Tractor Lease Agreement With Bad Credit

Description

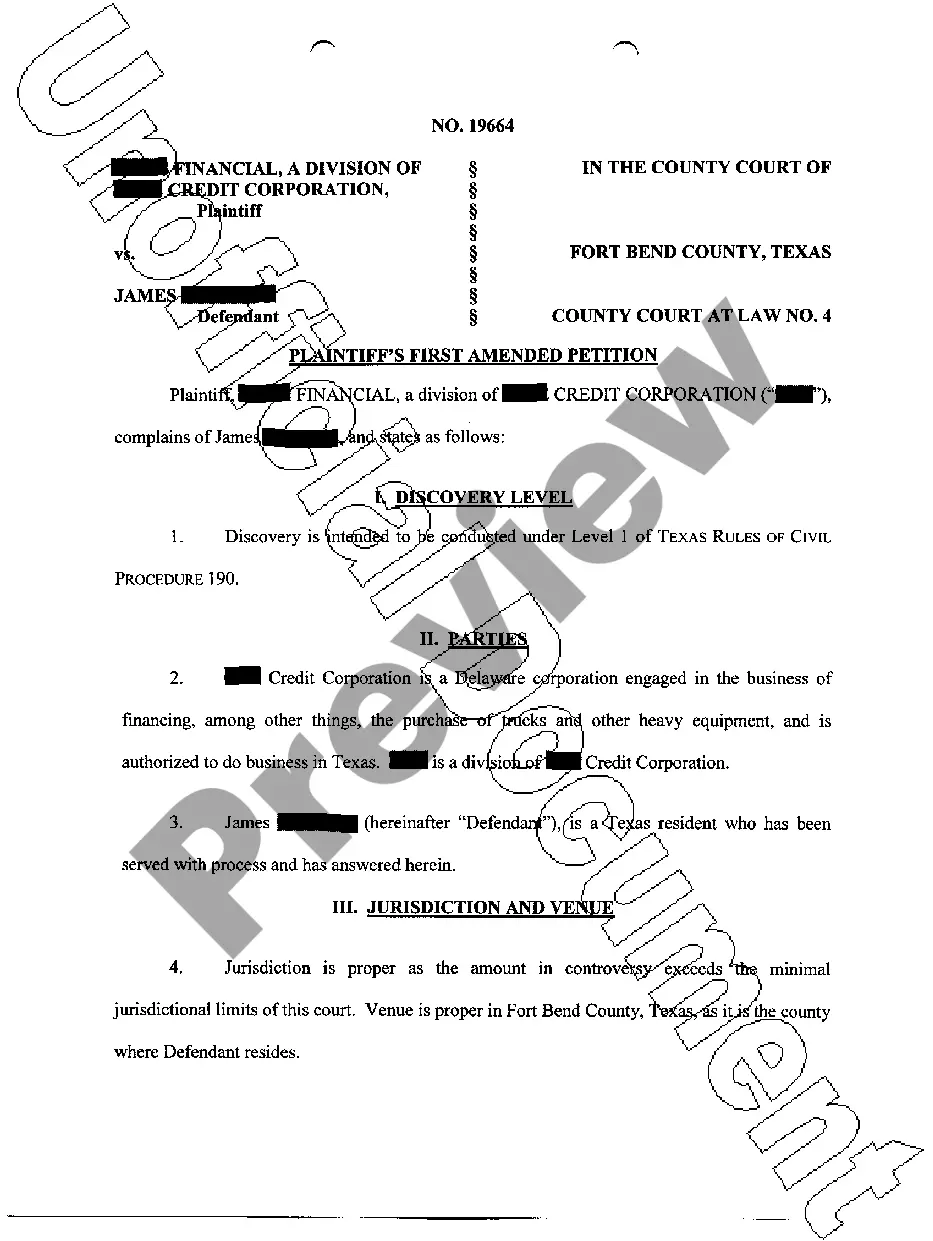

How to fill out Texas Plaintiffs Original Petition Regarding Finance Lease Agreement For Tractor?

Whether you handle documents regularly or occasionally need to submit a legal report, it is crucial to find a reliable source containing all the relevant and current samples.

The first step with a Tractor Lease Agreement With Bad Credit is to ensure you have the most recent version, as this determines its acceptability.

If you want to make your document search for the latest examples easier, look for them on US Legal Forms.

Utilize the search function to find the form you need. Examine the preview and description of the Tractor Lease Agreement With Bad Credit to confirm it is what you're looking for. After verifying the document, click Buy Now. Choose a subscription plan that fits your needs. Either create a new account or Log In to your existing one. Enter your credit card details or PayPal account to complete the purchase. Select the desired file format for download and confirm it. Eliminate the confusion associated with legal documents. All your templates will be arranged and verified with an account at US Legal Forms.

- US Legal Forms is a resource of legal documents that includes nearly every sample you might be searching for.

- Locate the templates you need, assess their immediate relevance, and learn more about their application.

- With US Legal Forms, you have access to approximately 85,000 document templates across various areas.

- Acquire the Tractor Lease Agreement With Bad Credit samples in just a few clicks and store them in your profile anytime.

- A US Legal Forms account will offer you easy access to all the samples you need with added convenience and less hassle.

- Simply click Log In in the website header and visit the My documents section to have all the forms at your fingertips, eliminating the need to spend time searching for the correct template or verifying its authenticity.

- To obtain a form without creating an account, adhere to these steps.

Form popularity

FAQ

Tractor loans fall within the category of agriculture loans. This loan can be applied by an individual or group of individuals. The repayment can be done by the entire group of individuals or by a single individual within the group. This loan follows the equated monthly installment (EMI) schedule.

What Credit Score is Needed to Finance a Tractor? The best tractor financing programs require credit scores over 680 but there are programs in the marketplace for most credit profiles. Often, tractors can be financed with FICO scores all the way down to 500 based on cash flow, collateral, or other factors.

DocumentationFilled in application form.Two latest photograph of all borrowers.Proof for signature verification - Passport/ Driving licence/ Pan card / Bank's verification.Identity proof.Address proof.Quotation of tractor issued by dealer to customer.Proof of land holding.

If you have good credit, financing options can be plentiful, with low-interest options that offer long-term financing. Tractor financing for bad credit, on the other hand, can be more difficult. For those with poor borrowing histories, the road to securing that tractor is a little bumpy.

What Credit Score is Needed to Finance a Tractor? The best tractor financing programs require credit scores over 680 but there are programs in the marketplace for most credit profiles. Often, tractors can be financed with FICO scores all the way down to 500 based on cash flow, collateral, or other factors.