Land Trust Example For Project

Description

How to fill out Texas Land Trust Agreement?

Locating a reliable source for obtaining the latest and suitable legal templates constitutes a significant part of managing bureaucracy.

Identifying the appropriate legal documents requires accuracy and meticulousness, which is why it is crucial to source Land Trust Example For Project exclusively from credible providers, such as US Legal Forms.

Once you have the form on your device, you can edit it using the editor or print it out and fill it in manually. Remove the stress associated with your legal documentation. Explore the extensive US Legal Forms library to discover legal templates, assess their applicability to your situation, and download them instantly.

- Make use of the catalog navigation or search bar to locate your template.

- Review the document’s description to determine if it meets your state's and locality’s requirements.

- Examine the form preview, if available, to confirm that it is the specific document you need.

- Return to the search and discover the suitable document if the Land Trust Example For Project does not fulfill your needs.

- If you are confident about the form’s suitability, proceed to download it.

- If you have an account, click Log in to verify and access your chosen forms in My documents.

- If you have yet to create an account, click Buy now to acquire the template.

- Select the pricing option that aligns with your preferences.

- Proceed to register to complete your purchase.

- Finalize your transaction by selecting a payment method (credit card or PayPal).

- Select the document format for downloading Land Trust Example For Project.

Form popularity

FAQ

A land trust project typically involves acquiring or conserving land to protect it for future generations. These projects often focus on environmental preservation and community benefit. A concrete land trust example for project can showcase how effective planning leads to sustainable outcomes.

A land trust example includes instances where a family places their home in a trust to avoid probate and protect it from creditors. This ensures that the family continues to benefit from the property without interruption. Such examples show how a land trust can be a strategic choice in estate planning.

The primary point of a land trust is to manage real estate privately and efficiently. It protects property from claims and offers flexibility in managing ownership interests. A clear land trust example for project can illustrate how this tool enhances real estate investment strategies.

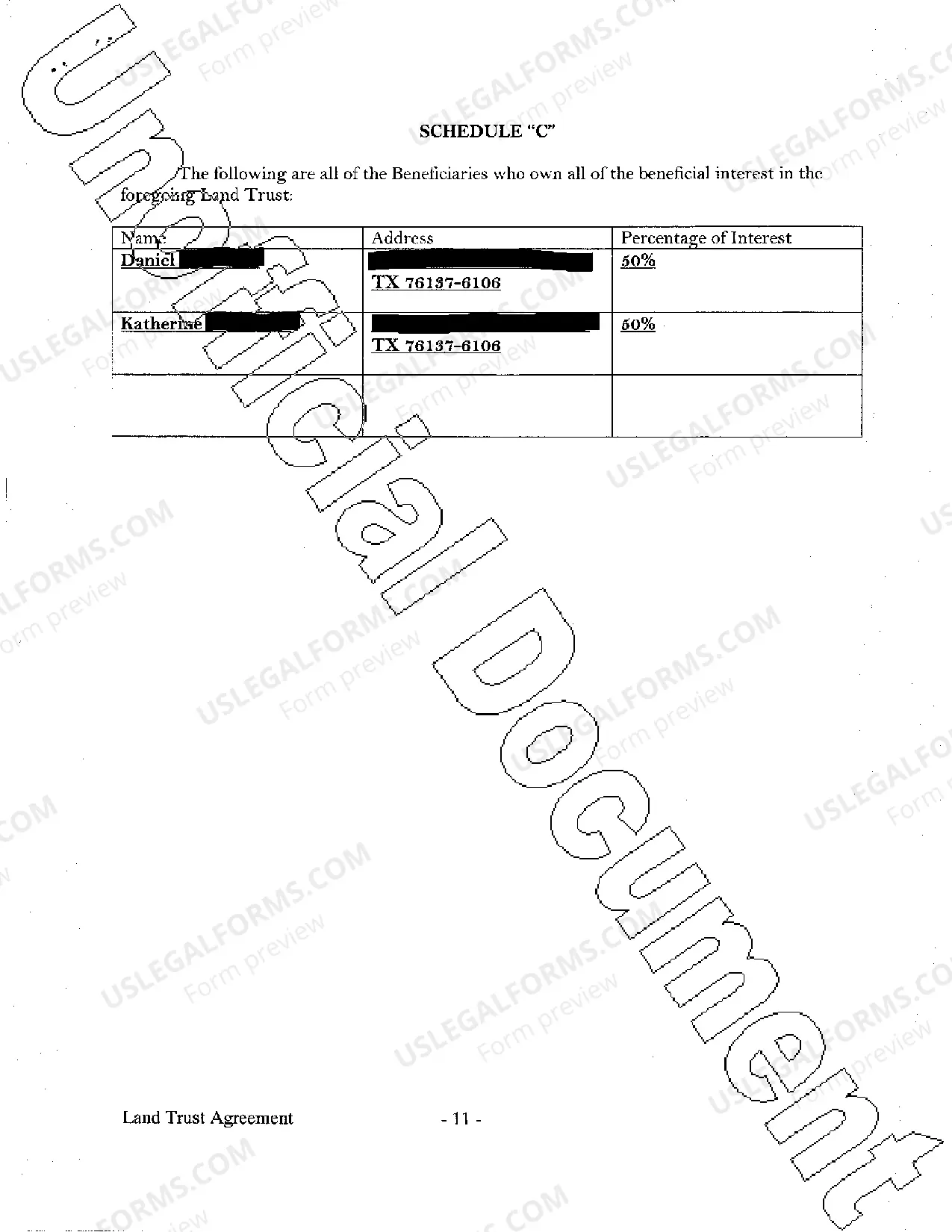

To write up a land trust, start by specifying the trust's name and the parties involved. Then, detail the property being placed in trust along with its intended use. A well-crafted land trust example for project simplifies this process, allowing you to see how essential components come together.

Placing land in a trust can offer significant benefits. It helps manage the property more effectively and provides privacy about ownership. Furthermore, a land trust example for project shows how you can protect your investment while potentially easing the process of transferring property to heirs.

The 5% rule for trusts helps to prevent the excessive accumulation of income within a trust. Essentially, this rule states that you should distribute at least 5% of the trust's income to beneficiaries annually to maintain its tax advantages and ensure compliance with federal regulations. If you look at a land trust example for project management, implementing this rule can secure ongoing benefits for property investments. Adhering to such guidelines can enhance the functionality and effectiveness of your trust, ensuring you meet legal requirements.

Disadvantages of Using Land Trusts One reason you may not want to use a land trust is because you will give up your redemption rights. Redemption rights allow you to reclaim your property before, and sometimes even after, foreclosure. Most land trusts also do not qualify for secondary market loans.

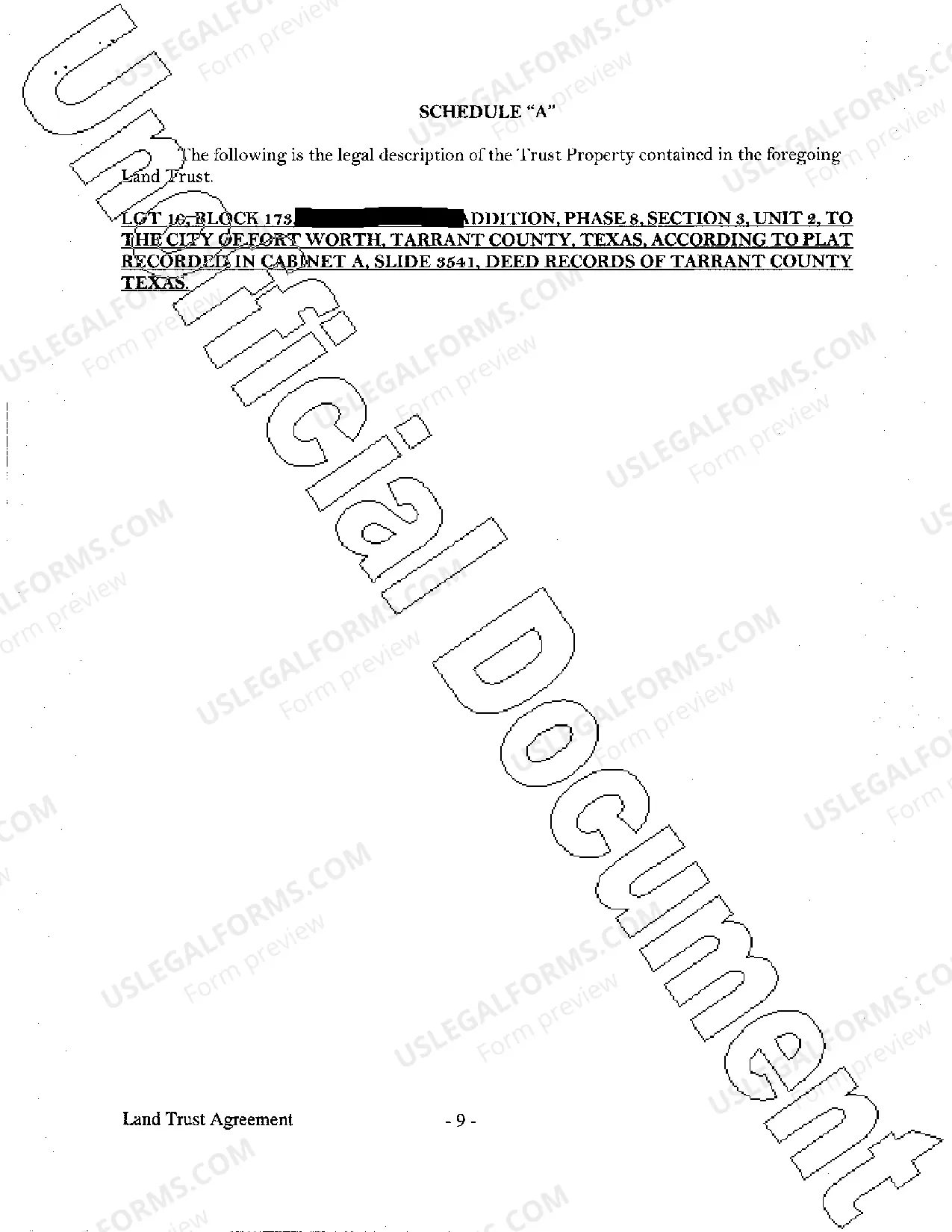

Land trusts are similar to other trusts but are meant exclusively for real estate. Land trusts can also hold other property-related assets, such as mortgages and notes. Any land can be used for a land trust, although they're mostly used for land conservation or developmental property.

Assets that should not be used to fund your living trust include: Qualified retirement accounts ? 401ks, IRAs, 403(b)s, qualified annuities. Health saving accounts (HSAs) Medical saving accounts (MSAs) Uniform Transfers to Minors (UTMAs) Uniform Gifts to Minors (UGMAs) Life insurance. Motor vehicles.

A simple example would be the situation in which one member of a family advances money to another and asks the second member to hold the money or to invest it for him. A more complicated example of an implied trust would be the situation in which one party provides money to another for the purchase of property.