Texas Trust Amendment Form For Taxes

Description

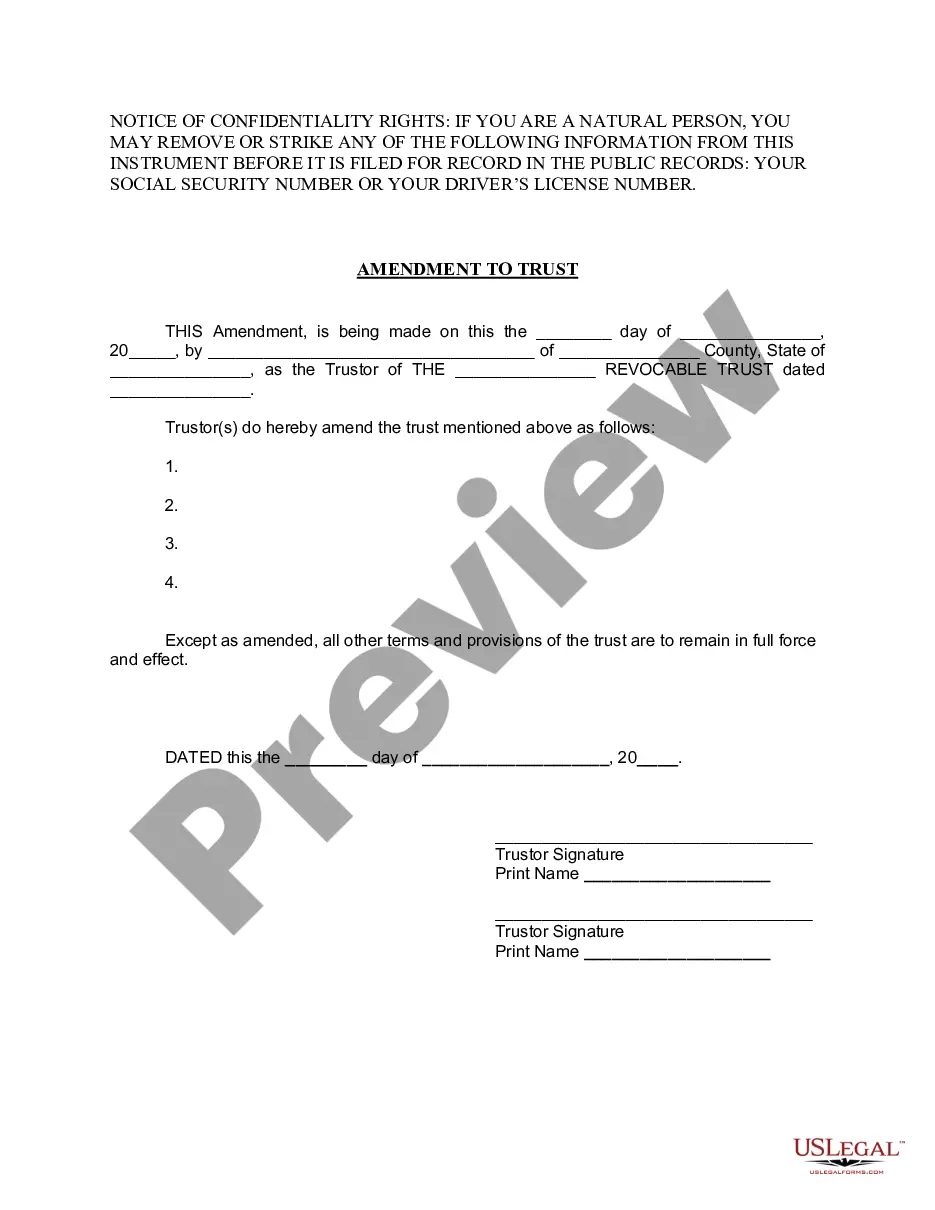

How to fill out Texas Amendment To Living Trust?

Obtaining legal document samples that meet the federal and local laws is essential, and the internet offers numerous options to pick from. But what’s the point in wasting time searching for the right Texas Trust Amendment Form For Taxes sample on the web if the US Legal Forms online library already has such templates accumulated in one place?

US Legal Forms is the biggest online legal library with over 85,000 fillable templates drafted by attorneys for any professional and personal situation. They are simple to browse with all papers arranged by state and purpose of use. Our professionals stay up with legislative changes, so you can always be sure your form is up to date and compliant when obtaining a Texas Trust Amendment Form For Taxes from our website.

Getting a Texas Trust Amendment Form For Taxes is easy and quick for both current and new users. If you already have an account with a valid subscription, log in and save the document sample you require in the right format. If you are new to our website, follow the steps below:

- Take a look at the template utilizing the Preview feature or through the text description to ensure it meets your requirements.

- Browse for another sample utilizing the search function at the top of the page if needed.

- Click Buy Now when you’ve found the correct form and choose a subscription plan.

- Register for an account or log in and make a payment with PayPal or a credit card.

- Choose the right format for your Texas Trust Amendment Form For Taxes and download it.

All templates you locate through US Legal Forms are reusable. To re-download and fill out previously purchased forms, open the My Forms tab in your profile. Enjoy the most extensive and straightforward-to-use legal paperwork service!

Form popularity

FAQ

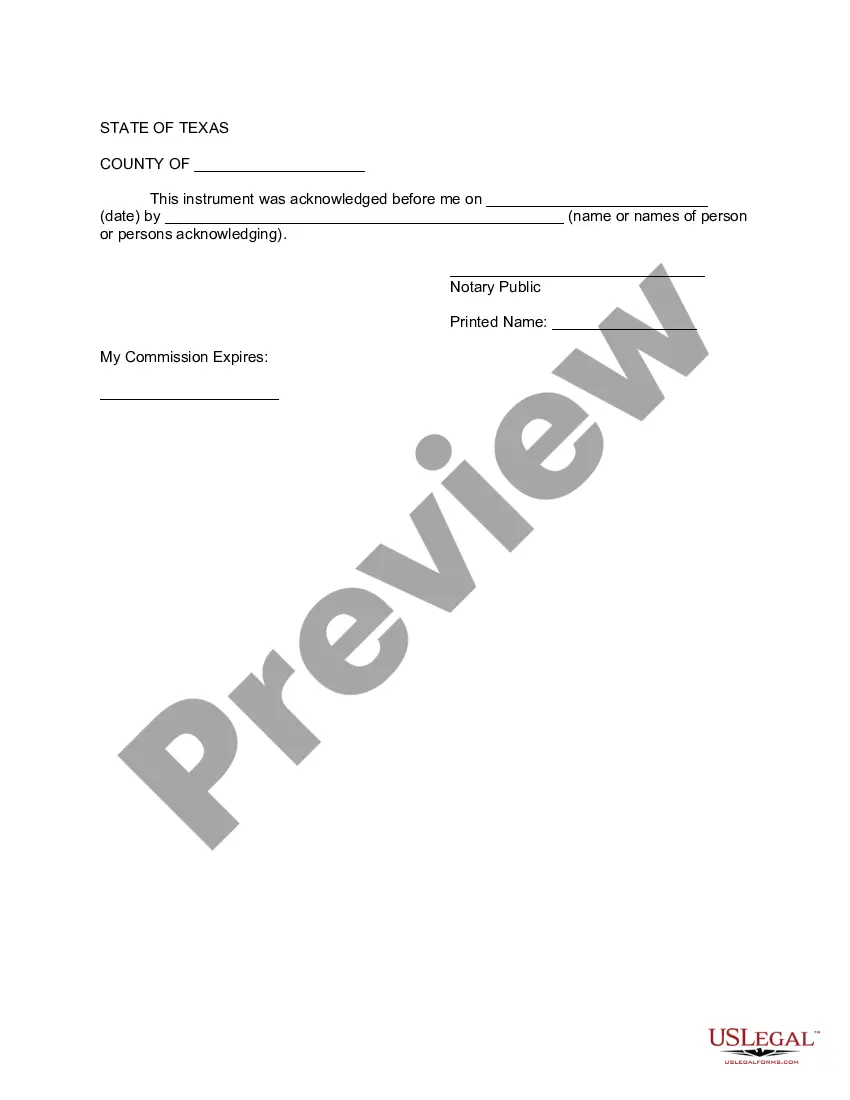

Amending a revocable trust, however, requires at most a notarized signature. There is often no need for you to sign a trust amendment in your attorney's office. As more people are living longer, the need to plan for incapacity is more important than ever.

An estate planning attorney must review the trust to ensure it can be amended. If the trust allows the surviving settlor to amend the trust, the authority to amend it may only be given to the surviving settlor. The mother may be permitted to amend the trust. However, it can't be anyone acting on her behalf.

It's important to know what you want to change and where in your trust document this information lives (such as the article number you're amending). Fill out the amendment form. Complete the entire form. It's important to be clear and detailed in describing your changes.

A court will allow a trust to be modified if you can show that the trust's main purpose is being inhibited in some way. A third way to change an irrevocable trust is by what is called ?decanting?. This means the trustee modifies the trust by moving assets from one trust to a new trust with different terms.