Dba Rules In Texas

Description

How to fill out Texas Assumed Name Certificate?

Whether for commercial reasons or personal matters, everyone must deal with legal issues at some point in their life.

Filling out legal papers requires meticulous care, starting with selecting the correct form template.

With an extensive US Legal Forms catalog available, you don't need to waste time searching for the right template online. Make use of the library's user-friendly navigation to find the correct template for any circumstance.

- Locate the template you require using the search feature or catalog browsing.

- Review the form’s description to ensure it aligns with your situation, state, and county.

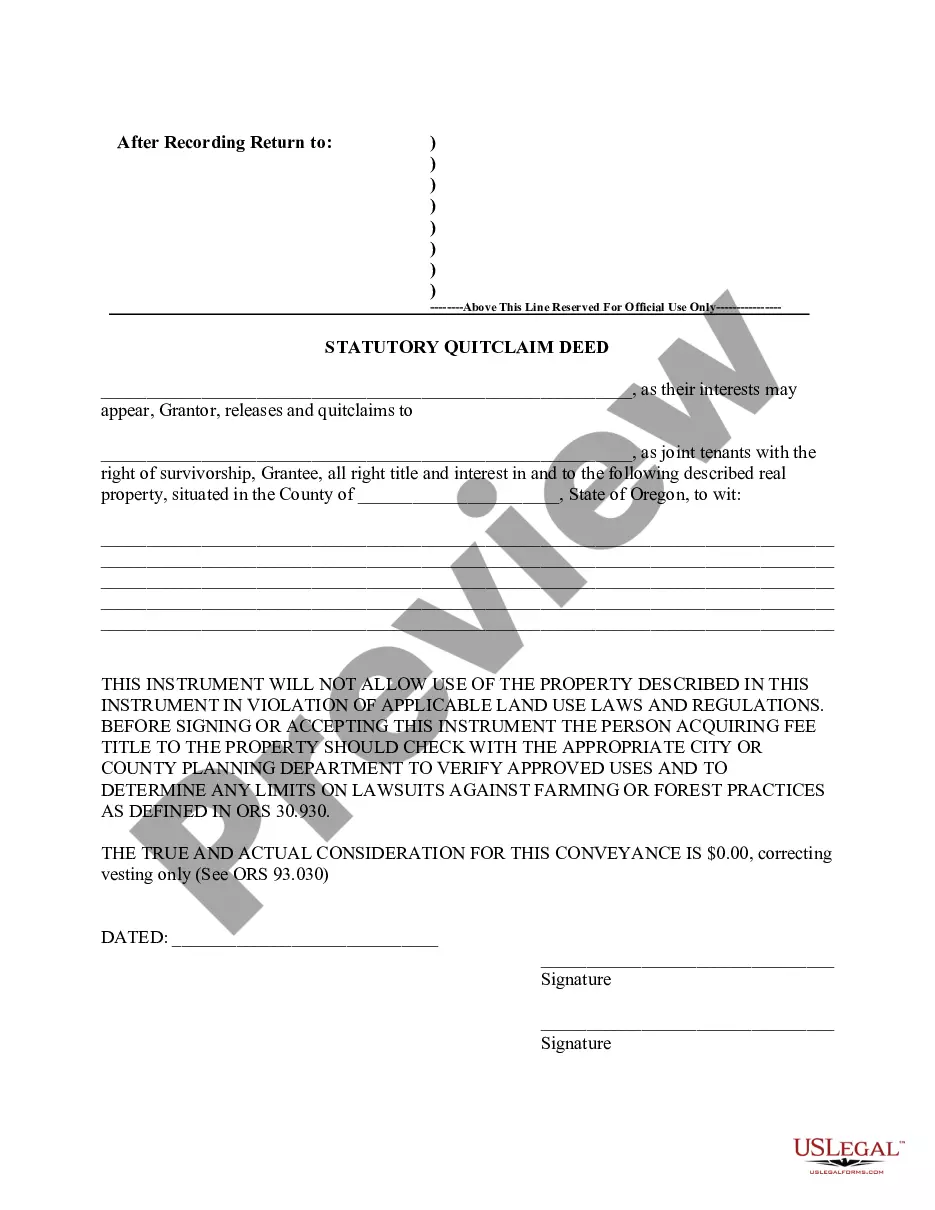

- Click on the form’s preview to inspect it.

- If it is the wrong form, revert to the search option to discover the Dba Rules In Texas sample you need.

- Obtain the file when it meets your specifications.

- If you already possess a US Legal Forms account, simply click Log in to access previously saved templates in My documents.

- If you do not have an account yet, you can download the form by clicking Buy now.

- Select the suitable pricing option.

- Complete the account registration form.

- Choose your payment method: use a credit card or PayPal account.

- Select the document format you desire and download the Dba Rules In Texas.

- Once it is saved, you can fill out the form using editing software or print it and fill it out manually.

Form popularity

FAQ

To file a DBA in Texas, you need to go to the county clerk's office where your business operates. Each county has its own requirements and processes for filing, so it's essential to check their specific guidelines. You can also file online through platforms like US Legal Forms, which provides an easy and efficient way to navigate the DBA rules in Texas. By using this platform, you can ensure that your application is completed correctly and submitted on time.

Yes, you can operate a business in Texas without a DBA if you use your legal name. However, if you plan to use a different name for your business, you will need to file a DBA to comply with state regulations. Not having a DBA could lead to confusion with customers, as they may not know who is behind the business. Understanding the DBA rules in Texas helps ensure you follow appropriate procedures for operating your venture.

While registering a DBA can be a straightforward process, it does come with certain drawbacks. First, a DBA does not provide personal liability protection, meaning your personal assets could be at risk if legal issues arise. Additionally, a DBA does not establish a separate legal entity, which can limit your business's branding and growth potential. It's essential to weigh these factors and consider how DBA rules in Texas might impact your specific situation.

When writing out DBA, you should use ‘doing business as’ followed by the business name you intend to use. It’s essential to mention this when signing contracts or legal documents, as this helps clarify your business identity. Familiarizing yourself with the DBA rules in Texas will ensure you use the term correctly.

Absolutely, you can register multiple DBAs under a single LLC in Texas. This flexibility allows you to operate different business ventures under unique names without forming multiple entities. This aligns with the DBA rules in Texas, making it easier for you to manage your business operations.

Yes, you can obtain a DBA without forming an LLC in Texas. A DBA is simply a way to operate under a name different from your legal name, whether you’re a sole proprietor or a corporation. Understanding the DBA rules in Texas will help you navigate this process smoothly.

Yes, you need specific documentation to register a DBA in Texas. You must fill out and submit a DBA application, which often includes details like your intended business name and ownership structure. Proper documentation is key to complying with the DBA rules in Texas and to protecting your interests legally.

In Texas, establishing a DBA requires you to file an application with the county clerk where your business operates. You'll need to provide your business name, the name of the owner, and the owner's contact information. It’s essential to adhere to the DBA rules in Texas to ensure your business name is legally recognized.