Motion For Rule 106 Texas

Description

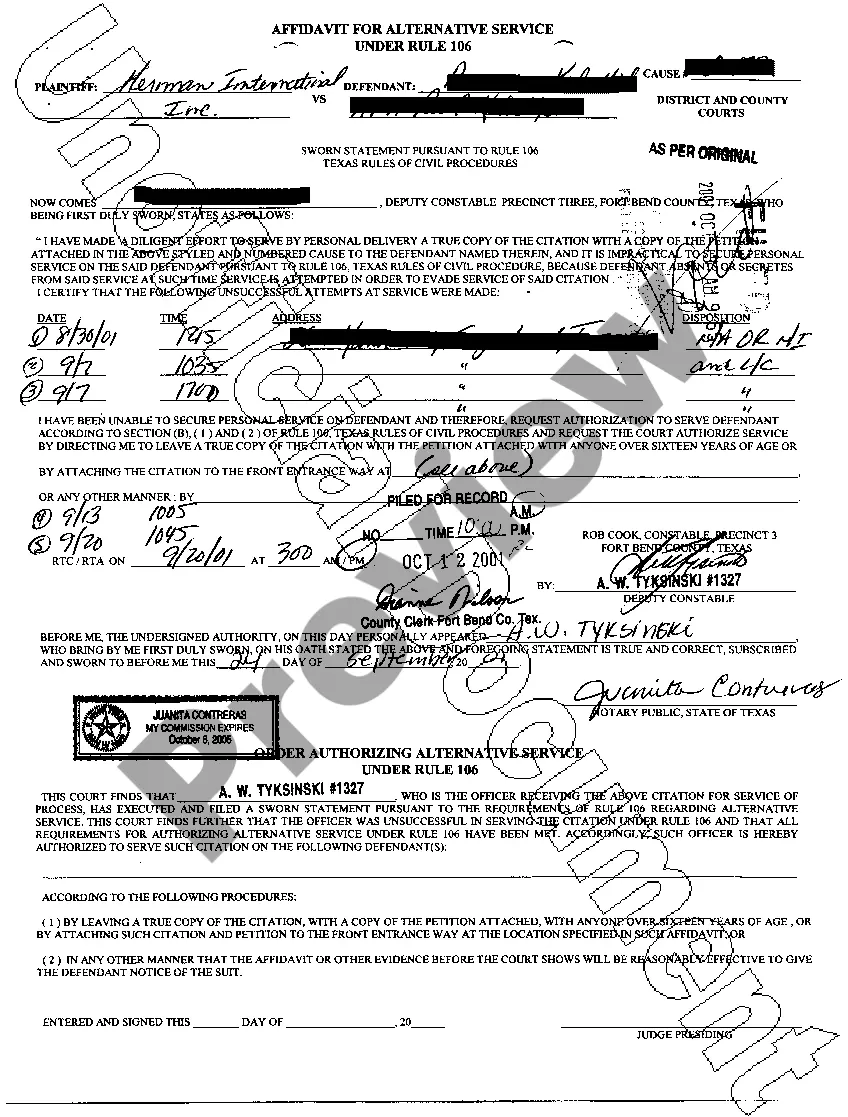

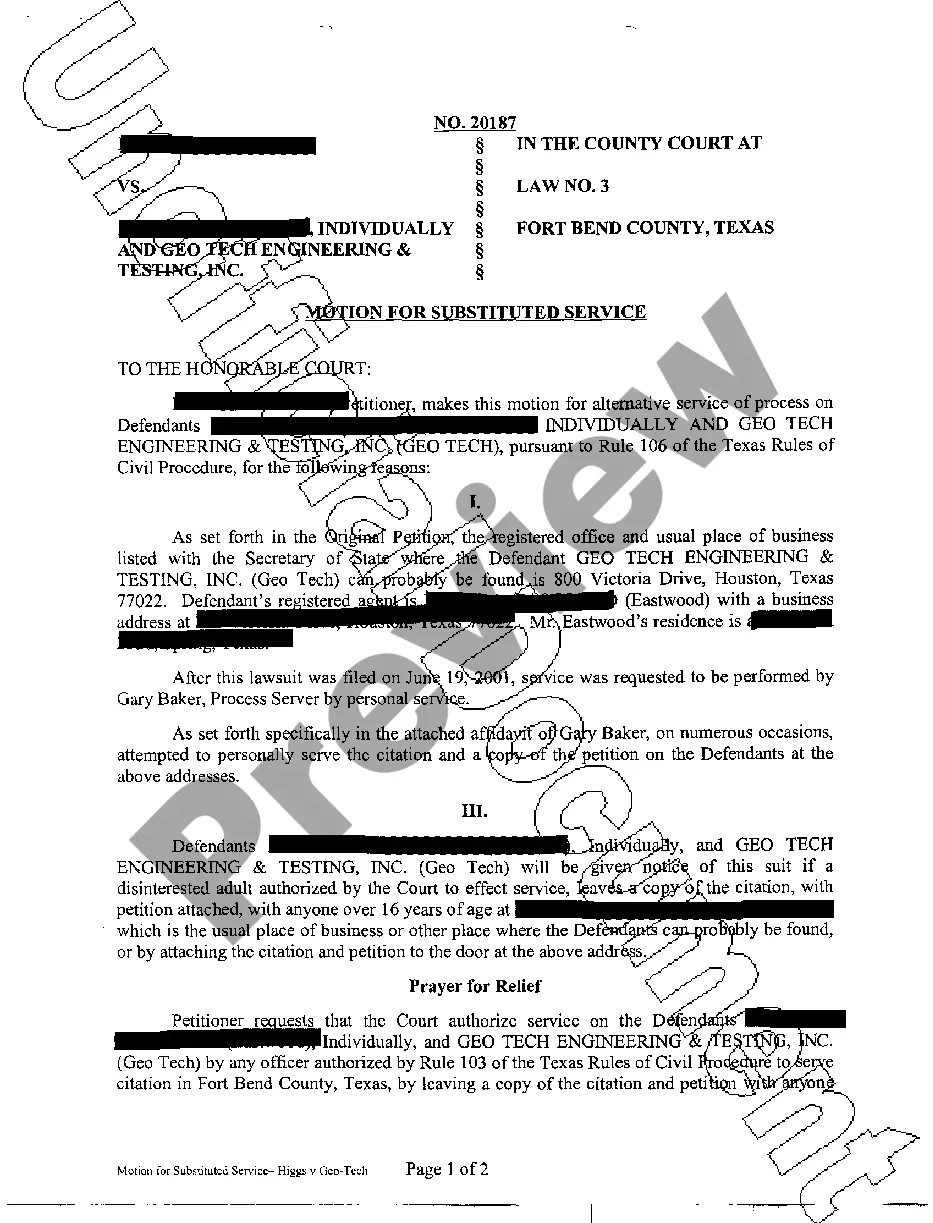

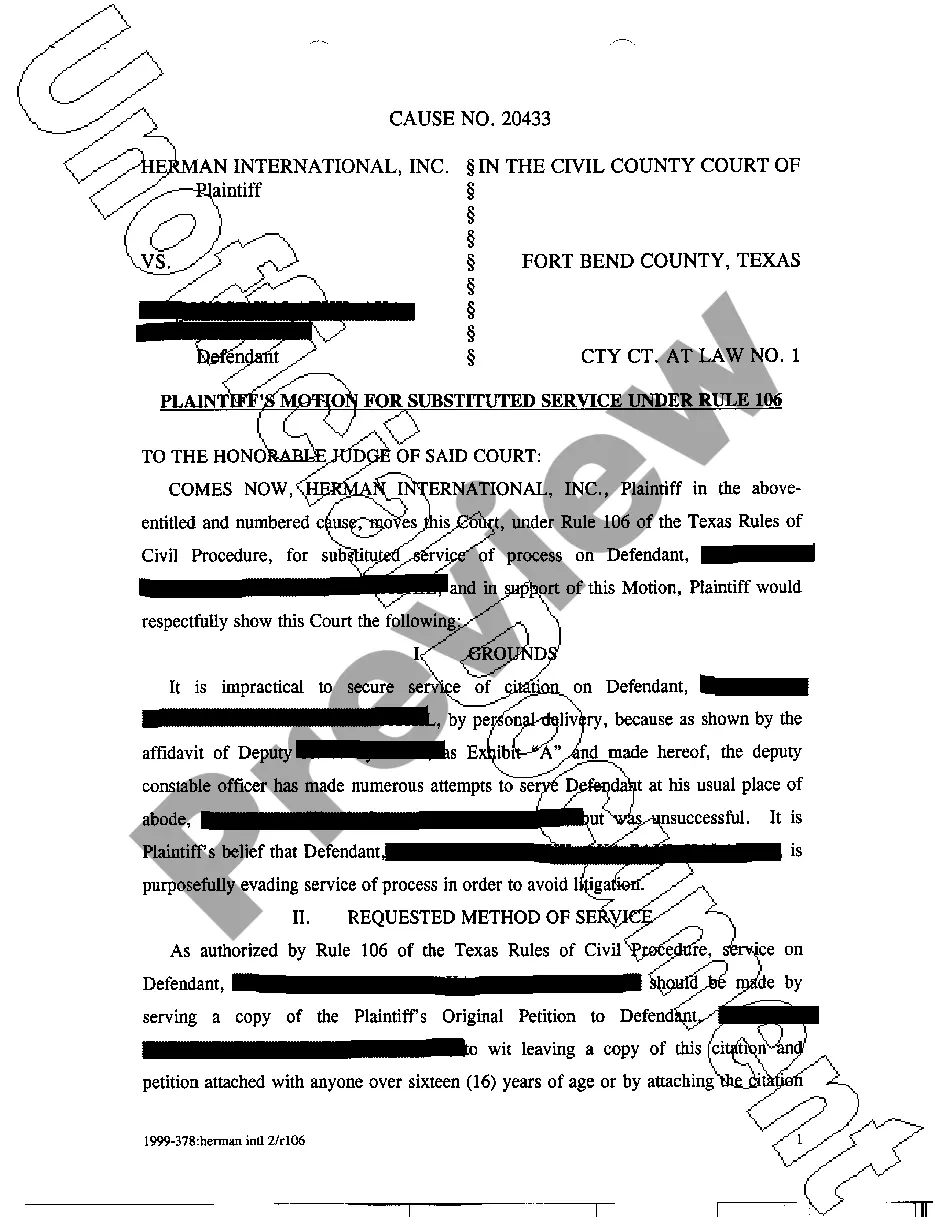

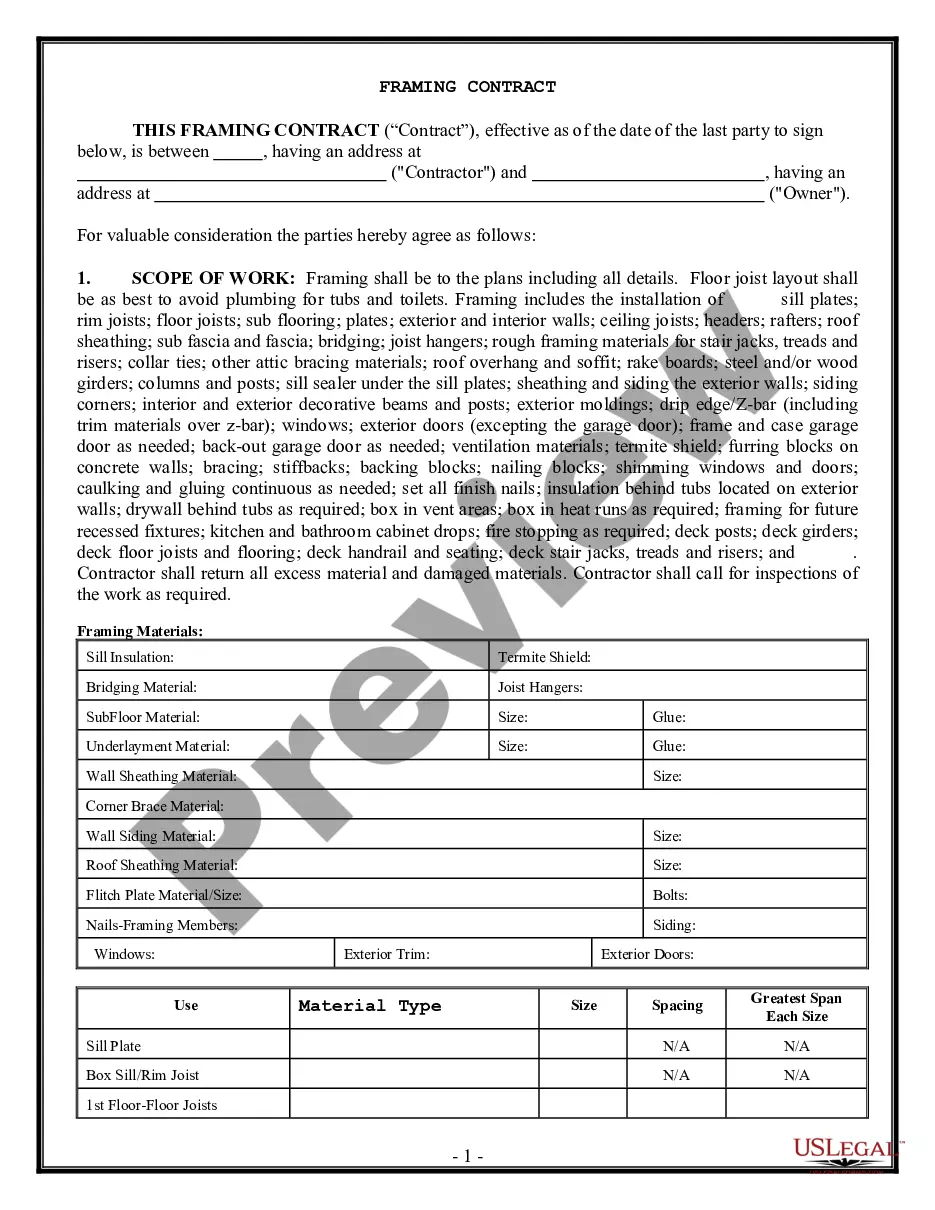

How to fill out Texas Order Of Substituted Service Under Rule 106?

Finding a reliable location to obtain the most up-to-date and suitable legal templates is a significant part of managing red tape.

Identifying the correct legal documents requires precision and meticulousness, which is why it is essential to source samples of Motion For Rule 106 Texas solely from trusted providers, such as US Legal Forms.

Eliminate the hassle associated with your legal documentation. Browse the vast US Legal Forms library where you can find legal templates, verify their appropriateness for your situation, and download them instantly.

- Utilize the library navigation or search feature to locate your template.

- Review the form's details to ensure it meets the criteria for your state and county.

- Check the form preview, if available, to confirm that the template is indeed the one you are seeking.

- If the Motion For Rule 106 Texas does not meet your requirements, continue the search to find the appropriate template.

- If you are confident about the form's relevance, proceed to download it.

- As an authorized user, click Log in to verify your identity and access your chosen templates in My documents.

- If you do not have an account yet, click Buy now to purchase the form.

- Choose the pricing option that suits your needs.

- Continue to the registration process to complete your transaction.

- Finalize your purchase by selecting a payment method (credit card or PayPal).

- Select the document format for downloading Motion For Rule 106 Texas.

- Once you have the document on your device, you can edit it using the editor or print it and fill it out by hand.

Form popularity

FAQ

Rule 167 in Texas pertains to the requirements for witness and party depositions in civil cases. This rule establishes the framework for how depositions should be conducted, including notice provisions and the format of testimonies. Familiarity with rules like this, alongside processes like the Motion for rule 106 Texas, is important for effective legal strategy. Resources available through platforms like USLegalForms can help clarify these procedures.

In Texas, grounds for a motion to recuse a judge include a demonstrated bias, impartiality concerns, or conflicts of interest. You must provide substantial evidence supporting your claim, as these motions can lead to judicial review. Familiarity with related motions, such as the Motion for rule 106 Texas, can strengthen your understanding of the process. Consulting with a lawyer helps ensure your motion is adequately supported.

Kentucky Franchise Tax The tax is calculated using the lesser of $0.095/$100 of Kentucky gross receipts or $0.75/$100 of Kentucky gross profits. Regardless of which calculation method is used, business owners are required to pay a minimum Kentucky LLET of $175.

Kentucky Form 20A100 "Declaration of Representative" is used for this purpose. IRS Form 2848, "Power of Attorney and Declaration of Representative", is also acceptable for income tax purposes. under the authority of the Finance and Administration Cabinet.

To make payments, the FEIN is required along with the Kentucky Corporate/LLET 6-digit account number.

KY Withholding Account Number Register online with the KY Dept of Revenue to receive a Withholding Account Number. Registration may also be completed via the Kentucky Registration Application (10A100).

Purpose of Form 20A100. Use the Declaration of Representative (Form 20A100) to authorize the individual(s) to represent you before the Kentucky Department of Revenue. You may grant the individual(s) authorization to act on your behalf with regard to any tax administered by the Kentucky Department of Revenue.

A Limited Liability Entity Tax (LLET) applies to both C corporations and Limited Liability Pass-Through Entities (LLPTEs) and is not an alternative to another tax. However, corporations paying the LLET are allowed to apply that amount as a credit towards its regular corporate income tax.

The State Records Center stores court records 15-35 years old. Submit this records request form to state.records@ky.gov or call 502-564-3617. The case and locator numbers must be provided as these records cannot be searched only by name and/or Social Security number.

To obtain your valid Kentucky Corporation/LLET account number, please contact the Department of Revenue at (502) 564-3306. To submit payment online, visit .