Georgia 10 Day Repossession Letter For Auto Loan

Description

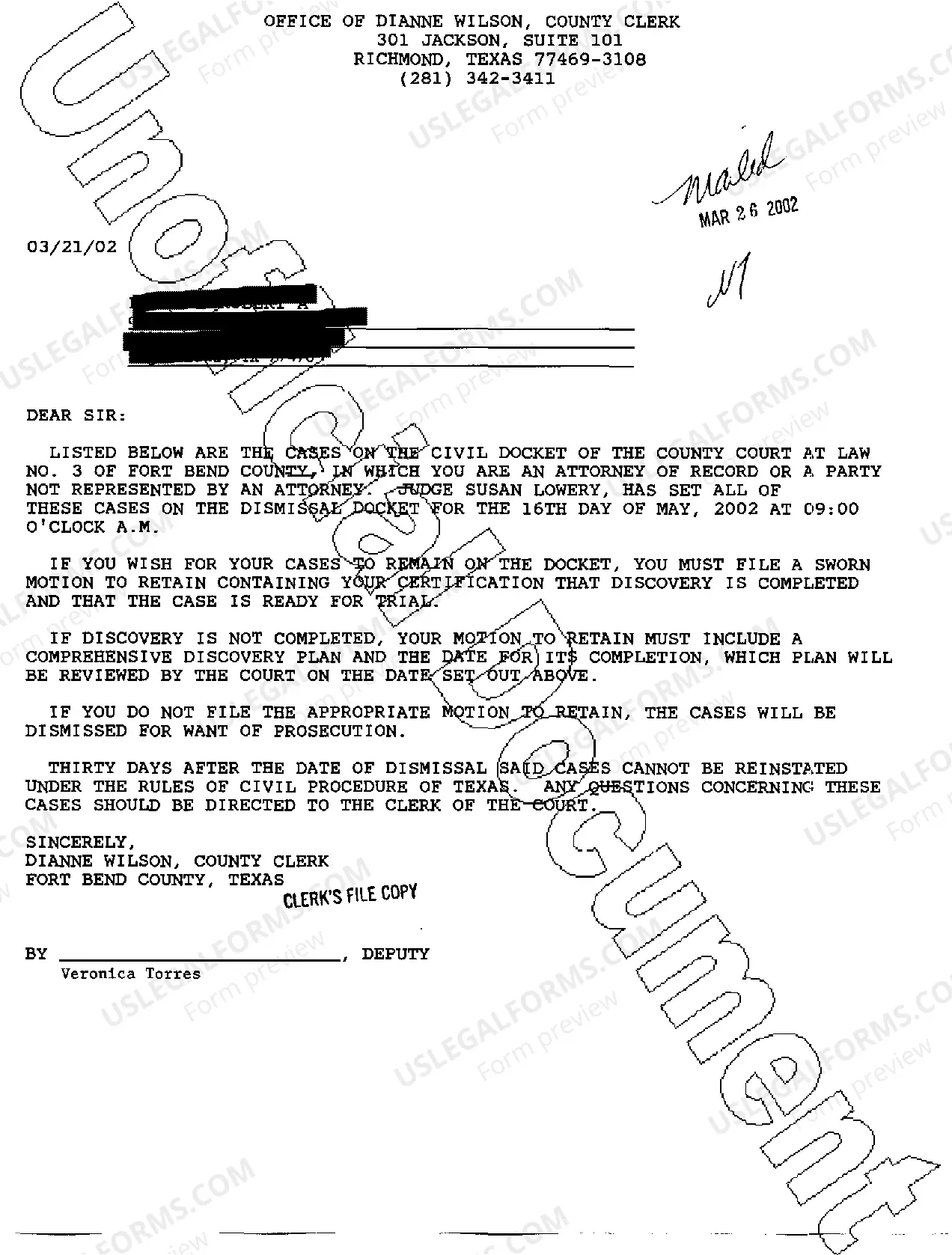

How to fill out Texas Letters?

The Georgia 10 Day Repossession Notice For Auto Loan displayed on this page is a reusable official template created by experienced attorneys in accordance with federal and state regulations.

For over 25 years, US Legal Forms has supplied individuals, institutions, and lawyers with more than 85,000 validated, state-specific documents for every business and personal situation. It’s the fastest, simplest, and most reliable means to acquire the paperwork you require, as the service guarantees bank-level data protection and anti-malware security.

Subscribe to US Legal Forms to have verified legal templates for every circumstance in life at your fingertips.

- Search for the document you require and review it.

- Browse through the file you searched and preview it or examine the form description to ensure it meets your requirements. If it does not, use the search feature to locate the correct one. Click Buy Now once you have found the template you need.

- Register and Log In.

- Choose the pricing plan that fits you and create an account. Use PayPal or a credit card to make a quick payment. If you already possess an account, Log In and verify your subscription to continue.

- Obtain the editable template.

- Select the format you prefer for your Georgia 10 Day Repossession Notice For Auto Loan (PDF, DOCX, RTF) and download the sample onto your device.

- Complete and sign the documents.

- Print the template to fill it out by hand. Alternatively, utilize an online multifunctional PDF editor to quickly and accurately complete and sign your document with a legally binding electronic signature.

- Re-download your documents.

- Access the same paper again whenever necessary. Open the My documents tab in your profile to redownload any forms previously saved.

Form popularity

FAQ

In Georgia, the repossession process can happen quite quickly after you miss a payment. Generally, your lender can issue a Georgia 10 day repossession letter for auto loan shortly after your payment is past due, giving you about 10 days to catch up. If you do not make the payment or arrange a repayment plan, the lender can proceed with repossession. It's essential to understand your rights and options, and platforms like US Legal Forms can help you navigate this process effectively.

The timeline for repossession efforts can vary depending on the lender's policies. Usually, they will continue attempts for resolution until your account is brought up to date or a Georgia 10 day repossession letter for auto loan reaches its deadline. It is critical to communicate with your lender to understand their processes and keep your account in good standing.

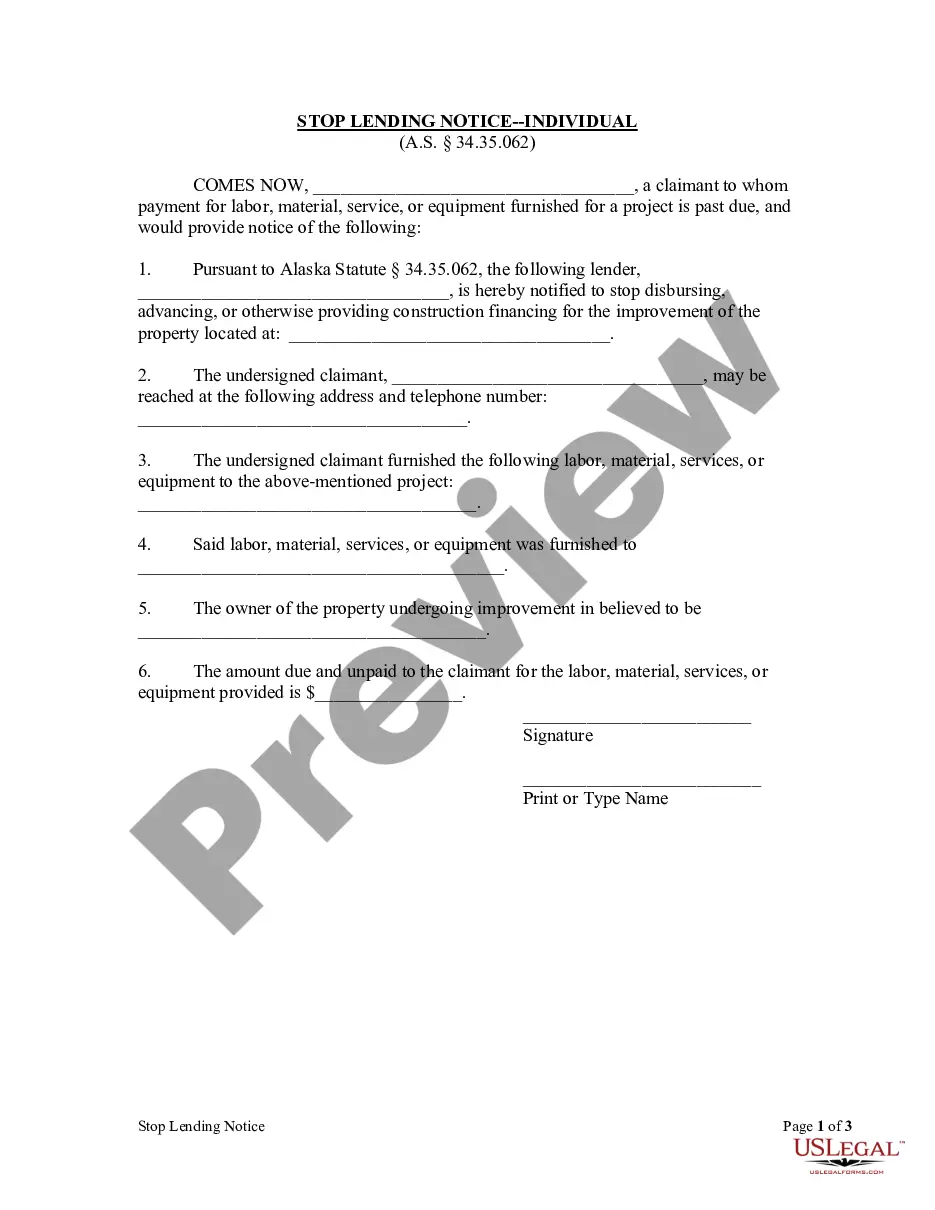

Creating a repossession letter requires clear communication of the account issues and the intention to repossess the vehicle. Use the format of a Georgia 10 day repossession letter for auto loan, ensuring to include account details, deadlines, and contact information for questions. You can also leverage platforms like US Legal Forms to find templates and guidance in drafting this letter.

Generally, you will receive a letter before repossession occurs. This notification, often a Georgia 10 day repossession letter for auto loan, informs you of your overdue payments and potential actions. It is your chance to resolve the matter before the lender follows through with repossession.

A repossession letter typically includes essential details such as your account status, missed payments, and the lender's intention to take back the vehicle. This letter will clearly state it is a Georgia 10 day repossession letter for auto loan, providing a deadline to address your delinquency. Reviewing this letter carefully can help you understand your next steps.

Yes, in most cases, lenders will provide warnings prior to repossession. This can include a call or a Georgia 10 day repossession letter for auto loan, which serves as a final notification before action is taken. It is essential to respond promptly to these warnings to avoid losing your vehicle.

Georgia has specific rules regarding car repossession that protect both lenders and borrowers. Lenders must provide a Georgia 10 day repossession letter for auto loan before proceeding with repossession actions. It is crucial to understand that borrowers have rights, which include the opportunity to redeem the vehicle by paying the full loan balance. Familiarizing yourself with these rules can help you navigate the repossession process effectively.

Writing a repossession letter requires clarity and precision. Start by clearly stating that this is a Georgia 10 day repossession letter for auto loan. Include essential details such as the loan account number, the vehicle information, and the reason for repossession. Finally, provide instructions on how the borrower can address the situation, such as paying the past due amount.

In Georgia, a lender can initiate repossession of your vehicle if you are typically more than 10 days late on your car payment. This is often after receiving a Georgia 10 day repossession letter for auto loan, which notifies you of your payment default. It's important to remember that once you receive this letter, your lender has the right to take back the vehicle without further notice. If you find yourself in this situation, consider accessing resources that can help you understand your rights and options.