Texas Closing Statement Withholding

Description

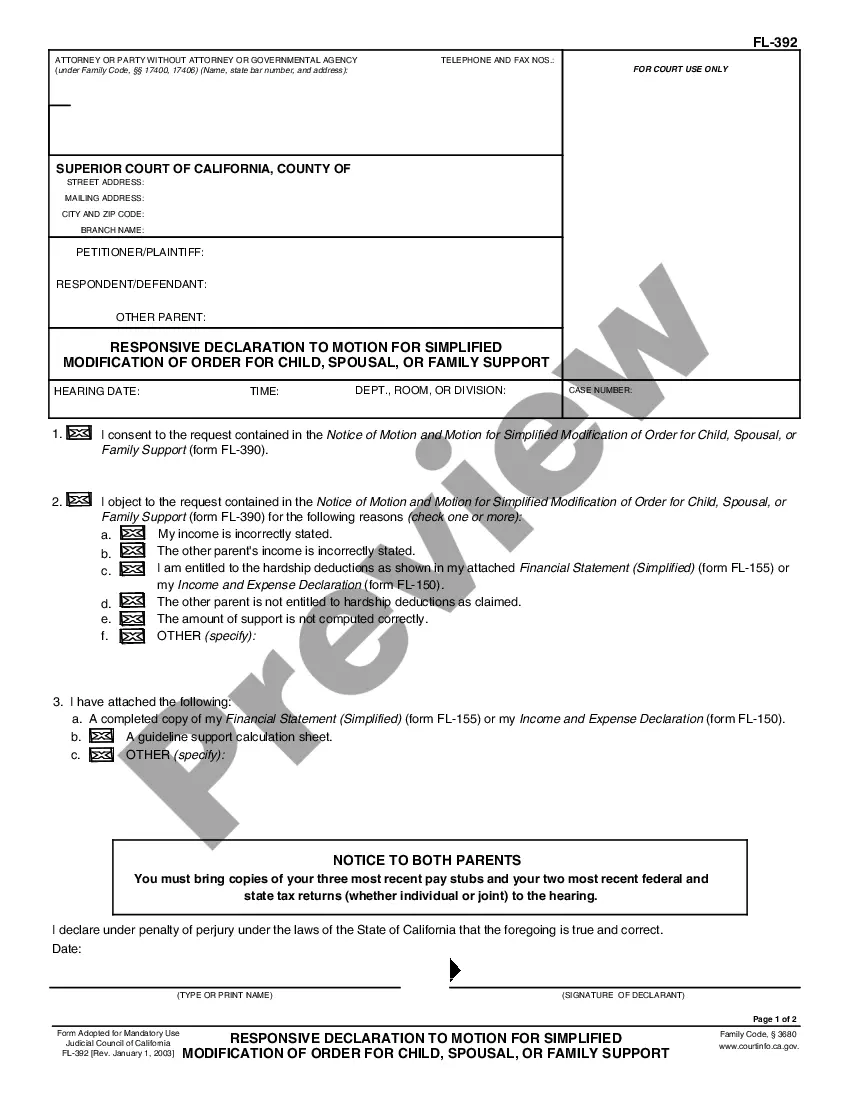

How to fill out Texas Closing Statement?

Managing legal documents can be daunting, even for experienced experts.

When seeking a Texas Closing Statement Withholding and lacking the time to find the correct and updated version, the process can become stressful.

US Legal Forms addresses all your needs, from personal to organizational documents, all in a single location.

Utilize advanced tools to complete and manage your Texas Closing Statement Withholding.

Here are the steps to follow after downloading the required form: Validate that this is the correct form by previewing it and reading its description. Ensure that the sample is approved in your state or county. Click Buy Now when you're ready. Choose a subscription plan. Select the format you need, and Download, complete, sign, print, and send your documents. Take advantage of the US Legal Forms web library, supported by 25 years of experience and reliability. Transform your daily document management into a simple and user-friendly process today.

- Access a valuable resource library of articles, tutorials, and guides related to your situation and requirements.

- Save time and effort in searching for the necessary documents, using US Legal Forms' sophisticated search and Review feature to locate Texas Closing Statement Withholding and obtain it.

- If you have a membership, Log In to your US Legal Forms account, search for the form, and retrieve it.

- Check your My documents tab to view previously saved documents and manage your folders as desired.

- If this is your first time using US Legal Forms, create an account for unlimited access to all the features of the library.

- A comprehensive web form library can be a transformative solution for anyone aiming to navigate these scenarios effectively.

- US Legal Forms stands as a leader in online legal documentation, offering over 85,000 state-specific forms available at any moment.

- With US Legal Forms, you can access state- or county-specific legal and business documents.

Form popularity

FAQ

To close a Texas sales and use tax permit, you must notify the Texas Comptroller of Public Accounts. This requires completing a specific form and providing details about your business. Ensure you have settled any outstanding tax obligations before submitting your request. For assistance with tax matters, consider using USLegalForms to guide you through the process.

Yes, if you are selling certain goods or services in Texas, you must withhold sales tax. The Texas closing statement withholding may include details about this requirement if applicable. Always check the regulations to ensure compliance, as failure to withhold can lead to penalties. Utilizing resources like USLegalForms can simplify understanding your responsibilities.

To find out your property tax bill in Texas, visit your local county appraisal district’s website. They typically provide online access to property tax records, where you can search by your property address or account number. Staying informed about your property tax bill is essential, especially when preparing for the Texas closing statement withholding. US Legal Forms can also guide you through the process of checking your tax records and understanding your responsibilities.

Yes, Texas does have a state withholding form that is used during real estate transactions. This form helps ensure that any applicable state taxes are withheld during the closing process, aligning with the Texas closing statement withholding guidelines. You can easily find this form on the Texas Comptroller's website or through reliable legal form services like US Legal Forms, which can provide additional assistance in completing the necessary paperwork.

No, the Texas sales and use tax permit number is different from the Employer Identification Number (EIN). The sales tax permit number is used specifically for sales tax purposes, while the EIN is an identification number for federal tax purposes. Understanding the distinction is important for compliance with tax regulations, including Texas closing statement withholding. For more detailed guidance, consider using USLegalForms.

To fill out a sales tax exemption certificate, provide your business name, address, and the specific reason for the exemption. Clearly describe the goods or services that qualify for the exemption and include your sales tax permit number. Completing this certificate accurately is crucial for meeting Texas closing statement withholding standards. USLegalForms offers templates to simplify this process.

Filling out an SST form involves providing information about your business and the transactions for which you are requesting sales tax relief. Accurately enter your seller’s permit number, business name, and the details of the goods you are purchasing. Ensure that all information is complete to avoid delays in processing. If you need further help, USLegalForms can provide templates and step-by-step instructions.

To fill out the Texas sales and use tax resale certificate, start by entering your business name, address, and seller's permit number. Clearly identify the items you plan to resell and provide the buyer's information. Make sure to sign and date the certificate. For detailed assistance, USLegalForms offers user-friendly resources to help you complete this document correctly.

Closing out an entity in Texas involves several steps, including filing the required dissolution documents with the Secretary of State. You must also settle any outstanding tax obligations, which may include reviewing your Texas closing statement withholding. If you find the process daunting, US Legal Forms offers resources and templates to guide you through the necessary steps. Properly closing your entity ensures compliance and protects you from future liabilities.

Yes, Texas form 05-102, which is used for various tax-related purposes, can be electronically filed. This feature streamlines the filing process and ensures you submit your information accurately and on time. By using the right platform, like US Legal Forms, you can easily access and file this form, making your tax obligations more manageable. Always check for updates to ensure compliance with current regulations.