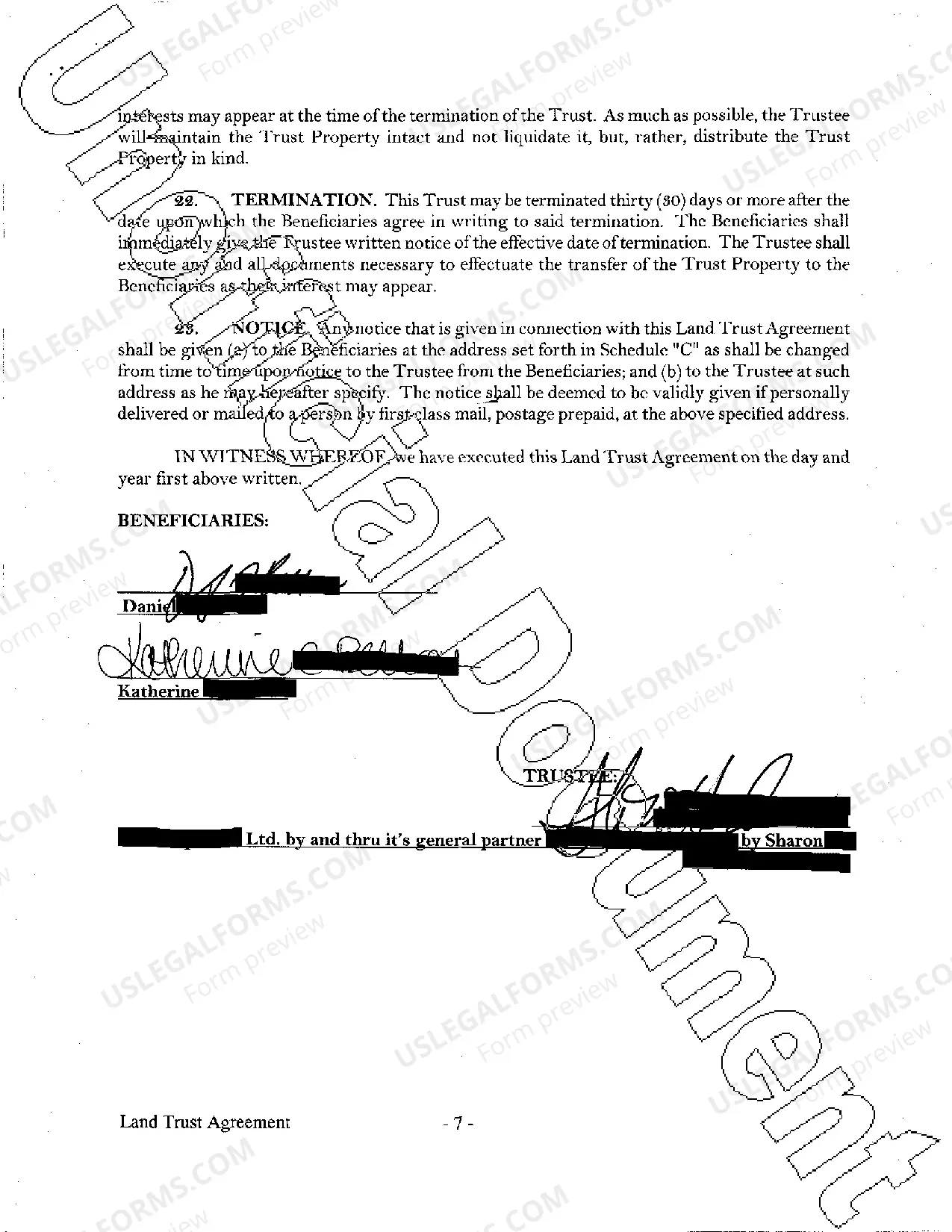

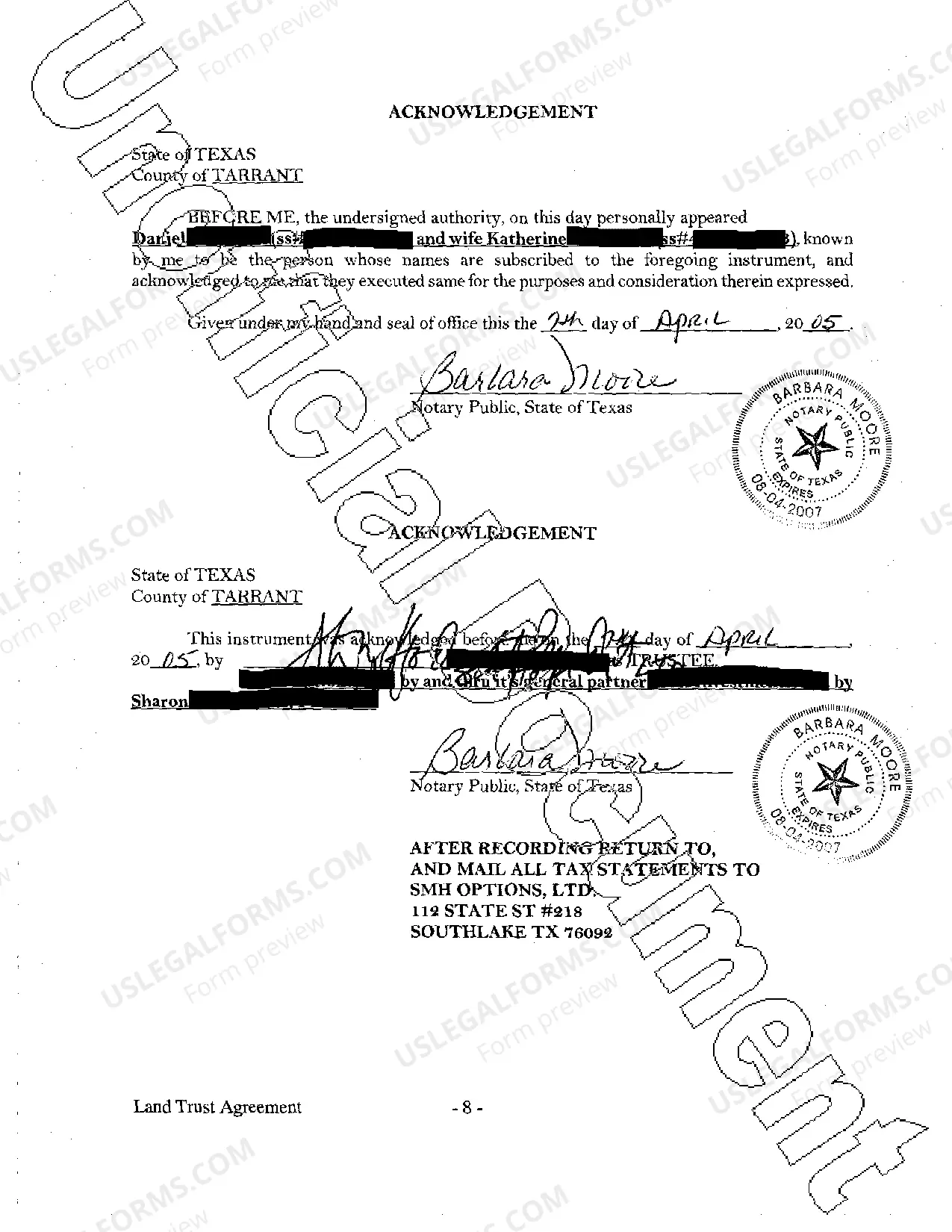

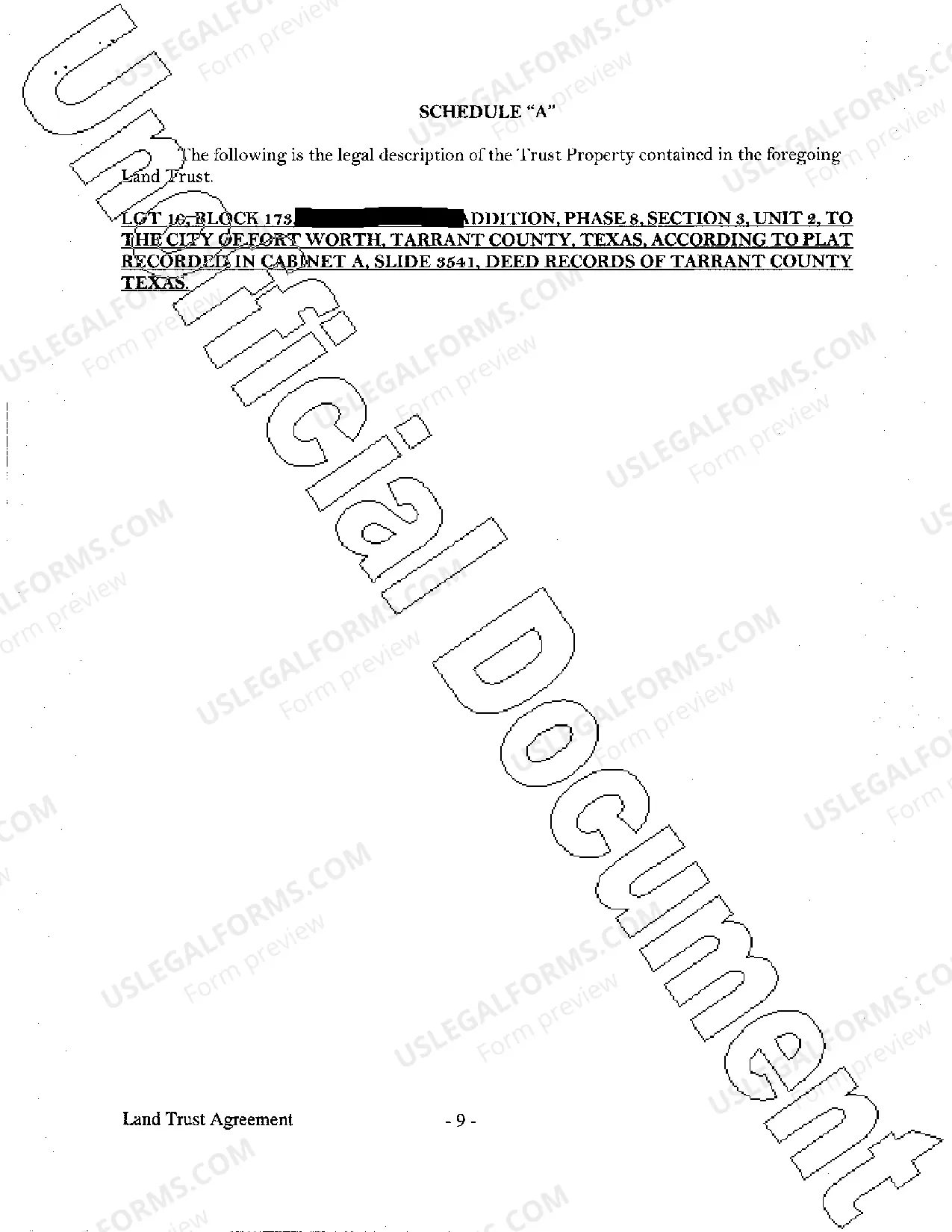

Land Trust Example With Llc As Beneficiary

Description

How to fill out Texas Land Trust Agreement?

Managing legal documents and processes can be a lengthy addition to your entire day.

Land Trust Example With Llc As Beneficiary and forms of this nature generally necessitate you to search for them and figure out the best method to fill them out accurately.

Thus, if you are handling financial, legal, or personal affairs, possessing a comprehensive and convenient online repository of forms when you require it will be quite beneficial.

US Legal Forms is the premier online platform for legal templates, providing over 85,000 state-specific forms and a wealth of resources to help you complete your documents seamlessly.

Is it your first time using US Legal Forms? Sign up and establish an account in a matter of minutes to gain access to the form library and Land Trust Example With Llc As Beneficiary. Then, follow the steps outlined below to complete your form.

- Browse the library of relevant documents available with a simple click.

- US Legal Forms offers you state- and county-specific forms accessible at any time for downloading.

- Safeguard your document management processes using a premier service that enables you to create any form in minutes without incurring additional or hidden fees.

- Simply Log In to your account, search for Land Trust Example With Llc As Beneficiary, and download it instantly from the My documents section.

- You can also retrieve previously saved forms.

Form popularity

FAQ

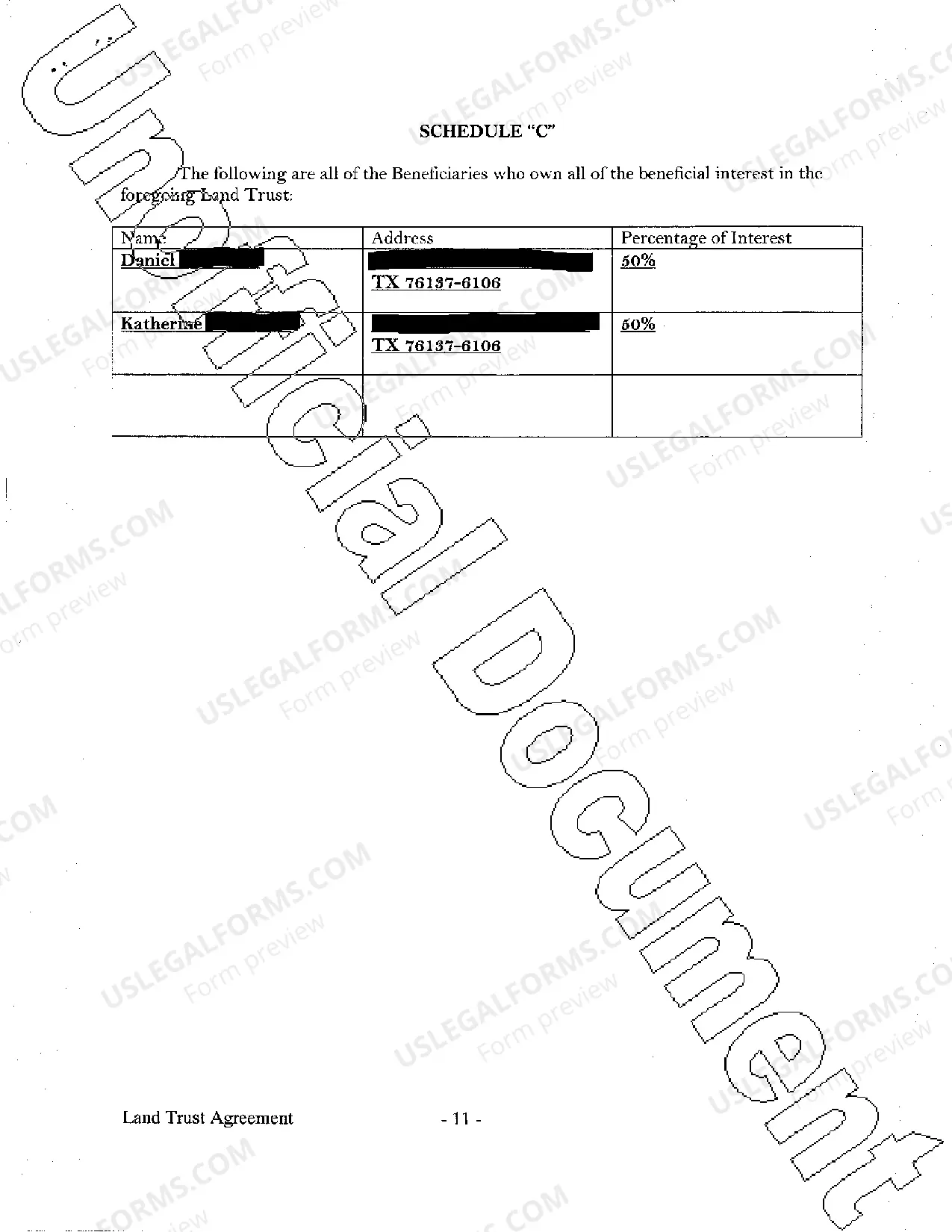

Yes, an LLC can be a beneficiary of a trust, and this arrangement is quite useful. In a land trust example with LLC as beneficiary, the trust holds the property while the LLC benefits from the assets. This set-up can simplify the management of real estate investments and provide legal safeguards against creditors. It allows for flexible ownership structures, making it easier for you to pursue your financial goals.

Using a land trust example with LLC as beneficiary comes with several benefits. First, it can provide asset protection, shielding your LLC from personal liabilities. Second, it facilitates smoother management of your assets, allowing for easier transfer of ownership without the need for public record changes. Finally, you enhance privacy, as the trust can keep your personal information off public records, making it beneficial for strategic planning.

Yes, you can definitely put an LLC in a land trust, especially when considering a land trust example with LLC as beneficiary. This setup allows for greater privacy and can protect your assets. Additionally, having an LLC as a beneficiary of the land trust can simplify estate management and potential tax benefits. If you want to learn more about structuring a land trust with an LLC, US Legal Forms can provide resources and forms to help you set this up correctly.

You can avoid probate for an LLC by either making a revocable living trust the member of your LLC or by editing the operating agreement of the LLC to contain probate-avoidance language. The first probate-avoidance strategy is to move your interest in the LLC into a revocable living trust.

The trustee of a land trust can be an LLC. A Florida resident can form an LLC and then use their own LLC as trustee of their land trust. That way, the Florida resident controls both the beneficial interest and the role as trustee.

Land trusts don't require any state or federal fees to establish. On the other hand, an LLC requires state fees in order to establish or register within a state. If an LLC owns a piece of land in a state, it must be established or at least registered in that state.

Which one of the following statements is true about land trusts? Land trusts generally continue for a specified term, such as 10, 20, or 30 years.

Disadvantages of Using Land Trusts Most land trusts also do not qualify for secondary market loans. Additionally, you will forfeit any homestead exemptions by forming a land trust which can have some serious tax consequences. While land trusts can provide anonymity, this protection is not bulletproof.