Land Trust Documents Withdrawal

Description

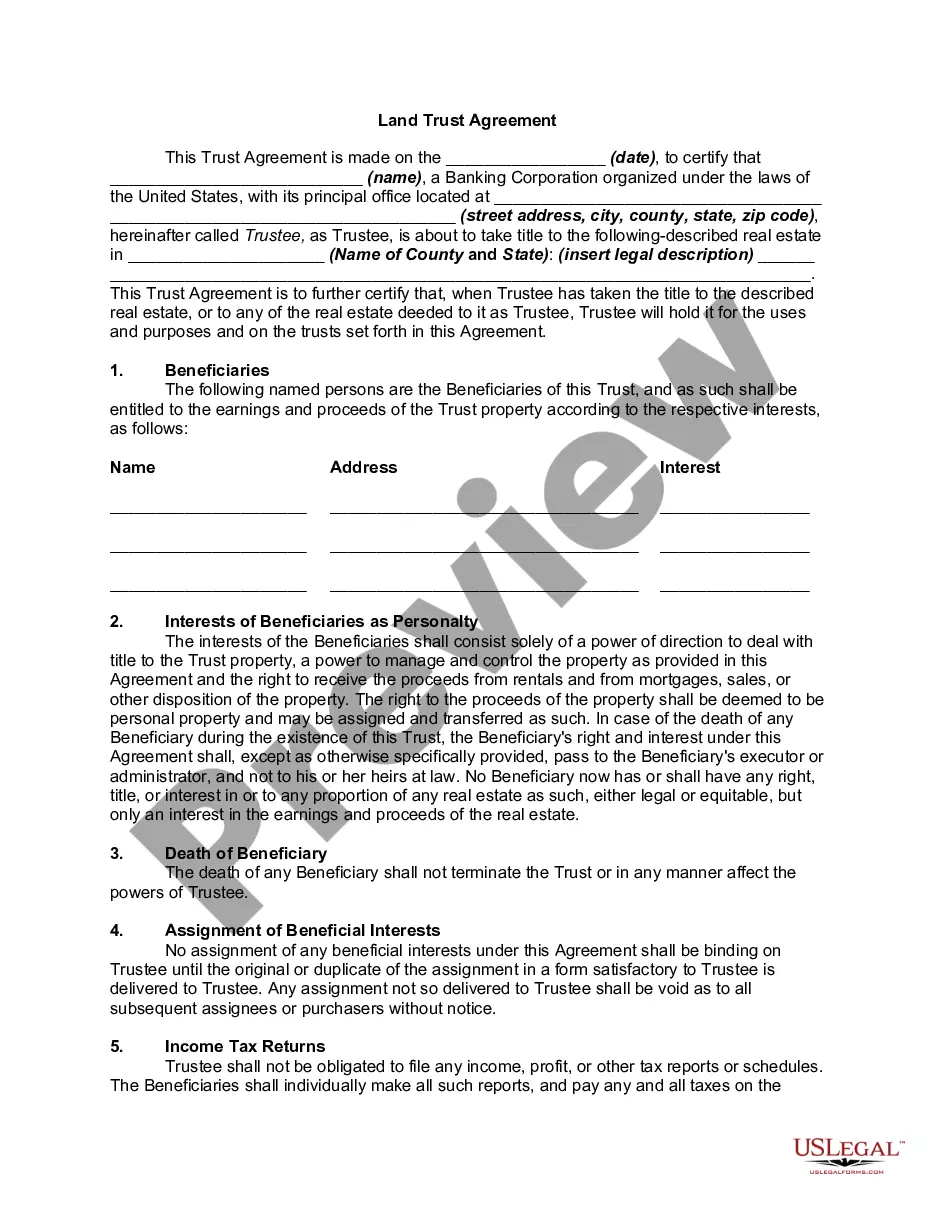

How to fill out Texas Land Trust Agreement?

Handling legal paperwork and processes can be a lengthy addition to your entire day.

Land Trust Documents Withdrawal and similar forms often necessitate searching for them and comprehending how to fill them out accurately.

Therefore, whether you are managing financial, legal, or personal affairs, having a comprehensive and accessible online repository of forms when needed will be extremely beneficial.

US Legal Forms is the premier online platform for legal templates, boasting over 85,000 state-specific forms and a variety of resources to assist you in completing your documents with ease.

Is this your first experience with US Legal Forms? Register and create your account in just a few minutes, and you'll gain entry to the form library and Land Trust Documents Withdrawal. Next, follow the steps outlined below to finalize your form.

- Explore the collection of pertinent documents available to you with just one click.

- US Legal Forms offers you access to state- and county-specific forms that can be downloaded anytime.

- Protect your document management processes with top-quality support that enables you to create any form in minutes without any extra or hidden fees.

- Simply Log In to your account, locate Land Trust Documents Withdrawal, and download it immediately from the My documents section.

- You can also access previously saved forms.

Form popularity

FAQ

Hear this out loud PauseDistribute trust assets outright The grantor can opt to have the beneficiaries receive trust property directly without any restrictions. The trustee can write the beneficiary a check, give them cash, and transfer real estate by drawing up a new deed or selling the house and giving them the proceeds.

Hear this out loud PauseWith an irrevocable trust, the transfer of assets is permanent. So once the trust is created and assets are transferred, they generally can't be taken out again. You can still act as the trustee but you'd be limited to withdrawing money only on an as-needed basis to cover necessary expenses.

Hear this out loud PauseWhen a trustee needs to withdraw money to fulfill their duties, they can use the bank account to write checks, withdraw cash, or complete wire transfers. It is imperative to note that trustees are responsible for managing all withdrawals of money from a trust account.

Hear this out loud PauseApproaching the Trustee Another possible way to get money out of a trust fund is to request a cash withdrawal. This would require putting the request in writing and sending it to the trustee. The trustee might agree. But that individual or entity must also fulfill their fiduciary obligations.

The trust can pay out a lump sum or percentage of the funds, make incremental payments throughout the years, or even make distributions based on the trustee's assessments. Whatever the grantor decides, their distribution method must be included in the trust agreement drawn up when they first set up the trust.