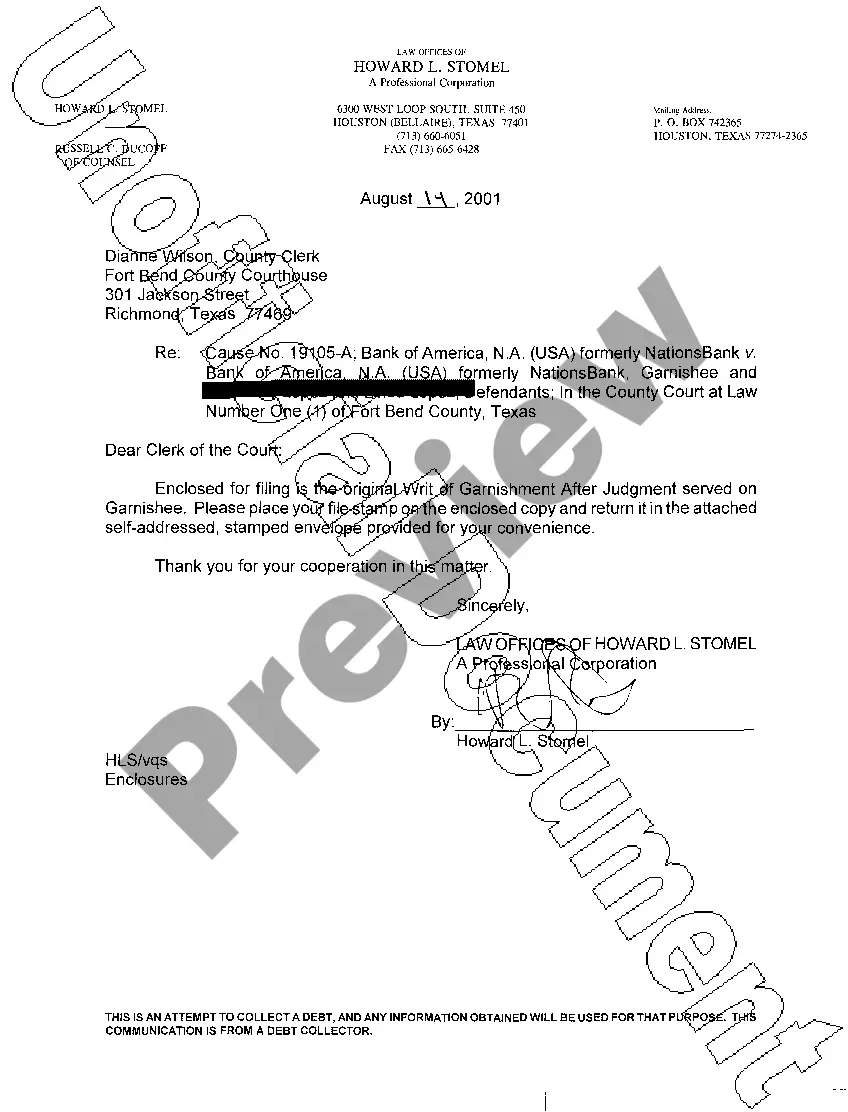

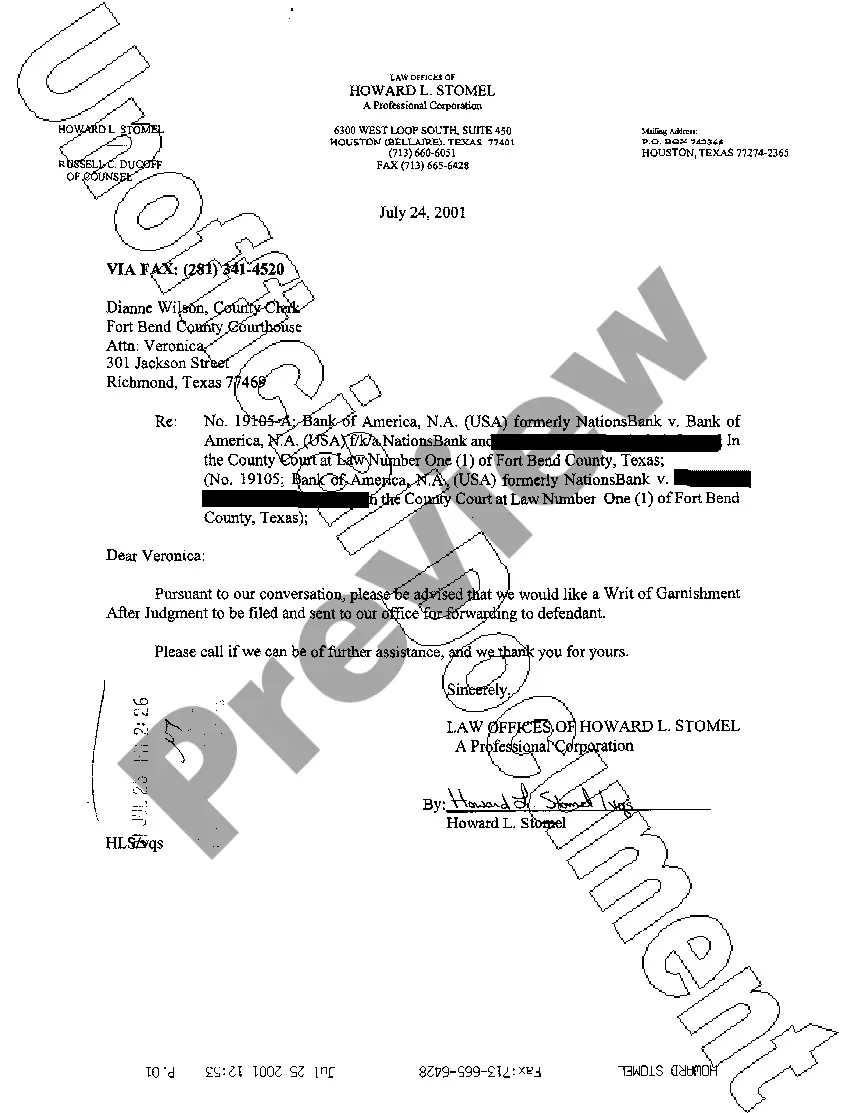

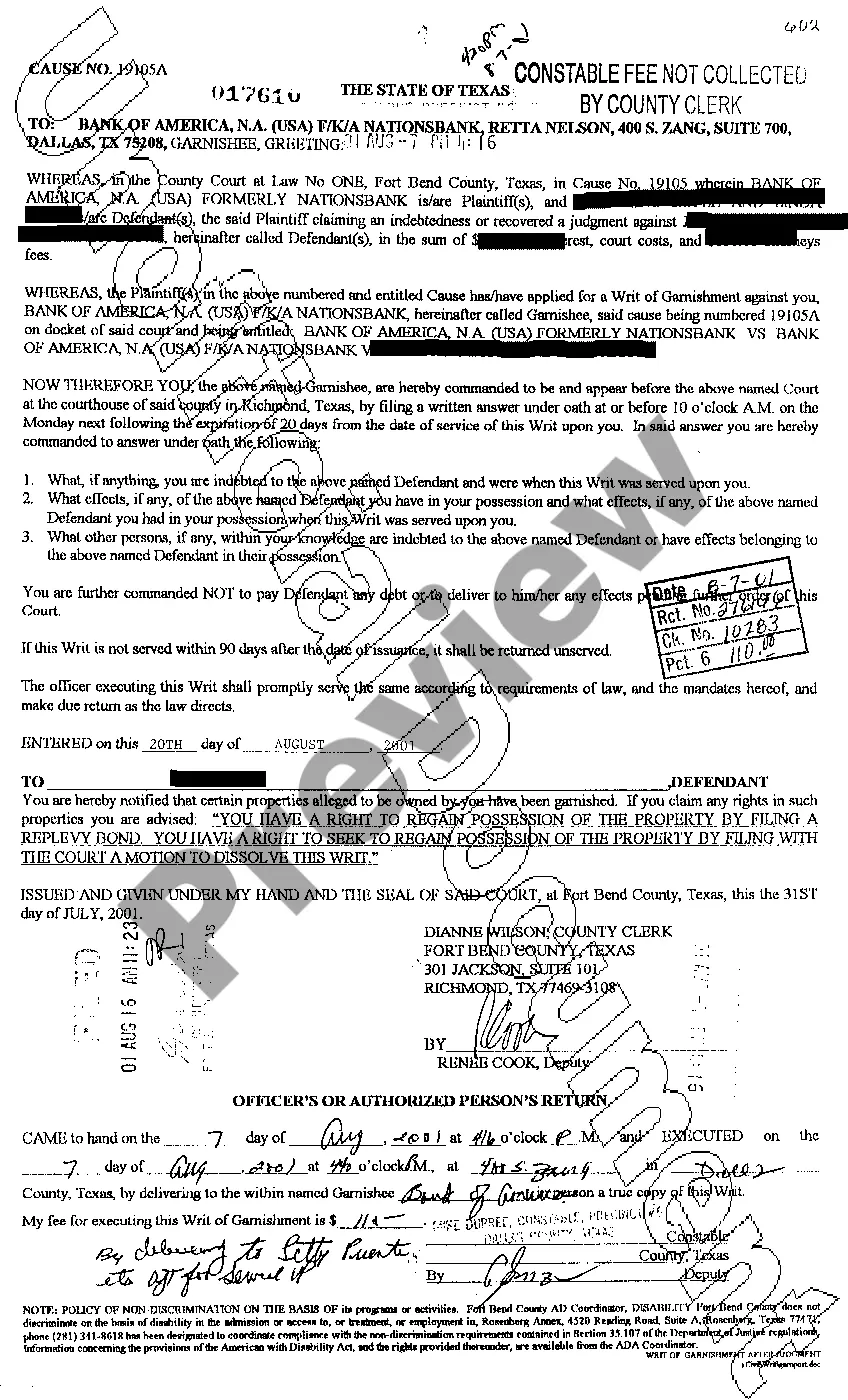

Writ Of Garnishment In Texas

Description

How to fill out Texas Writ Of Garnishment?

Whether for business purposes or for personal affairs, everybody has to handle legal situations sooner or later in their life. Completing legal paperwork needs careful attention, starting with picking the right form template. For example, when you choose a wrong version of the Writ Of Garnishment In Texas, it will be declined once you submit it. It is therefore crucial to have a dependable source of legal files like US Legal Forms.

If you need to obtain a Writ Of Garnishment In Texas template, stick to these simple steps:

- Get the sample you need using the search field or catalog navigation.

- Examine the form’s information to make sure it matches your situation, state, and region.

- Click on the form’s preview to view it.

- If it is the incorrect form, go back to the search function to locate the Writ Of Garnishment In Texas sample you need.

- Download the file if it matches your requirements.

- If you already have a US Legal Forms profile, simply click Log in to access previously saved templates in My Forms.

- If you don’t have an account yet, you may obtain the form by clicking Buy now.

- Pick the proper pricing option.

- Complete the profile registration form.

- Choose your transaction method: use a credit card or PayPal account.

- Pick the document format you want and download the Writ Of Garnishment In Texas.

- When it is downloaded, you are able to complete the form by using editing software or print it and finish it manually.

With a vast US Legal Forms catalog at hand, you don’t need to spend time seeking for the appropriate sample across the internet. Use the library’s easy navigation to find the correct form for any situation.

Form popularity

FAQ

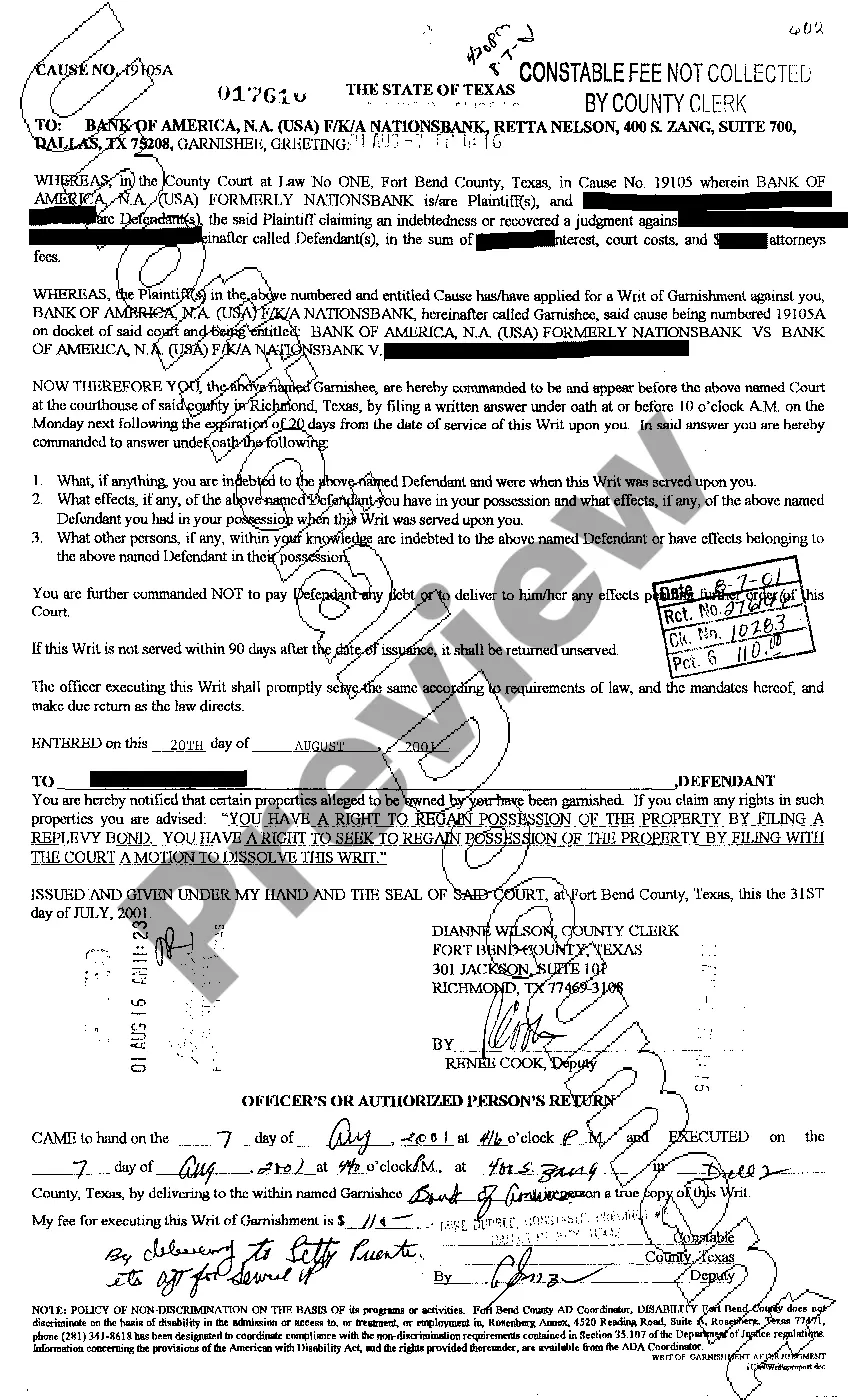

In order to file a Writ of Garnishment, the creditor must have an existing final judgment against the debtor and then must file for the writ in the court which rendered the original judgment against the debtor. It is the third party, the bank or financial institution, which receives the Writ of Garnishment. Tex.

In Texas, wage garnishment is prohibited by the Texas Constitution except for a few kinds of debt: child support, spousal support, student loans, or unpaid taxes. A debt collector cannot garnish your wages for ordinary debts. However, Texas does allow for a bank account to be frozen.

Typically, a creditor must have filed a lawsuit against the debtor and won a judgment. After winning the judgment, the creditor will file a separate court case against a third party (also called a "garnishee") who has your money and ask the court to issue a writ of garnishment.

The Writ of Execution is served to a county constable or sheriff, who must ?without delay? levy the real and personal property of the judgment debtor unless directed to do otherwise. If more than one Writ of Execution is served, then the assets are distributed in the order the writs are received.

Either at the commencement of a suit or at any time during its progress the plaintiff may file an application for a writ of garnishment. Such application shall be supported by affidavits of the plaintiff, his agent, his attorney, or other person having knowledge of relevant facts.