Form 2350 Instructions

Description

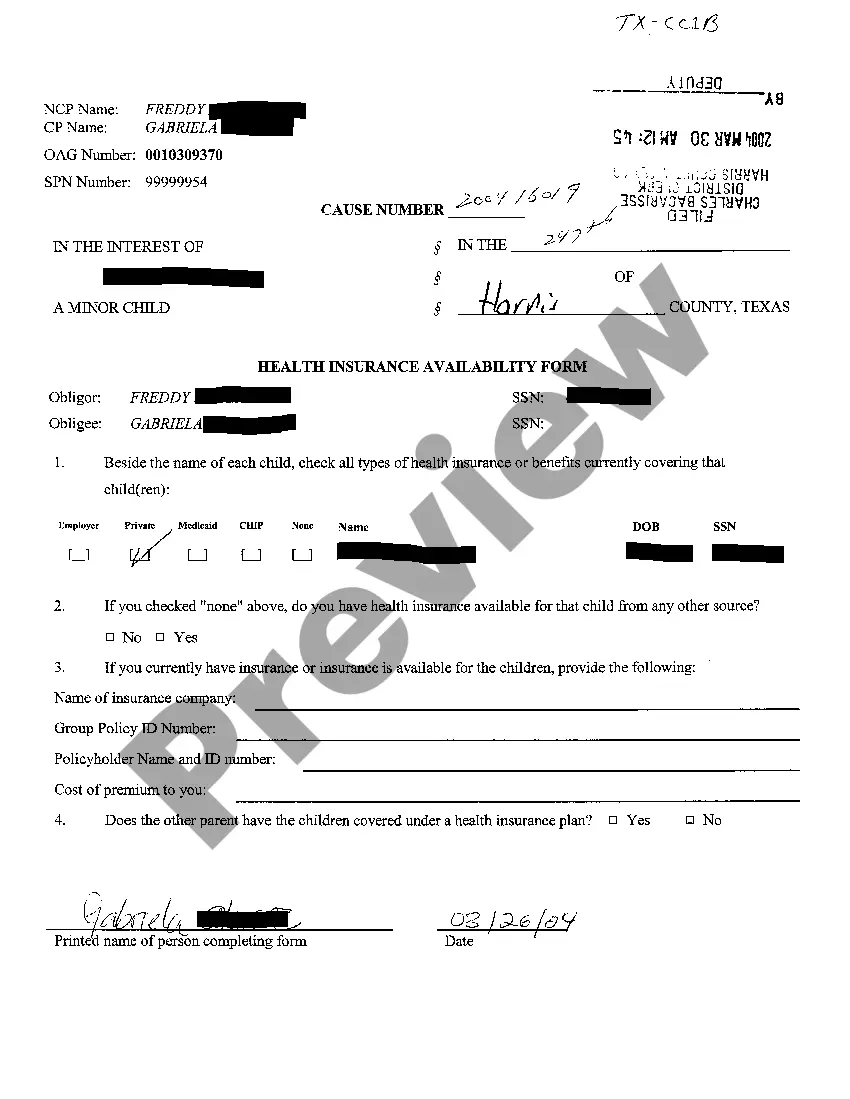

How to fill out Texas Health Insurance Availability Form?

Whether for business purposes or for individual matters, everybody has to handle legal situations at some point in their life. Filling out legal papers requires careful attention, beginning from choosing the right form template. For example, if you pick a wrong version of a Form 2350 Instructions, it will be turned down once you send it. It is therefore essential to have a dependable source of legal papers like US Legal Forms.

If you have to get a Form 2350 Instructions template, follow these simple steps:

- Get the sample you need by using the search field or catalog navigation.

- Examine the form’s information to ensure it suits your situation, state, and county.

- Click on the form’s preview to see it.

- If it is the wrong form, go back to the search function to locate the Form 2350 Instructions sample you require.

- Download the template when it meets your needs.

- If you already have a US Legal Forms profile, click Log in to gain access to previously saved documents in My Forms.

- If you do not have an account yet, you may obtain the form by clicking Buy now.

- Select the correct pricing option.

- Finish the profile registration form.

- Choose your payment method: you can use a bank card or PayPal account.

- Select the file format you want and download the Form 2350 Instructions.

- When it is saved, you are able to complete the form by using editing software or print it and complete it manually.

With a substantial US Legal Forms catalog at hand, you never have to spend time searching for the appropriate sample across the internet. Utilize the library’s simple navigation to get the right form for any situation.

Form popularity

FAQ

You can get an automatic extension of time to file your tax return by filing Form 4868 electronically.

U.S. citizens and resident aliens abroad file this form 2350 to ask for an extension of time to file their tax return only if they expect to file Form 2555 or 2555-EZ and need the time to meet either the bona fide residence test or the physical presence test to qualify for the foreign earned income exclusion and/or the ...

File Form 2350 by mailing it to: Department of the Treasury Internal Revenue Service Austin, TX 73301-0045 You can also file by giving it to a local IRS representative or other IRS employee.

You can file an extension for your taxes by submitting IRS Form 4868 with the Internal Revenue Service (IRS) online or by mail. This must be done before the last day for filing taxes. Filing an extension for your taxes gives you additional months to prepare your tax return no matter the reason you need the extra time.

Form 4868 is used to apply for a standard extension to October 15. Form 2350, on the other hand, is intended to help new expatriates qualify for the Foreign Earned Income Exclusion.