Land Trust Documents Format

Description

How to fill out Texas Land Trust Agreement?

Legal oversight can be daunting, even for the most proficient professionals.

When you are looking for a Land Trust Documents Format and lack the time to dedicate to finding the correct and current version, the undertaking can be overwhelming.

With US Legal Forms, you have the ability to.

Access legal and organizational documents specific to your state or county. US Legal Forms meets any requirements you might have, whether personal or organizational paperwork, all in one location.

If this is your first experience with US Legal Forms, create an account and gain unlimited access to all the platform's benefits. Here are the steps to take after obtaining the form you need: Validate that this is the correct document by previewing it and reading its description. Confirm that the sample is authorized in your state or county. Click Buy Now when you are ready. Choose a subscription plan. Select the format you need, and Download, complete, eSign, print, and dispatch your document. Take advantage of the US Legal Forms online library, supported by 25 years of expertise and reliability. Transform your routine document management into a seamless and user-friendly process today.

- Utilize advanced tools to complete and manage your Land Trust Documents Format.

- Tap into a valuable repository of articles, tutorials, and guides relevant to your circumstances and needs.

- Save time and effort searching for the documents you require, and leverage US Legal Forms’ sophisticated search and Review feature to find and obtain Land Trust Documents Format.

- If you possess a subscription, Log In to your US Legal Forms account, search for the document, and acquire it.

- Visit My documents tab to view the documents you have previously downloaded and to manage your folders as you see fit.

- A comprehensive online form repository could be a pivotal resource for anyone who wants to handle these matters efficiently.

- US Legal Forms is a frontrunner in digital legal documents, boasting over 85,000 state-specific legal forms available at any time.

Form popularity

FAQ

No, a Florida certificate of trust does not need to be notarized. However, it should be signed by a trustee.

We think of trust as precious, and yet it's the basis for almost everything we do as civilized people. Trust is the reason we're willing to exchange our hard-earned paychecks for goods and services, pledge our lives to another person in marriage, cast a ballot for someone who will represent our interests.

A simple example would be the situation in which one member of a family advances money to another and asks the second member to hold the money or to invest it for him. A more complicated example of an implied trust would be the situation in which one party provides money to another for the purchase of property.

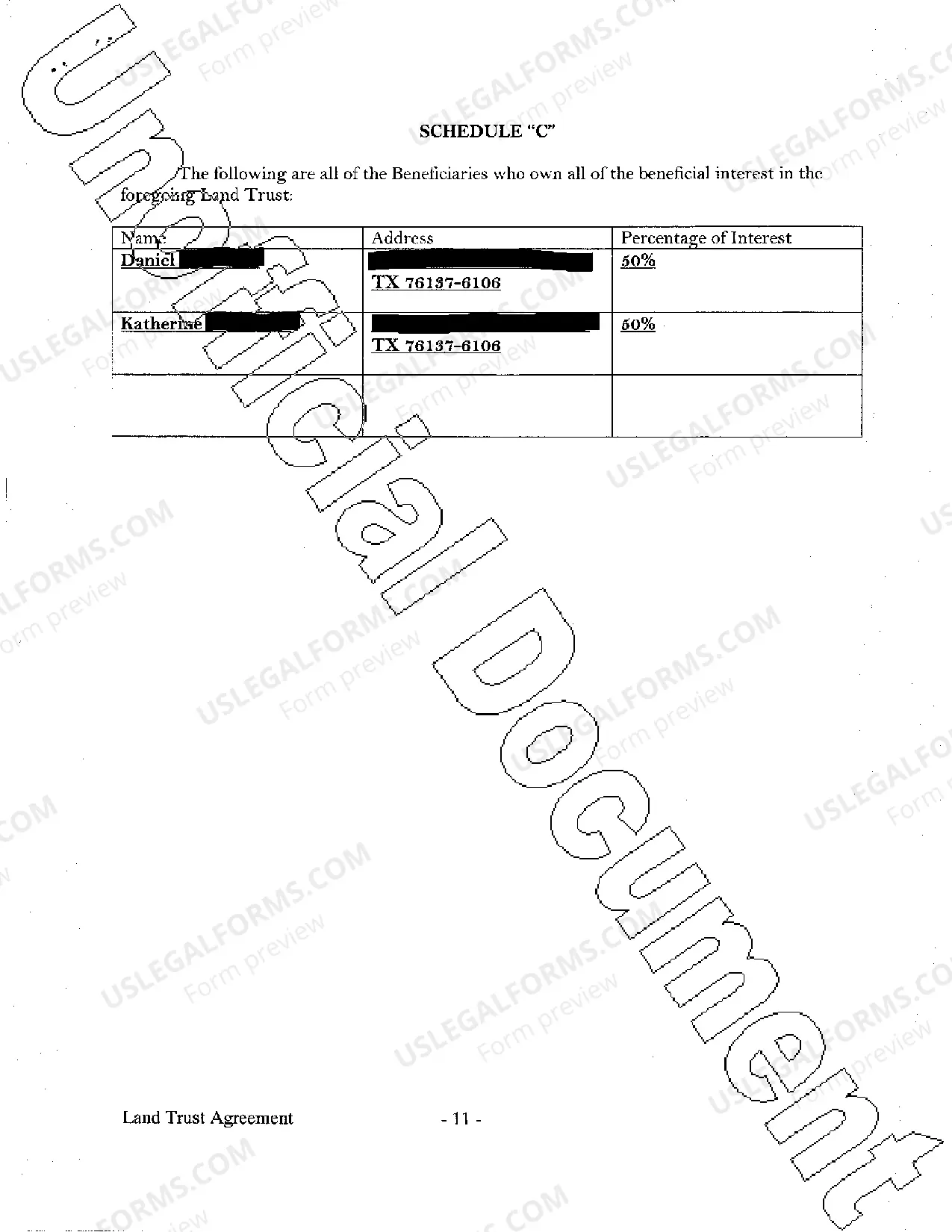

The Land Trust is created through the execution of two documents: 1) a Deed in Trust, where the real property is conveyed into the name of the Trustee in its fiduciary capacity as Trustee (not in its corporate capacity), and 2) a Florida Land Trust Agreement pursuant to which the Trustee administers the terms of the ...

Second, most land trusts are automatically disqualified from secondary market loans. The other issue with land trusts is that they give the illusion that there is no liability. Land trusts still have liability, even in Illinois. The real property owner, and not just the trust or trustee, can be found liable for things.