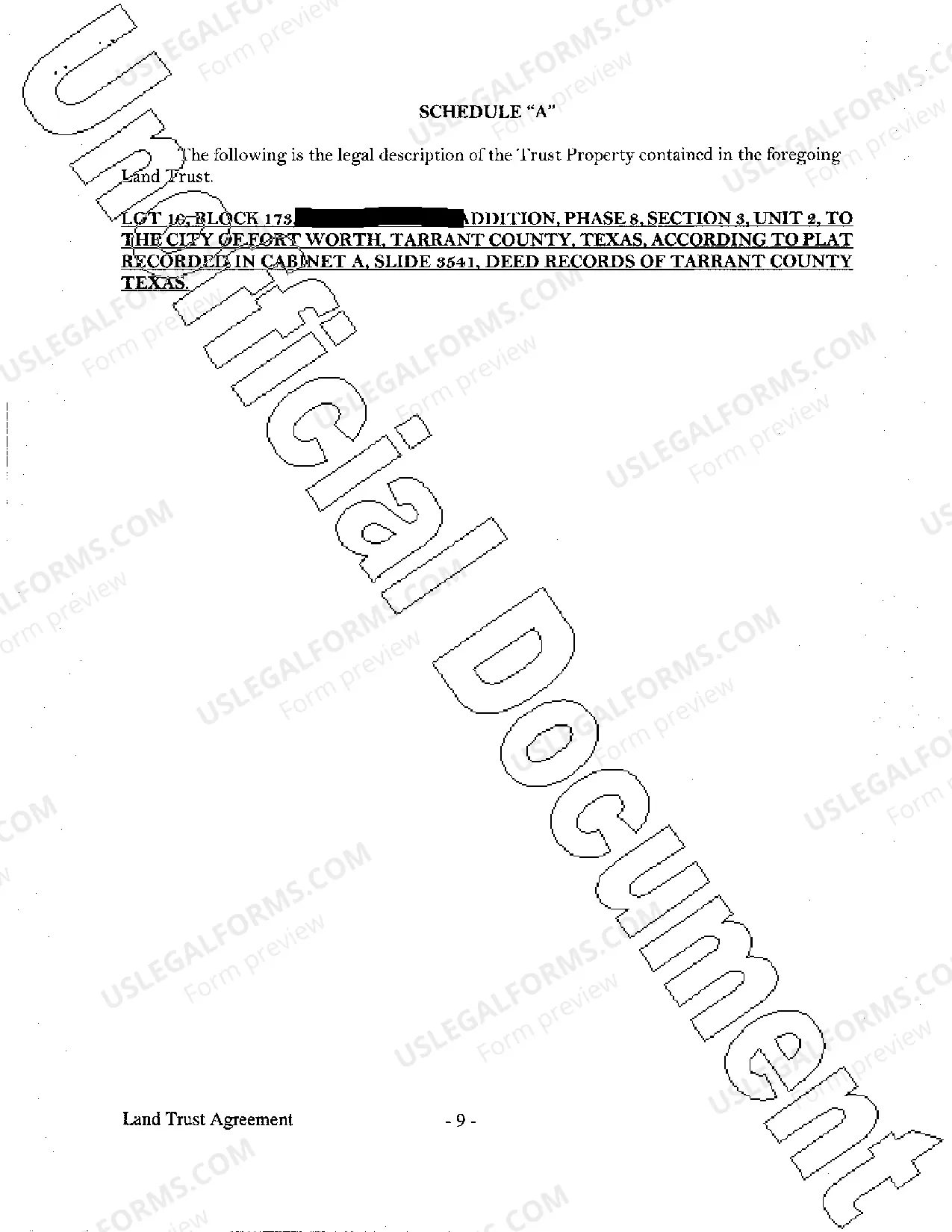

The Texas Land Trust Agreement Template presented on this page is a versatile legal framework created by expert attorneys in accordance with federal and state laws.

For over 25 years, US Legal Forms has supplied individuals, businesses, and legal practitioners with over 85,000 authenticated, state-specific documents for any commercial and personal situation. It’s the fastest, most straightforward, and most dependable way to procure the forms you require, as the service assures bank-level data protection and anti-malware safeguards.

Select the format you desire for your Texas Land Trust Agreement Template (PDF, Word, RTF) and download the sample onto your device.

- Search for the document you require and examine it.

- Browse through the file you searched and preview it or review the form description to confirm it meets your needs. If it doesn’t, use the search feature to locate the appropriate one. Click Buy Now once you find the template you need.

- Register and Log In.

- Choose the pricing option that suits you and create an account. Utilize PayPal or a credit card for a prompt payment. If you already possess an account, Log In and verify your subscription to proceed.

- Access the editable template.

Form popularity

FAQ

New Hampshire does not tax individuals' earned income, so you are not required to file an individual New Hampshire tax return. The state only taxes interest and dividends at 5% on residents and fiduciaries whose gross interest and dividends income, from all sources, exceeds $2,400 annually ($4,800 for joint filers).

To request forms, please email forms@dra.nh.gov or call the Forms Line at (603) 230-5001. If you have a substantive question or need assistance completing a form, please contact Taxpayer Services at (603) 230-5920.

New Hampshire extensions are automatic, which means there is no application to submit. As long as 100% of your I&D Tax is paid by the original due date (April 15), you will automatically receive a New Hampshire tax extension. NOTE: Do not file Form DP-59-A if you have zero state tax balance due.

If you are claiming a refund on behalf of a deceased taxpayer, you must file Form NH-1310. Mail forms to the New Hampshire Department of Revenue Administration, Taxpayer Services Division, PO Box 3306, Concord, NH 03302-3306.

A POA is required prior to the Department of Revenue Administration communicating with anyone other than the taxpayer regarding any issue relating to the taxpayer. All applicable items must be filled in to properly complete Form DP-2848 New Hampshire Power of Attorney (POA).

Steps for Making a Financial Power of Attorney in New Hampshire Create the POA Using a Statutory Form, DIY program, or Attorney. ... Sign the POA in the Presence of a Notary Public. ... Store the Original POA in a Safe Place. ... Give a Copy to Your Agent. ... File a Copy With the Land Records Office.