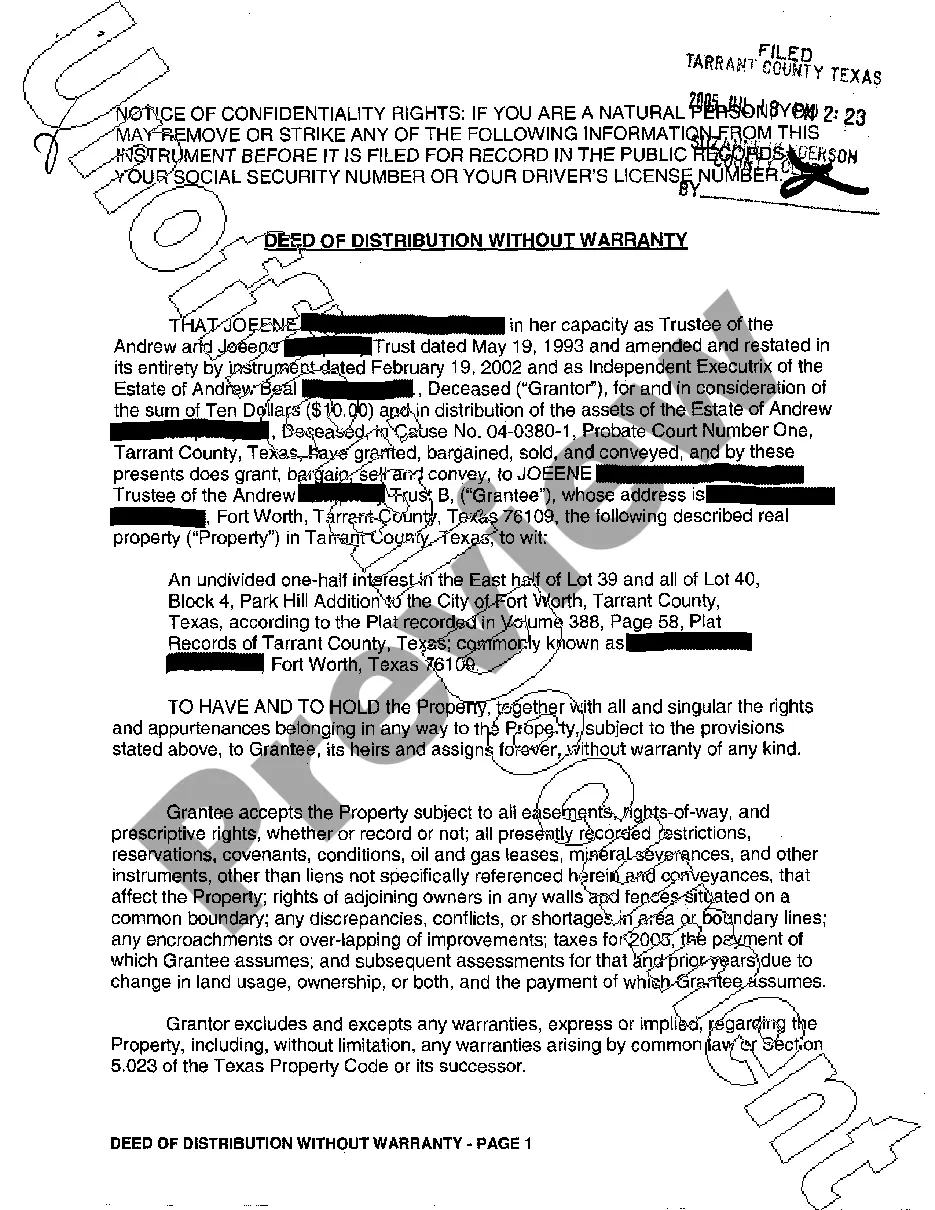

Deed Without Warranty For House

Description

How to fill out Deed Without Warranty For House?

What is the most reliable service to obtain the Deed Without Warranty For House and other current variations of legal documents? US Legal Forms is the answer!

It's the best collection of legal forms for any purpose. Each template is professionally crafted and verified for conformity with federal and state laws and regulations. They are categorized by region and jurisdiction, making it easy to locate the one you require.

US Legal Forms is a fantastic resource for anyone needing to manage legal documentation. Premium users can enjoy even more benefits as they can fill out and sign previously saved documents electronically at any time using the built-in PDF editing tool. Explore it today!

- Seasoned users of the system only need to Log In to the platform, verify if their subscription is active, and click the Download button next to the Deed Without Warranty For House to acquire it.

- Once saved, the template is accessible for future reference in the My documents section of your profile.

- If you do not yet have an account with our database, follow these steps to create one.

- Form compliance examination. Before you obtain any template, ensure it meets your use case requirements and adheres to your state or county regulations. Review the form description and utilize the Preview if available.

Form popularity

FAQ

Quitclaim deeds often benefit parties like family members or friends who trust one another. They can facilitate quick transfers of property with little concern about the title’s status. However, for buyers seeking more security, a deed without warranty for house may be a more appropriate choice. Regardless, it is best to evaluate your circumstances and consult a qualified service like US Legal Forms for guidance.

The key difference lies in the level of assurance each deed provides. A quitclaim deed transfers interest without guarantees, leaving you at risk of title issues. On the other hand, a deed without warranty for house implies that the seller holds the title but does not affirm its quality. This subtle difference can significantly affect your property ownership, so understanding your options is crucial.

In Texas, a deed without warranty for house may offer more security than a quitclaim deed. A quitclaim deed transfers whatever interest the seller has without making any promises about the title’s cleanliness. Conversely, a deed without warranty implies that the seller holds the title but does not guarantee its quality. Depending on your situation, it can be beneficial to use a deed without warranty for added reassurance.

The strongest type of deed is typically the warranty deed, as it provides the highest level of protection for the buyer. However, a Deed without warranty for house can also be a useful option in certain circumstances, such as when sales occur between parties who trust each other. Each deed type serves specific purposes, and understanding their differences empowers you to make informed choices. Consulting resources on US Legal Forms can help clarify these distinctions further.

If you lost your warranty deed, you can obtain a copy through your county's recorder or assessor's office. These offices keep public records of property transactions, including deeds. If a Deed without warranty for house is involved, remedy may depend on local laws regarding ownership. It's advisable to act quickly and explore options offered on platforms like US Legal Forms to ensure proper documentation.

Yes, you must file a warranty deed to make it legally effective and protect your ownership rights. Filing formally records the transaction with local authorities, ensuring public awareness of ownership. When pondering alternatives like a deed without warranty for a house, consider the implications of not filing. To guarantee your legal ownership, utilize platforms like uslegalforms for streamlined filing processes.

One significant disadvantage of a quit claim deed is that it offers no guarantee of clear title. With this type of deed, the seller conveys whatever interest they have, but may not possess full ownership. This leaves the buyer vulnerable to future claims or issues with the title. When compared to a deed without warranty for a house, the quit claim deed may expose you to increased risk, making it vital to choose wisely.

You would need a warranty deed to ensure security and peace of mind during a property transaction. This deed serves as a legal promise that you receive clear title to the property, which is beneficial for both buyers and sellers. Especially in transactions involving a deed without warranty for a house, it is prudent to understand the protections provided by a warranty deed. It enhances the transparency and trustworthiness of the sale.

While a warranty deed is not mandatory, it is often recommended for residential transactions. This document provides full ownership guarantees and protects buyers from undisclosed problems with the property title. In contrast, if you're considering a deed without warranty for a house, you may have to accept more risk about your future ownership. Knowing your options can guide your decision.

A primary disadvantage of a warranty deed is the potential liability it places on the seller. If title issues arise after the sale, the seller may be held responsible for resolving them. This can lead to increased stress and financial burdens. If you're exploring a deed without warranty for a house, it's crucial to understand the risks associated with both types of deeds.