Assignment Of Personal Property To Trust Form For Tax Purposes

Description

How to fill out Texas Assignment To Living Trust?

It’s clear that you can't instantly become a legal professional, nor can you easily determine how to swiftly prepare Assignment Of Personal Property To Trust Form For Tax Purposes without a specific set of abilities.

Drafting legal documents is an arduous task that demands certain education and expertise.

So why not entrust the creation of the Assignment Of Personal Property To Trust Form For Tax Purposes to the experts.

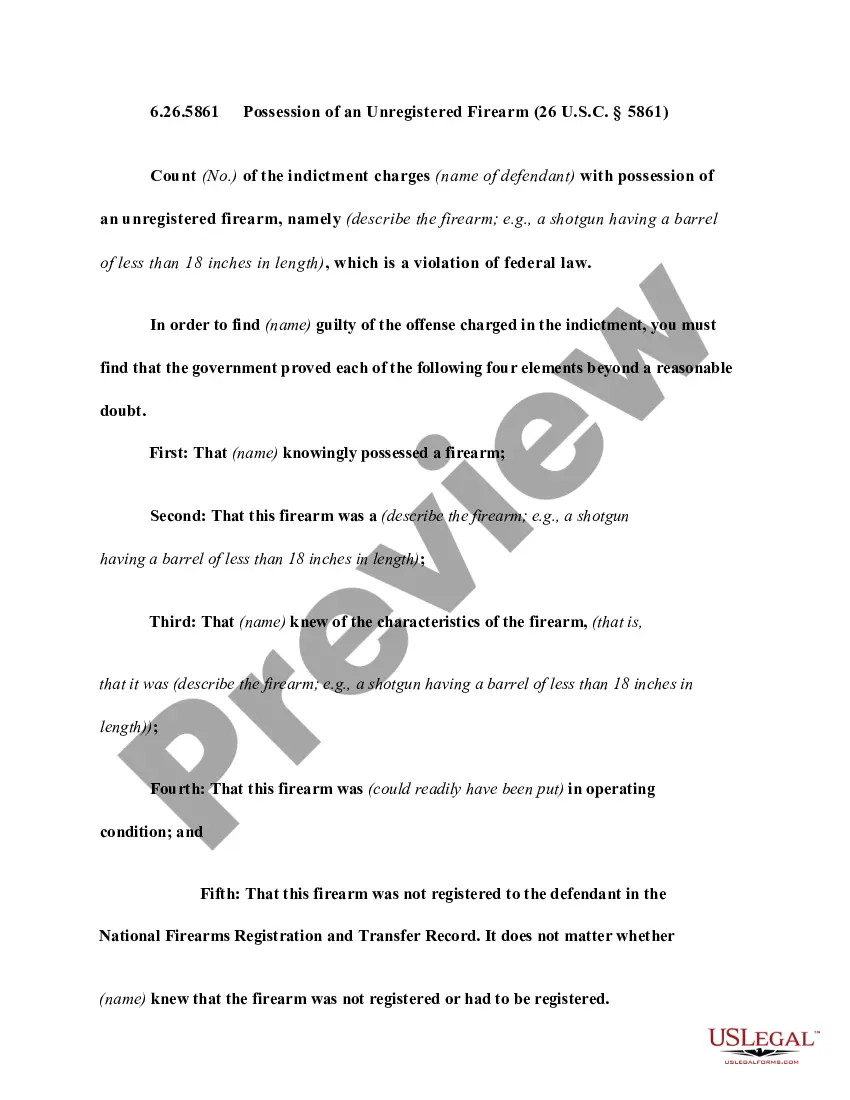

Preview it (if this feature is available) and read the accompanying description to determine whether Assignment Of Personal Property To Trust Form For Tax Purposes is what you’re looking for.

If you require another form, begin your search again.

- With US Legal Forms, one of the most complete legal document repositories, you can find everything from court papers to templates for internal business communication.

- We recognize the significance of compliance and adherence to federal and state statutes and rules.

- That’s why, on our site, all templates are location-specific and current.

- Start by visiting our website and obtaining the form you require in just a few minutes.

- Search for the form you need using the search box at the top of the page.

Form popularity

FAQ

This transfer doesn't usually lead to an immediate tax obligation, meaning no tax is levied for merely changing the ownership. However, the trust, which now owns the stock, may become liable for taxes on dividends and capital gains from the stock.

However, a trust involves the expenses of attorneys, any property registration or title transfers, filing fees, and any compensation granted to the trustee. These fees, when added up, can create an estate planning option that is actually quite expensive. Some of these variables are controllable.

The Assignment of Property lists every item of trust property that you've indicated doesn't have a title document, plus ones you weren't sure about. It simply says that you're transferring all those items to you as the trustee of your trust. All you need to do is sign it and keep it with your trust document.

To transfer cash or securities, the trustee will open an account in the trust's name, and the grantor will instruct his or her bank or broker to move the funds from his or her account to the trust's account. For real estate, a deed is used to transfer legal title of the property from the grantor to the trust.

Gift Tax Consequences The grantor must pay gift taxes whenever assets are transferred into an irrevocable trust. Revocable trusts are not subject to gift taxes, but will be included in the grantor's estate for estate tax purposes.