Cost For Dba In Texas

Description

How to fill out Texas Assumed Name Certificate?

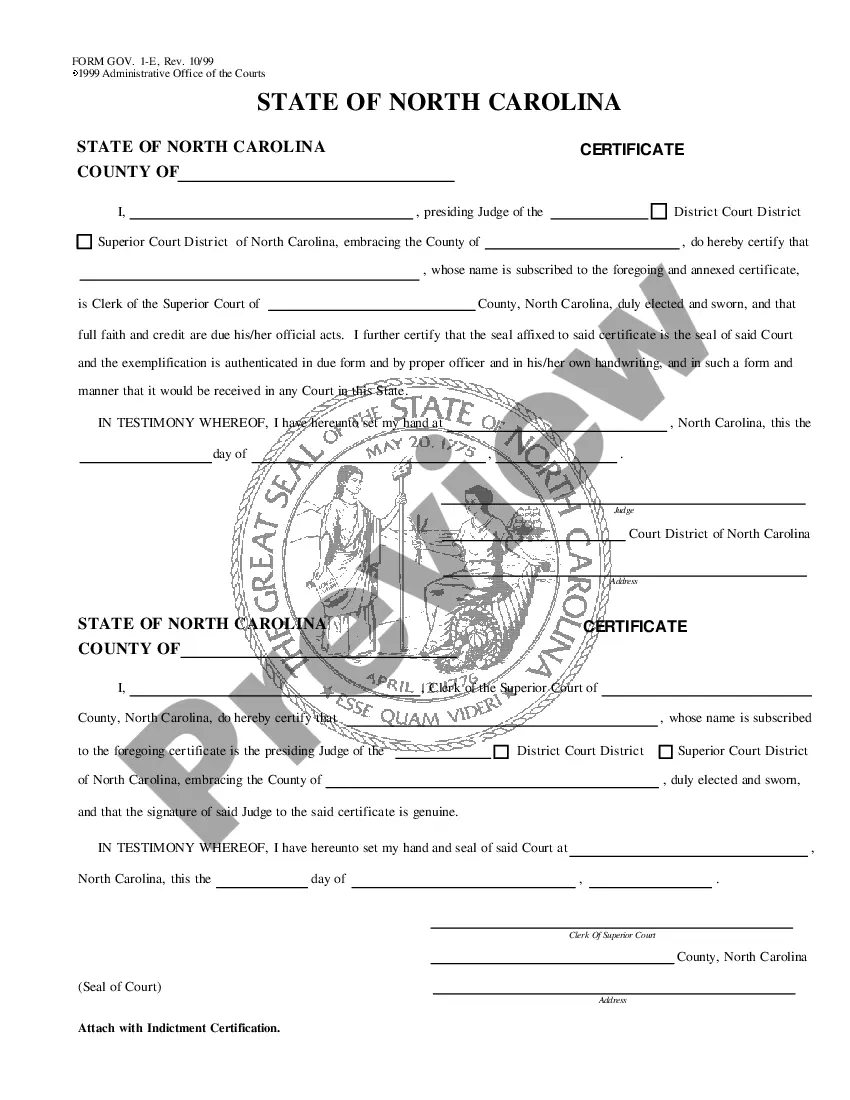

Whether for corporate goals or personal issues, everyone must confront legal circumstances at some point in their lives.

Filling out legal paperwork requires meticulous care, beginning with selecting the right form template.

With an extensive US Legal Forms catalog available, you do not have to waste time searching for the correct sample across the internet. Take advantage of the library’s straightforward navigation to discover the suitable template for any event.

- For instance, if you choose an incorrect version of a Cost For Dba In Texas, it will be rejected upon submission.

- Thus, it is essential to have a reliable source of legal documents such as US Legal Forms.

- Should you require a Cost For Dba In Texas template, adhere to these straightforward steps.

- 1. Obtain the sample you need through the search bar or catalog browsing.

- 2. Review the form’s details to confirm it fits your circumstances, state, and county.

- 3. Click on the form’s preview to inspect it.

- 4. If it is not the correct form, return to the search function to find the Cost For Dba In Texas sample you need.

- 5. Download the file if it fulfills your requirements.

- 6. If you already possess a US Legal Forms account, simply click Log in to access previously stored files in My documents.

- 7. In the case you do not yet have an account, you can download the form by clicking Buy now.

- 8. Select the appropriate pricing option.

- 9. Complete the account registration form.

- 10. Choose your payment method: either a credit card or PayPal account.

- 11. Select the document format you wish and download the Cost For Dba In Texas.

- 12. Once downloaded, you may fill out the form using editing software or print it to complete it manually.

Form popularity

FAQ

The cost for a DBA in Texas typically ranges from $15 to $25, depending on the county where you file. Be aware that additional fees may apply if you need certified copies or if there are name publication requirements. It's important to check with your local county clerk’s office for the most accurate information. For a streamlined process, consider using US Legal Forms, which provides resources and guidance to help you navigate the filing process efficiently.

To start a DBA in Texas, you need a few essential items. First, identify your business name and ensure it complies with state regulations. You must also check the availability of the name through the Texas Secretary of State's website. Lastly, be prepared to manage the cost for DBA in Texas, which may include registration fees and filing costs.

In Texas, the approval process for a DBA typically takes about one to two weeks. Once you submit your application to the county clerk's office, expect some processing time. If there are no issues, you will receive your DBA promptly. Ensuring that your application is filled out correctly can expedite this process.

Yes, a DBA is generally cheaper than forming an LLC. While the cost for DBA in Texas can be as low as $15, forming an LLC involves additional fees, such as filing fees and possibly annual franchise taxes. If you are looking for a straightforward business structure without complexities, a DBA may be the more economical choice. However, consider your business needs carefully.

The cost for a DBA in Texas typically ranges from $15 to $25, depending on the county where you file. Additionally, if you choose to publish your DBA in a local newspaper, this can add to the overall cost. It's essential to check specific county regulations, as fees may vary slightly. Therefore, understanding the total cost for DBA in Texas is crucial for budgeting.

Texas DBA filing & registration The proposed DBA to be registered. The true or legal name of the entity. The jurisdiction of organization. The address of the entity, The period during which the name will be used(maximum of 10 years) A statement as to what type of entity it is. Whether the entity maintains an office in Texas.

Payment and Delivery Instructions: The filing fee for an assumed name certificate filed with the secretary of state is $25. Fees may be paid by personal checks, money orders, LegalEase debit cards, or American Express, Discover, MasterCard, and Visa credit cards.

How Much Does a Texas DBA Cost? The filing fee for an assumed name certificate with the secretary of state of Texas is $25. You may pay this fee by personal check, money order or a LegalEase debit card. You may also pay online using a credit card but may be subject to a 2.7 percent fee for paying with credit card.

Texas law requires all sole proprietors and partnerships to file an Assumed Name Registration with the county clerk's office you wish to operate within to operate under a DBA. The Texas Secretary of State website gives you the contact information for each county.

How Much Does a Texas DBA Cost? The filing fee for an assumed name certificate with the secretary of state of Texas is $25. You may pay this fee by personal check, money order or a LegalEase debit card. You may also pay online using a credit card but may be subject to a 2.7 percent fee for paying with credit card.